Structuring your buy-to-let portfolio under a Limited Company has become an increasingly popular strategy for landlords. But while this setup can offer clear tax advantages for new purchases, it’s not always suitable when transferring properties already held in personal names—unless the property was once your own residence.

This article walks through how Ltd company mortgages work, who they suit best, when transferring properties makes sense, and the key traps to avoid.

Buy-to-let mortgage interest relief restrictions introduced in recent years have pushed many landlords—especially higher rate taxpayers—to consider purchasing properties through a limited company. Some of the key benefits include:

- Full mortgage interest tax relief available against rental income for Ltd companies

- Corporation tax rates typically lower than individual higher rate tax bands

- More efficient profit retention, especially for those not needing to draw all profits personally

- Potential inheritance tax planning benefits when combined with the use of Trusts and careful structuring

A Limited Company structure tends to suit landlords who:

- Are higher or additional rate taxpayers

- Plan to build or grow a property portfolio over time

- Have a trading business generating surplus profits and wish to diversify into property in a tax-efficient manner

- Want to retain profits within the company to reinvest rather than drawing income personally

It’s worth noting that Ltd company mortgages often have slightly higher interest rates and fees compared to personal name buy-to-let mortgages. So the overall benefits depend on your personal tax position and investment strategy.

Buy-to-let properties held under a Ltd company must be let to a third party at arm’s length (i.e. someone unrelated to you, with no personal or family connection, and on standard market terms). They are not intended for personal use or occupation by family members.

Even short-term or rent-free use by relatives can lead to serious tax implications, including disqualification from allowable deductions and potential issues with HMRC.

What if you plan to live in the property?

While it is technically possible to live in a property owned by a Ltd company, this structure becomes financially unviable due to two major tax consequences:

- The Stamp Duty Land Tax (SDLT) jumps to 15% of the property’s full value (not just the 5% surcharge)

- You may also become liable for the Annual Tax on Enveloped Dwellings (ATED), a yearly charge applied to residential properties held by companies

These penalties are significant and are specifically designed to deter individuals from using Ltd companies to hold personal residences.

Don’t get caught out inadvertently—Ltd company property ownership is strictly for genuine rental purposes only.

While Ltd company ownership has advantages, it’s not one-size-fits-all. Before setting up a company or purchasing under one, it’s crucial to seek professional tax advice.

Your adviser should look at:

- Your current and projected income tax position

- Exit strategy and plans to access profits

- Long-term inheritance tax planning

- Implications for Capital Gains Tax (CGT) and Stamp Duty Land Tax (SDLT) if you already own property

One of the most frequent misunderstandings we come across is:

“It’s the first property in the company, so the additional stamp duty doesn’t apply.”

This is incorrect.

- All purchases by Ltd companies are subject to the higher rate stamp duty surcharge—currently 5% on top of the standard SDLT rates, regardless of whether it is the company’s first property or not.

- This applies even if the directors or shareholders do not own any properties personally.

While new buy-to-let purchases may benefit from being held in a Ltd company, transferring existing properties from personal names to a Ltd company often triggers high upfront costs:

Key Costs to Consider:

- Capital Gains Tax (CGT) on any gains made during personal ownership

- Stamp Duty Land Tax (SDLT) payable by the company at the higher 5% surcharge

- Legal and conveyancing costs for both the sale from personal names and purchase by the company

- Mortgage implications, as most lenders will require a full remortgage under Ltd company terms

These costs can be significant—and in many cases, outweigh the long-term tax savings.

Even where the property is owned outright and no money changes hands, the transfer is still treated as a market value transaction by HMRC.

That means:

- CGT is calculated based on the current market value of the property

- SDLT is still payable by the Ltd company at the full market value, including the 5% surcharge

- Both sale and purchase will require full legal representation and conveyancing

Unless additional tax reliefs or planning advantages apply, mortgage-free transfers to a Ltd company are generally not tax-efficient and need to be considered carefully.

There are a few exceptions where transferring a property from personal ownership to a Ltd company may be more favourable.

Transferring a Former Residential Property While Buying a New Home

If the property being transferred:

- Was your former main residence, and

- You are planning to purchase a new residential home

…then a correctly timed transfer might make sense.

Here’s why:

- Private Residence Relief may reduce or eliminate CGT liability on the transfer, depending on how long you lived in the property during your ownership

- The transfer may help you avoid the 5% additional SDLT surcharge on the new property you are buying, provided it happens within the current 3-year window for replacing a main residence

This dual benefit can offset the SDLT payable on the Ltd company transfer—but only where the reliefs apply and the timeline is carefully managed. It is essential to take advice before proceeding, as this is a narrowly defined window that not all clients will qualify for.

Whether you’re exploring the Ltd company route for your next buy-to-let purchase or considering if transferring an existing property makes sense, we’re here to guide you through the options.

At Nachu Finance, we take the time to:

- Understand your personal tax position and property goals

- Explain how ownership structure impacts lending, tax, and long-term planning

- Liaise with accountants and solicitors where needed to ensure all angles are covered

- Offer flexible, tech-savvy support with honest, jargon-free guidance

We’re not here to just secure a mortgage—we’re here to help you structure your investment the right way.

