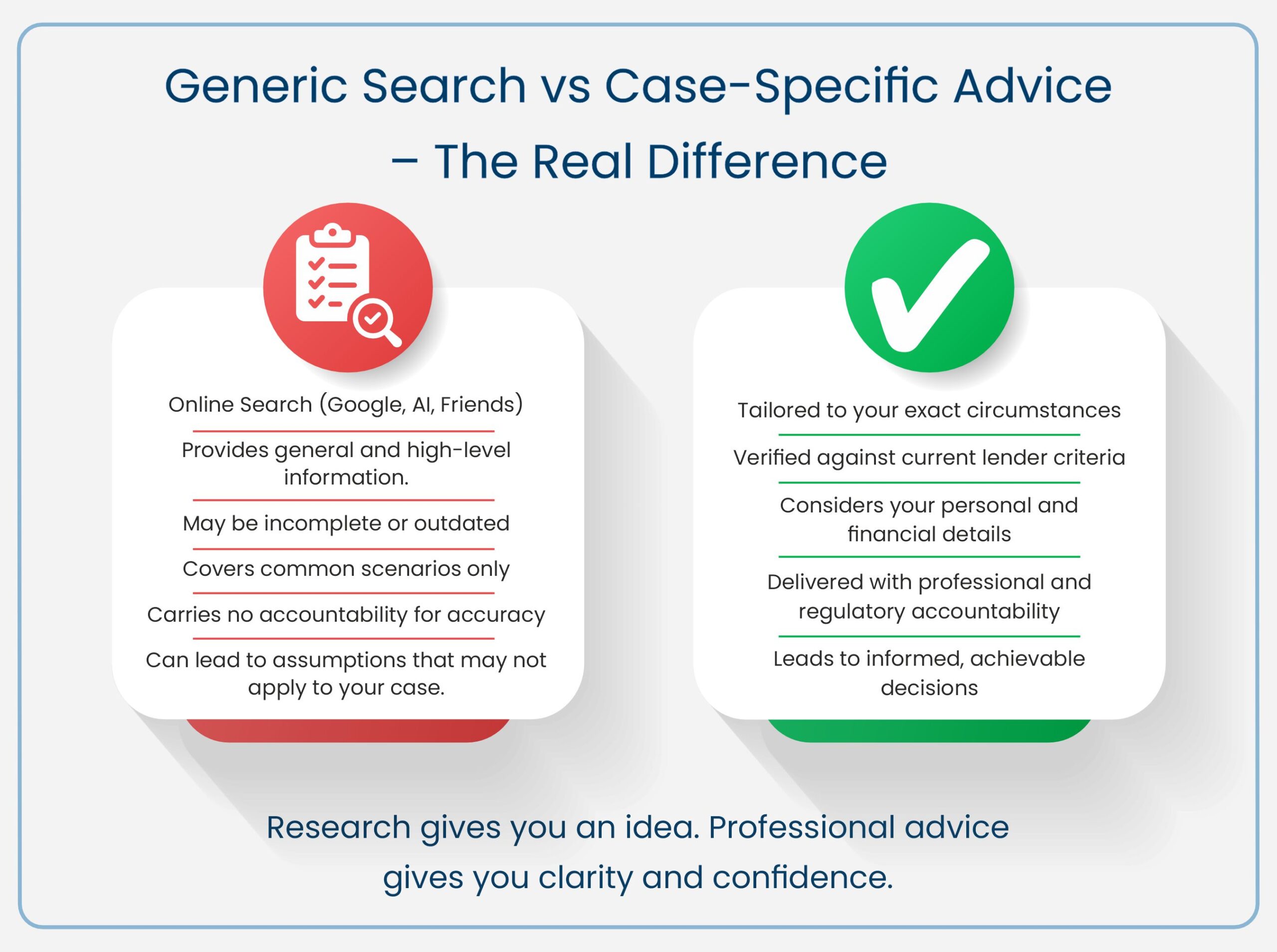

A very common question from clients looking to invest in a buy-to-let property is whether it is better to purchase in a personal name or through a limited company.

