Renting out a spare room is a practical way for homeowners to improve their monthly cash flow while continuing to live in their main residence. It is fully legal and increasingly common in areas where both property values and rental demand are high.

However, it is important to understand the rules around mortgage consent, tax obligations, insurance conditions and the type of agreement you must use before taking in a lodger.

To bring this to life, consider the example of Manjula, a young accounting professional who purchased a two bedroom flat early in her career. Once she completed the purchase and moved in, she began thinking about the potential of renting out her spare room. Although she did not rely on this income for day to day expenses, she recognised it as an opportunity to enhance her cash flow. Being from a financial background, she wanted to ensure she did everything correctly and complied with all legal and regulatory requirements.

This article outlines the key steps she needed to take and what every homeowner should consider.

Can You Rent Out a Spare Room in the UK?

Yes, you can. Renting out a furnished room in your own home is allowed, provided you continue living in the property as your main residence. When done correctly, it is a simple and effective way to earn additional income.

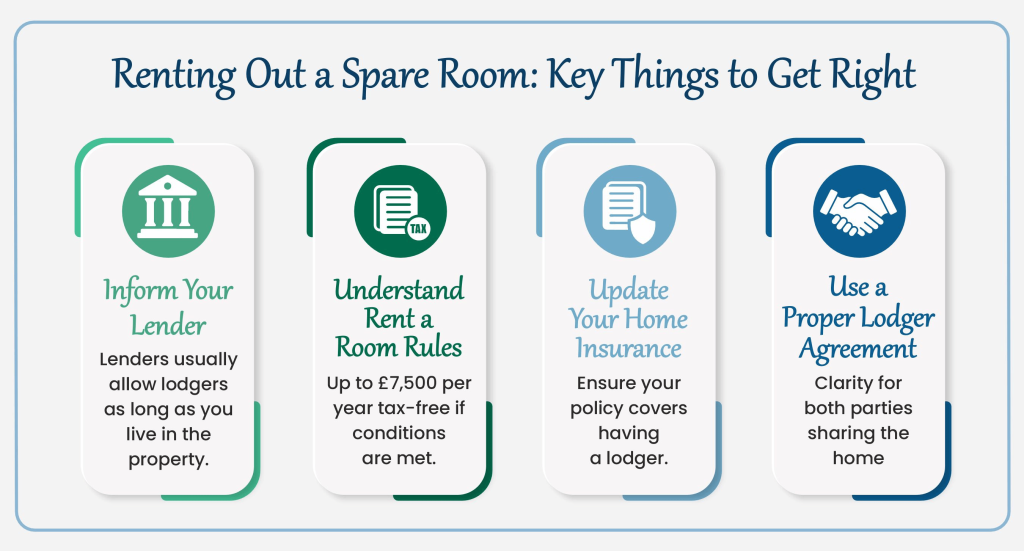

Mortgage Lender Consent

Most mortgage lenders, including major high street names, are typically comfortable with a homeowner taking in a lodger.

Some lenders require notification, while others require formal consent. The requirement usually appears in the mortgage offer or the lending criteria.

From our experience advising clients, we have not encountered a case where a lender refused permission for a lodger. If you are planning to rely on lodger income before you complete your purchase, it is best to tell us early so we can place you with a lender who is fully supportive of this arrangement.

HMRC Rent a Room Scheme

If you take in a lodger, the Rent a Room Scheme may apply to you. This is HMRC’s specific tax allowance for homeowners who let out furnished accommodation in their main home.

The scheme allows you to earn up to £7,500 per year tax-free. If the income is shared with someone else, the threshold is £3,750.

If your income from the lodger is below your threshold, the exemption is automatic and you do not need to do anything.

If you earn above the threshold, you must complete a tax return and can either opt into the scheme to claim the allowance, or opt out and record your income and expenses in the usual way.

For full details, HMRC guidance is available at:

https://www.gov.uk/rent-room-in-your-home/the-rent-a-room-scheme

Lodger Agreement

Because you will continue living in the property and sharing accommodation with the lodger, a lodger agreement is required rather than a standard tenancy agreement.

This agreement provides clarity for both parties on expectations, access, notice periods and house rules. Although less formal than a tenancy, documenting the arrangement properly helps prevent misunderstandings.