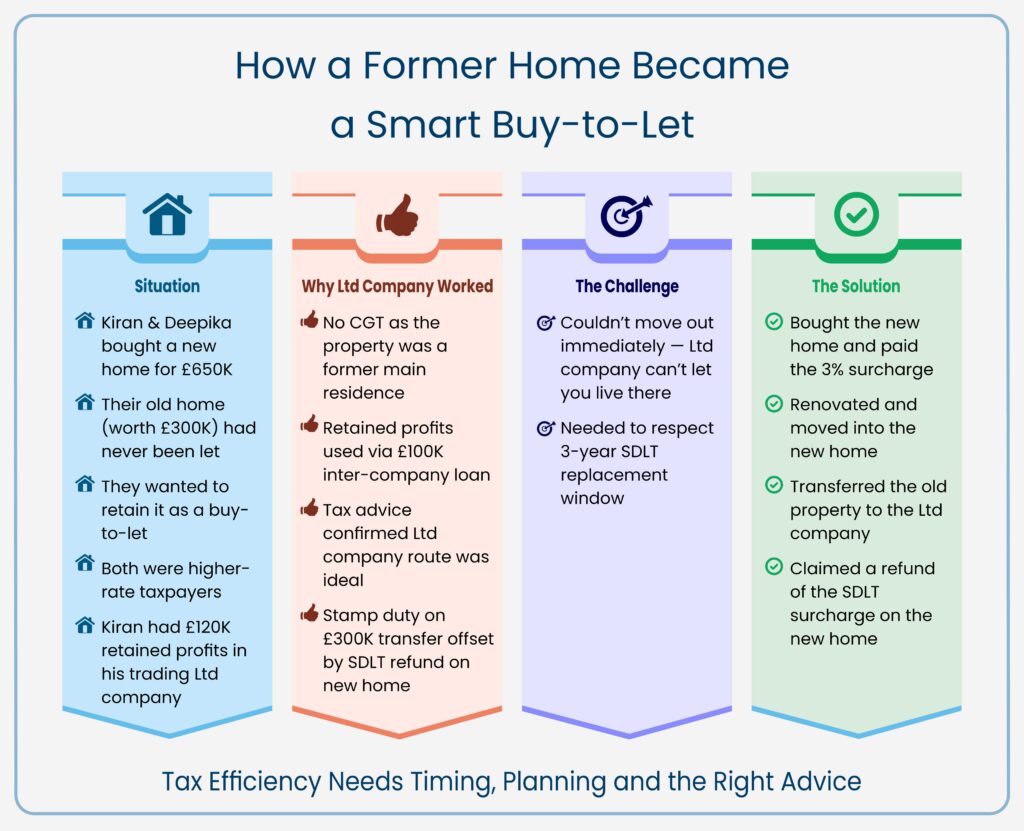

Kiran and Deepika were in the process of purchasing a new residential property in 2024, priced at £650,000. At the time, the additional stamp duty surcharge was still 3%, just before it increased to 5%. Both were higher-rate taxpayers, and they had carefully planned their next move with tax efficiency in mind.

Their existing property—valued at £300,000—had never been let out and had always been Kiran’s primary residence. While they had no intention of selling it, they also didn’t want to hold it personally as a buy-to-let due to the tax inefficiencies.

Kiran, an IT contractor, had £120,000 in retained profits in his trading Ltd company. After consulting with their accountant, it was clear that using a Ltd company structure for the buy-to-let was the right option for their circumstances.

As part of the transaction, £100,000 of the retained profits was used towards the property purchase, structured as an inter-company loan from the trading business to the new property investment company. This helped minimise personal capital outlay and allowed tax-efficient use of existing funds.

- As it was a former residential property, no Capital Gains Tax was payable at the point of transfer

- Stamp duty would apply on the transfer to the Ltd company—but that cost could be offset by avoiding the 3% additional SDLT on their new residential purchase

- The purchase did not rely on extracting funds from the former property, allowing for smooth structuring

- Their accountant confirmed that the Ltd company structure aligned with their long-term plans

However, there was one challenge: the timing.

To reclaim the additional 3% SDLT paid on their new home, they would need to complete the transfer of their old home to the Ltd company within the 3-year replacement window. But at the time of purchasing the new property, Kiran and Deepika were not ready to move out of the former home.

Since Ltd company-held properties cannot be occupied by the shareholders or their family, even temporarily, the advice was as follows:

- Complete the purchase of the new residential property first, paying the 3% additional SDLT up front

- Carry out the necessary works and fully move into the new home

- Then transfer the former residence to the Ltd company once it was fully vacated

- Finally, submit a claim for refund of the additional SDLT paid on the new purchase—since it now qualified as a genuine replacement of their main residence

This careful sequencing allowed them to remain compliant while still achieving the long-term goal: retaining their former home as a rental property under the Ltd company in a tax-efficient way.

Our Transparency Promise

We’ll Tell You When It’s Not Worth It

We’re often asked whether it’s a good idea to transfer a property into a Ltd company. In truth, the answer depends entirely on your circumstances—and in many cases, it may not be the right move.

Our role is to:

- Clearly explain both the potential benefits and the costs involved

- Highlight when the numbers don’t add up

- Avoid recommending changes just for the sake of complexity or sales

We take pride in giving advice that’s aligned with your best interests, even when that means recommending you not proceed with a transfer.

Ready for Clarity and Confidence?

Whether you’re a first-time landlord or looking to restructure an existing portfolio, we’re confident we can help you move forward with clarity.

Contact us and take your first step to joining the several happy Nachu Finance clients.

With our experience, whole-of-market service, and client-first approach, we’re always willing to go the extra mile.

And with flexible, tech-savvy options for appointments and document sharing, reaching out & doing business with us is easier than you think.