The short answer is: there is no one-size-fits-all solution. The best structure depends on your individual circumstances, tax position, and long-term objectives. In this article, we’ll explore the broad considerations for each route – but before diving into the comparison, there are a couple of important points to clarify.

Before Anything Else – Understand the Responsibilities of Being a Landlord

Owning property as an investment is not the same as investing in stocks, bonds, or commodities. A buy-to-let comes with legal, financial, and moral responsibilities. These include ensuring the property is safe, compliant with regulations, and that tenants are treated fairly.

Before weighing up ownership structures, make sure you fully understand what being a landlord entails. Otherwise, you risk facing unwelcome surprises after completing your purchase.

We’ve written a detailed article on this topic: The Realities of Buy-to-Let – What Every Landlord Needs to Know.

Buying a buy-to-let in your personal name is generally:

- Simpler to set up and manage – no need to create and maintain a company structure.

- Lower cost – ongoing compliance, accounting, and administration are minimal compared with a company.

- Access to cheaper mortgage rates – lenders usually offer more competitive rates for personally owned properties.

The downside: personal ownership is often less tax efficient. Rental profits are taxed at your marginal income tax rate, and high earners can feel the impact of reduced mortgage interest tax relief.

Using a limited company (commonly set up as a Special Purpose Vehicle or “SPV”) has its advantages:

- Tax efficiency – profits are subject to corporation tax, which may be more favourable depending on your income bracket.

- Flexibility for reinvestment – easier to reinvest profits into future property purchases without incurring personal tax first.

- Long-term planning – can allow for more efficient inheritance and capital gains planning.

The trade-offs include:

- Setup and running costs – accountancy fees, compliance charges, bank fees, and Companies House filing obligations.

- Mortgage considerations – limited company mortgage rates are usually higher than personal ones.

- Director responsibilities – you will need to act as a director and comply with company law.

- Personal guarantees – lenders typically require directors to give personal guarantees when borrowing through a limited company.