Home Insurance Considerations

Your home insurance provider must be informed before a lodger moves in.

If you own a freehold house, both your buildings and contents insurer need to be notified.

If you own a leasehold flat, buildings insurance is usually arranged by the freeholder or management company, but you must still update your contents insurer.

Failing to disclose a lodger could invalidate future claims, so it is essential to check this before renting out the room.

In Summary

Renting out a spare room can be a straightforward and rewarding way to supplement your income, provided it is done correctly. Ensuring lender consent, meeting HMRC requirements, updating your insurance and using the right agreement will help you stay compliant and avoid future issues. With a little preparation, taking in a lodger can be a simple and efficient way to make the most of your home while maintaining full control and peace of mind.

Frequently Asked Questions

Generally, mortgage lenders will not use lodger income for affordability assessments.

It is not considered stable enough from a lender’s perspective, so it cannot be relied upon to support borrowing.

A lender may ask questions during a remortgage to satisfy themselves that everything is in order, but in our experience it is very unlikely to lead to a decline. The lodger’s income will not be used for affordability, but lenders are usually comfortable as long as the arrangement is compliant and correctly disclosed.

Yes, you can rent out more than one room, and all the rules mentioned in this guide continue to apply, including lender notification, HMRC obligations and updating your home insurance.

However, you must be careful not to fall into the House in Multiple Occupation (HMO) category. If you have three or more unrelated lodgers, the property may be classed as an HMO. In that case, additional legal and safety requirements apply, including fire safety standards, gas safety compliance and, in many areas, the need for an HMO licence from the local council.

This article applies only to situations where you continue living in the property and rent out a spare room while it remains your main residence.

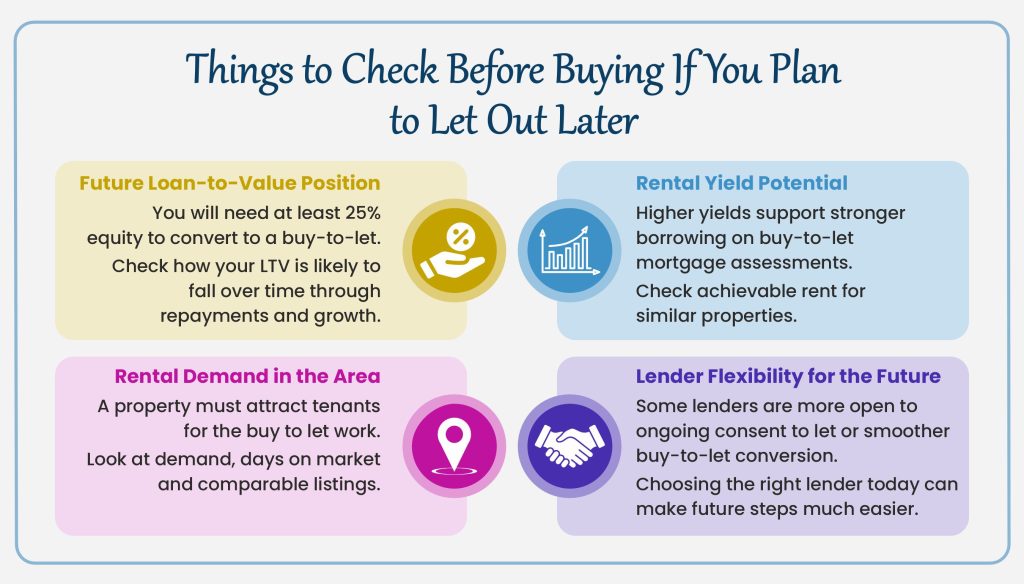

If you intend to move out completely and let the whole property, the rules are very different. You may need consent to let from your lender or a full buy to let mortgage.

For this scenario, please refer to our detailed blog on renting out a former residential property, where we explain the steps involved, lender requirements and compliance points.