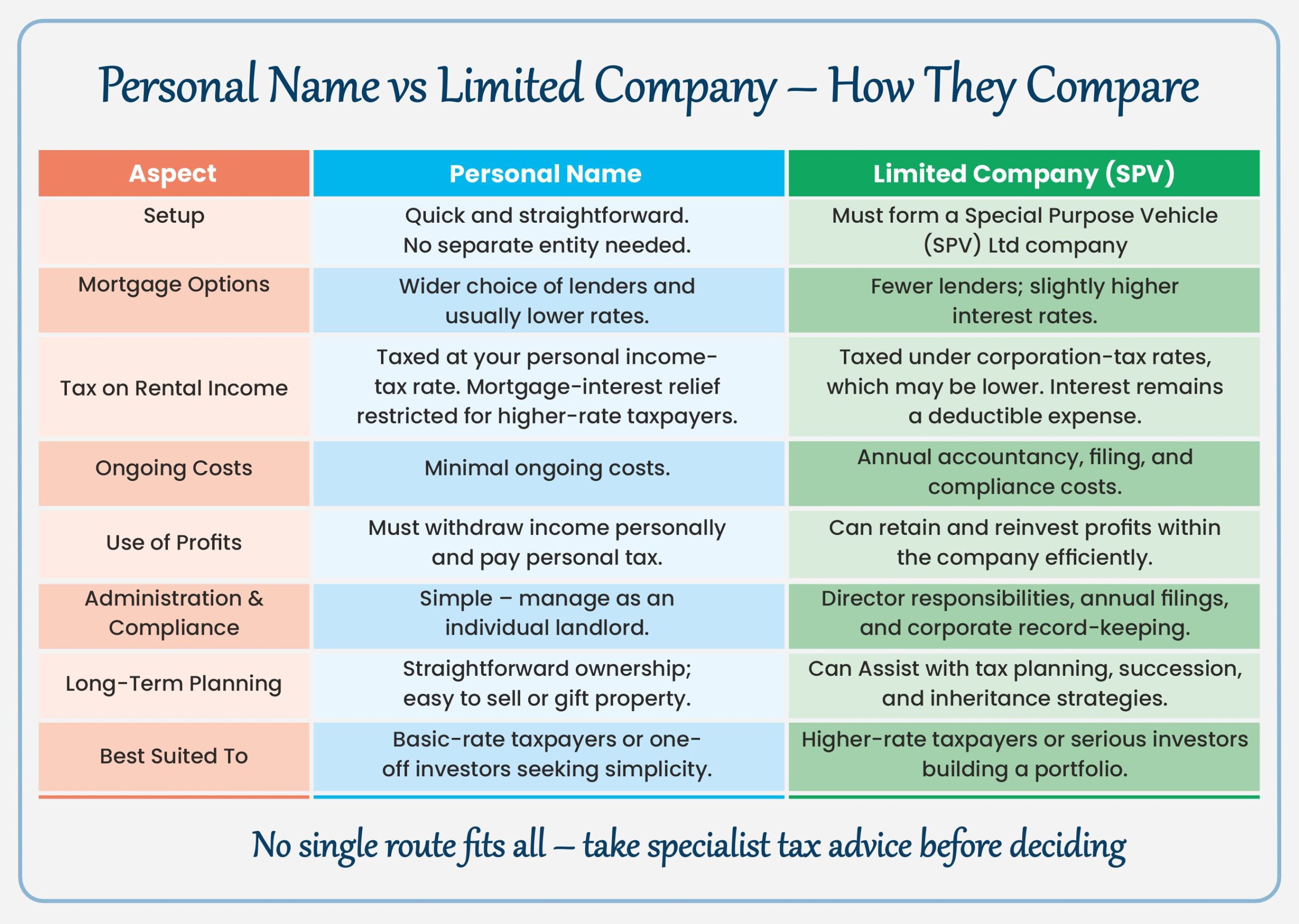

At a Glance – How Personal Name and Limited Company Ownership Compare

To help summarise the key differences, the infographic below provides a quick visual comparison of both routes.

Important Distinction – Buying New vs Transferring Existing

This article focuses on the decision when purchasing a new buy-to-let property.

Transferring an existing personally owned property into a limited company is a separate subject. Such transfers often trigger stamp duty and capital gains tax, and can be expensive unless there is a strong reason.

For more detail on this specific scenario, see: Transferring Property into a Limited Company.

- You are a basic rate taxpayer or have no other income.

- You are buying a one-off buy-to-let rather than building a portfolio.

- You want a simpler, lower-cost route with less paperwork and compliance.

- You prefer access to lower mortgage interest rates.

- You are a higher rate or additional rate taxpayer.

- You already run a trading limited company and have significant retained profits you wish to reinvest.

- You are building a portfolio of buy-to-lets and plan to treat property as a serious long-term business.

- You want more flexibility for tax planning and inheritance planning.

- Annual filings with Companies House (confirmation statements, statutory accounts).

- Corporation tax returns and ongoing accountancy costs.

- Acting as a director/shareholder and ensuring compliance with company law.

Personal guarantees: even if the mortgage is in the limited company’s name, most lenders will require the directors to personally guarantee the loan. This means that if the company defaults, your personal assets may still be at risk.

Your end goal should influence the decision. For example:

- If you plan to sell the property and cash out the gains, your tax route may look different in personal names versus a company.

- If your plan is to retain and pass on the property, limited companies can sometimes help with inheritance planning and structuring shares.

- If your plan is simply to earn rental income during retirement, personal names may be simpler and more cost-effective.

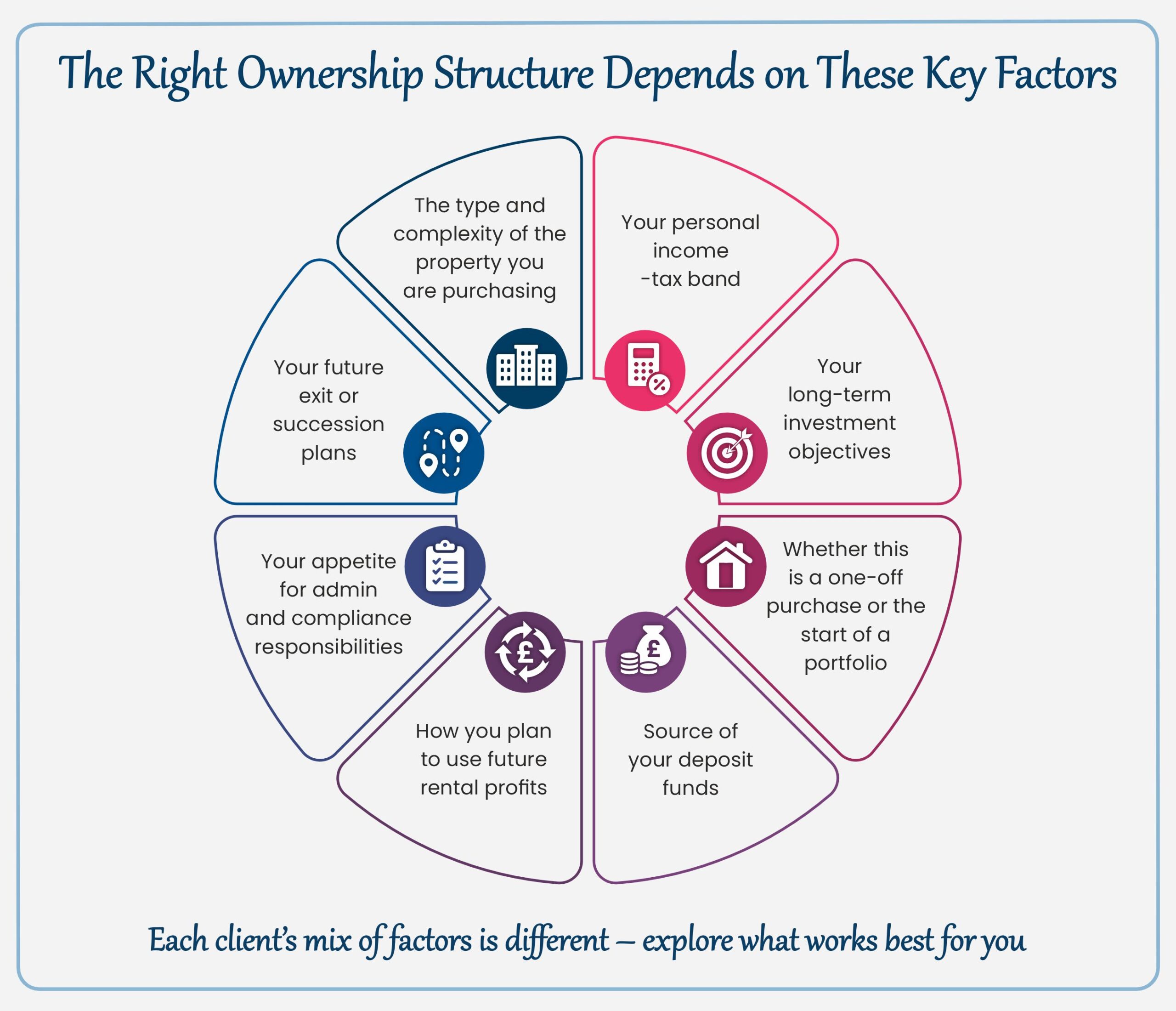

Choosing the right structure depends on a combination of factors. The infographic below outlines the key elements that typically influence what works best for each client

The decision between purchasing a buy-to-let property in personal names or through a limited company depends heavily on each client’s individual circumstances.

Below are two real examples that highlight how different factors can lead to entirely different ownership structures, yet both outcomes were appropriate and efficient for the clients involved.

Balaji is a full-time NHS doctor and a higher-rate taxpayer. Nila is a homemaker with no personal income, and her long-term plan is to continue in this role. The couple received an inheritance from Nila’s parents and wanted to invest part of it into a single buy-to-let property located close to their main home. Their intention was simply to hold one additional property for future family needs, rather than building a wider portfolio or running a property business.