About the Author

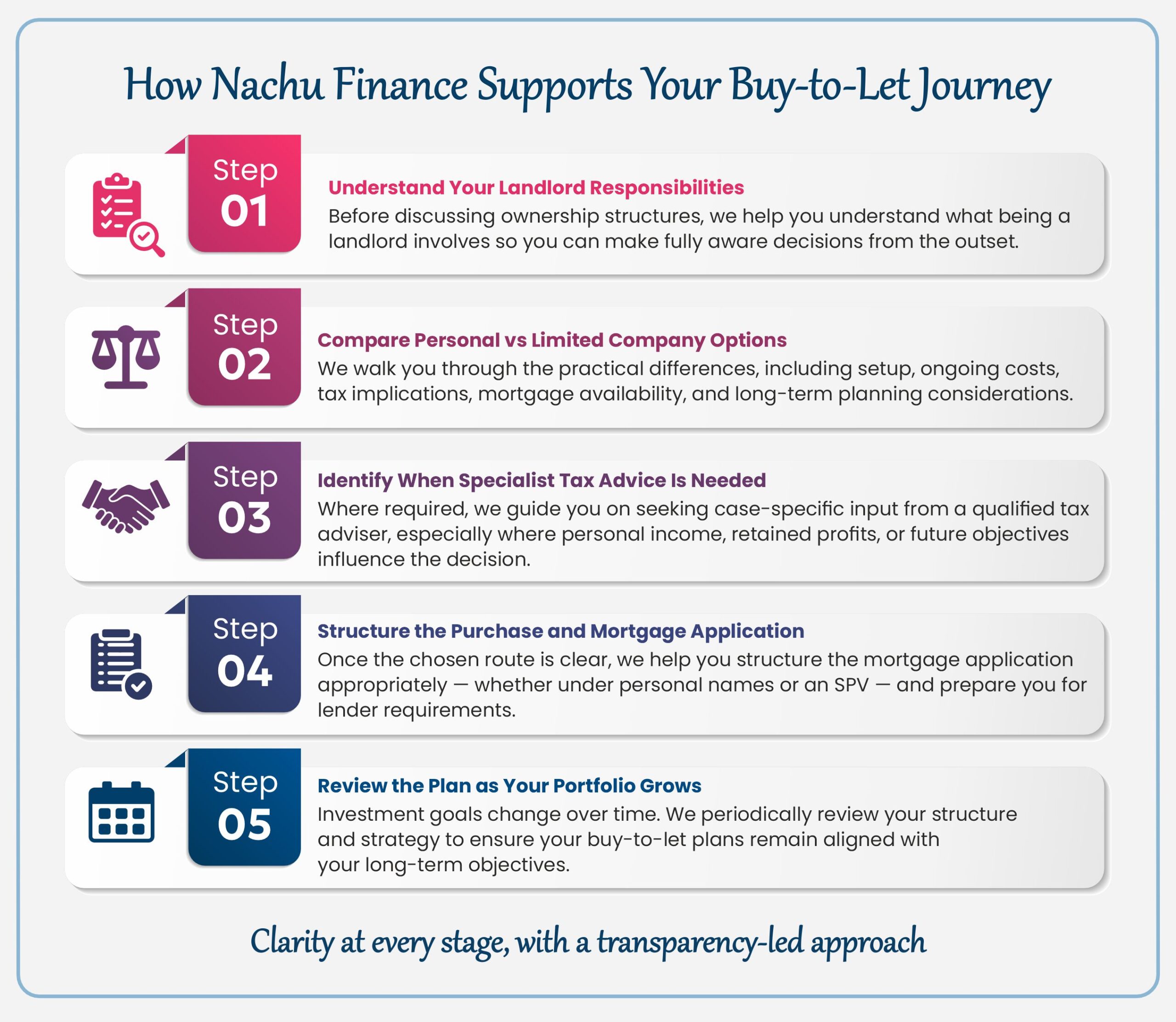

Sekkappan Alagu is the Founder of Nachu Finance Ltd, established in 2006. With a background in journalism, publishing and communication, he is passionate about simplifying complex financial topics. Through the Nachu Finance Blog and Knowledge Hub, he shares first-hand insights from nearly two decades of client advisory experience, helping readers make informed decisions and understand best practices in property and financial planning.

Business Profile

Nachu Finance Ltd is a directly authorised FCA-regulated firm providing mortgage, insurance and estate planning advice to clients across the UK. To learn more about the firm’s background and story, visit the About Nachu Finance page.