Given their objectives, their tax positions and the source of deposit, the couple sought tax advice and considered both ownership routes.

The outcome was clear: purchasing in personal names suited their circumstances best.

To reflect the origin of the deposit and to ensure the rental income was taxed more efficiently, they chose to own the property as tenants in common with unequal shares — 90 percent for Nila and 10 percent for Balaji.

This structure aligned with their financial objectives, long-term plans and family considerations.

For readers who wish to understand the difference between joint tenancy and tenants in common, we have explained this in detail here : Joint Tenancy vs. Tenants in Common

Sai and Devi are married, both higher-rate taxpayers and both expecting to remain in well-paid full-time roles. Sai is an IT contractor operating through his own trading limited company, which had accumulated around £140,000 in retained profits. Their long-term aim was to build a small property portfolio over the years.

Because they were already higher-rate taxpayers and the deposit was coming from retained profits within a trading company, purchasing in personal names would have meant drawing funds as dividends and incurring additional personal tax.

After discussing their situation with their accountant and taking specialist tax advice, they decided that purchasing through a new limited company (SPV) was the more efficient and future-proof structure.

This allowed them to deploy the retained profits more effectively and positioned them better for expanding their property portfolio over time.

The two examples above demonstrate situations where one structure clearly made more sense than the other.

However, in many real-life scenarios, clients present a mix of factors — some favouring personal ownership and others favouring a limited-company route.

In such cases, the decision is not straightforward.

It often requires weighing up long-term objectives, tax considerations, deposit sources, income levels, portfolio intentions and administrative responsibilities before arriving at an informed and balanced choice.

Every client’s circumstances are different, and the most suitable structure is the one that aligns with their overall financial picture and future plans.

Our Transparency Promise

Multiple Professionals Are Involved in Getting This Right

Choosing whether to hold a buy-to-let property in your personal name or through a limited company is not a decision made in isolation.

Before finalising your route, you will usually need input from more than one professional:

- A mortgage adviser to explain lending rules, interest-rate differences, and structuring requirements.

- A qualified tax adviser to confirm how each option affects your personal tax position, long-term plans, and future liabilities.

While we can guide you on how each structure works from a property-finance perspective, we are not tax advisers, and tax planning sits outside the scope of mortgage advice.

Given the long-term consequences of choosing the wrong structure, we strongly recommend seeking independent, specialist tax advice before arriving at a final decision.

For more details on why specialist advice is crucial in these scenarios, see our article on Why Specialist Advice Matters in Property and Tax Planning

Our goal is to ensure you make a well-informed decision, and that all relevant professionals are involved where needed.

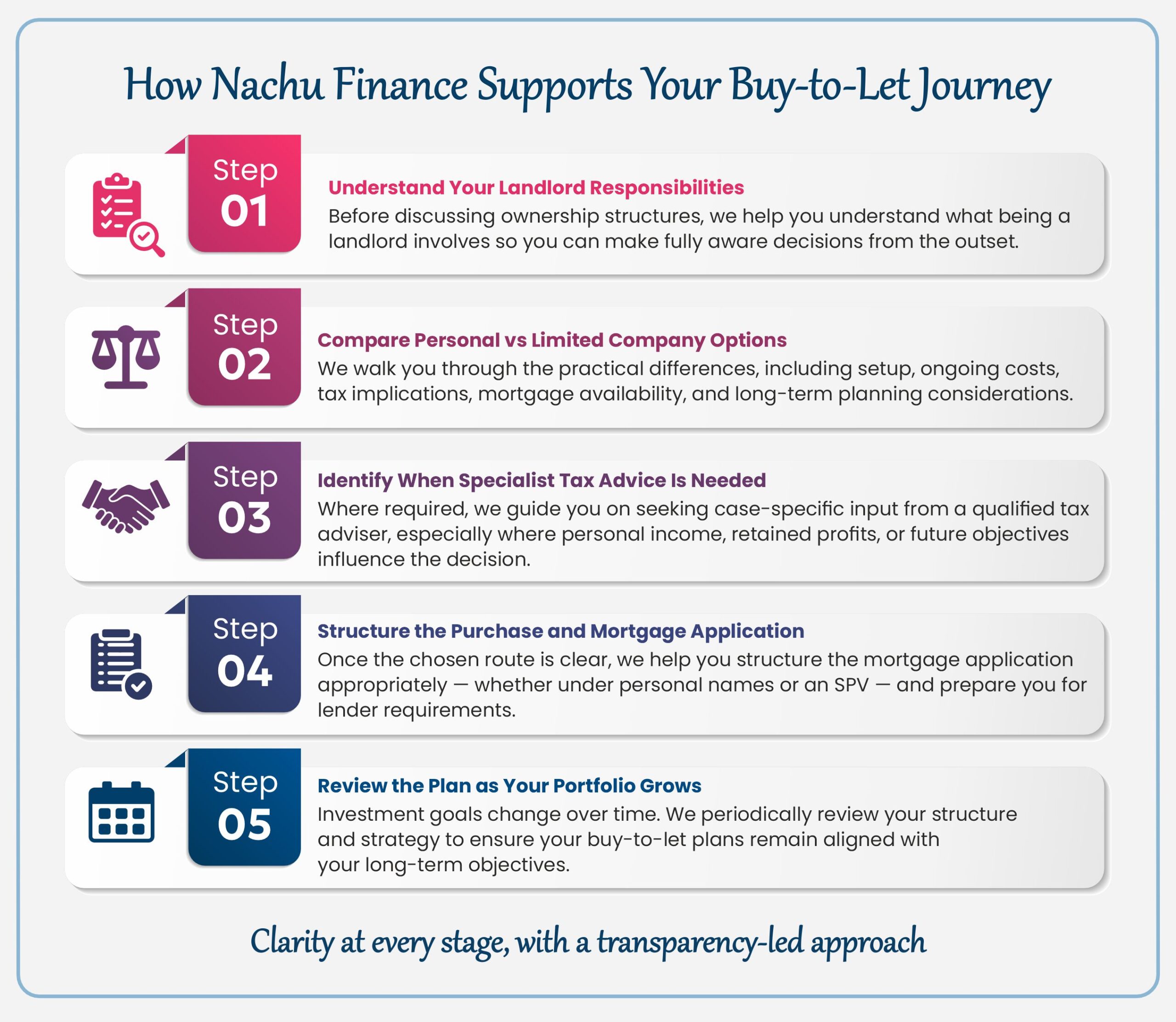

At Nachu Finance, our role is to guide you through every stage of your buy-to-let planning with clarity and structure.

We start by ensuring you fully understand what it means to be a landlord, then help you compare the practical differences between personal ownership and using a limited company.

Where a tax specialist’s input is needed, we point you in the right direction so your decision is made with complete confidence.

Once the structure is clear, we help you position the mortgage application correctly and follow through with the paperwork, lender requirements and timelines. As your plans evolve, we continue to review your approach so your strategy remains aligned with your long-term goals.

Ready to Explore Which Structure Works Best for You?

At Nachu Finance, we understand that buying an investment property is a long-term commitment, and getting the structure right at the outset can make a meaningful difference over time. We are always happy to have an initial conversation, understand your goals and personal circumstances, and outline the available options in a clear and transparent way.

Where required, we can also refer you to experienced tax specialists so you receive the right guidance from all relevant professionals.

If you are planning a purchase, weighing up your options, or would simply like to talk through the considerations, feel free to reach out. We will be glad to guide you and support you at every stage.

No, not all lenders offer mortgages to limited companies. However, more and more lenders—including well-known high-street names such as Birmingham Midshires, Coventry Building Society and The Mortgage Works—are now active in this space.

It is fair to say the choice is still more limited compared with personal-name mortgages, but as limited-company structures become more popular with landlords, the number of lenders willing to lend to SPVs continues to grow.

Criteria and flexibility vary significantly between lenders, so understanding who supports what structure is important before finalising your route.

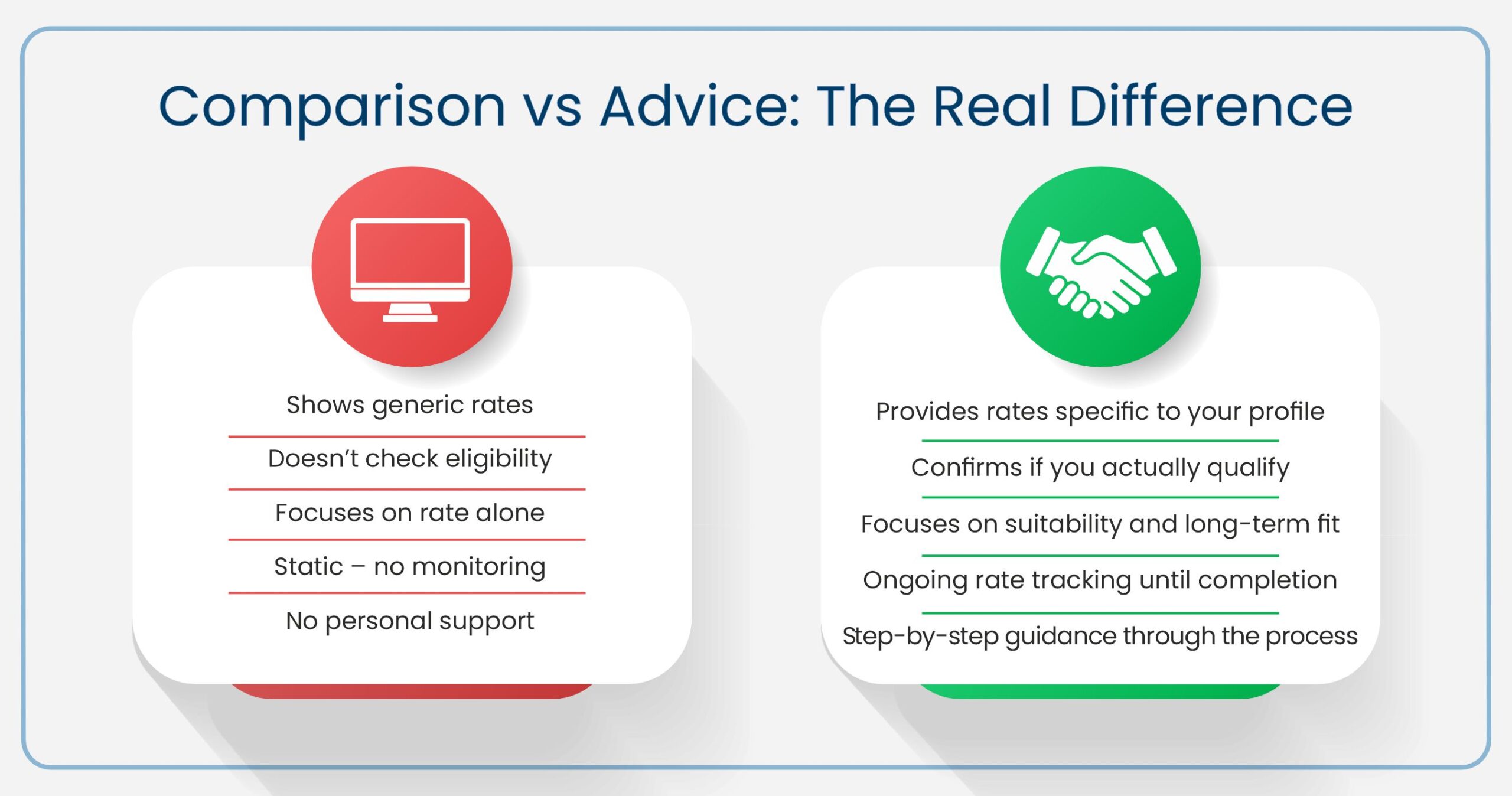

Generally speaking, yes.

Limited-company mortgage rates tend to be slightly higher than equivalent products in personal names.

However, the interest rate should not be looked at in isolation.

A limited company can offer potential tax advantages and reinvestment benefits which, depending on your circumstances, may outweigh the slightly higher cost of borrowing.

The decision should therefore be based on the overall position and long-term outcomes, not the rate alone.

Yes, you can.

The limited company simply acts as the legal “envelope” for the mortgage. All due diligence—identity checks, credit checks, income verification, deposit evidence and background assessments—is still performed on you as the applicants.

Because of this, lenders are generally comfortable with:

- a newly incorporated SPV, or

- a company that will be set up shortly before the mortgage application is submitted.

A new company is not a negative point and does not reduce your chances of obtaining a mortgage.

In most cases, yes.

Although the property is owned by the limited company, lenders usually require all directors and shareholders to provide a personal guarantee.

This means you remain personally responsible if the limited company fails to meet the mortgage obligations.

Additionally, lenders often require you to take independent legal advice before signing the personal-guarantee documents, because the guarantee creates obligations separate from the company.

Often yes, but the way you structure this makes a significant difference.

If the property is purchased in your personal name, you would first need to withdraw the funds from the trading company and pay any tax due on the withdrawal (for example, dividend tax). Only then can the funds be used as your personal deposit.

However, if the property is purchased through a limited company SPV, there may be more efficient options, such as:

- inter-company loans, or

- structuring the SPV as a subsidiary of your trading company.

These options can avoid unnecessary tax leakage and allow efficient use of retained profits. Because the tax implications vary widely, this is an area where specialist tax advice is strongly recommended.

Generally speaking, no. Only a small number of lenders accept gifted deposits under a limited-company structure

Most lenders do not permit gifted deposits when buying through a limited company.

Gifted deposits are far more commonly accepted for:

- residential property purchases, and

- buy-to-let purchases in personal names.

If using a gifted deposit forms part of your plan, it is essential to confirm lender acceptance before progressing too far.

In theory, yes — but in practice, most lenders prefer not to lend to active trading companies.

Only a handful of lenders will consider a mortgage where the borrowing entity is a trading business, and the choice of products is very limited.

Setting up a separate Special Purpose Vehicle (SPV) specifically for property investment generally:

- keeps borrowing cleaner,

- simplifies lender due diligence,

- avoids mixing trading activity with property assets, and

- ensures a wider choice of lenders and mortgage products.

Yes, it is possible and you should consider.

Whether you are a first-time landlord or an experienced investor, the considerations remain the same:

- your tax position,

- your long-term investment plans,

- the source of your deposit,

- your comfort with administrative responsibility, and

- whether you intend to build a portfolio.

Being a first-time landlord does not restrict you from using a limited company; it simply means the need to understand both options clearly is even more important.

In many cases, yes.

Some lenders do allow both adult and minor children to hold shares in a property SPV.

However, every lender applies its own criteria regarding:

- acceptable ages,

- maximum shareholding percentages, and

- any responsibilities or limitations placed on younger shareholders.

If involving your children forms part of your long-term strategy, this should be discussed at the outset so that a suitable lender can be identified.

A limited company, on its own, is not an inheritance-tax or succession-planning solution.

While shareholding allows some flexibility in how interests are held or transferred, this does not automatically reduce inheritance tax or solve estate-planning needs.

Inheritance Tax planning is a separate and specialist area, and decisions about property ownership should be reviewed together to get the full picture.

If you buy a buy-to-let in your personal name, then when you go on to buy your residential property, it will be treated as an additional property, and the 5% additional stamp duty will apply. You will not be considered a first-time buyer.

If you buy the buy-to-let through a limited company, your personal first-time buyer status is not affected, provided you do not personally own any property.

Yes.

Regardless of whether this is the company’s first property or whether the company has only just been formed, the 5% additional stamp duty surcharge automatically applies to all limited-company residential property purchases.

In practice, no.

The tax rules — including ATED (Annual Tax on Enveloped Dwellings) — and higher stamp duty make it uneconomical for an individual to buy their own home through a limited company.

In addition, mortgage lenders do not offer residential mortgages to limited companies for owner-occupied properties.

For these reasons, a limited-company structure is used only for buy-to-let properties, not residential homes for personal occupation.