A Financial Insight for First-Time Buyers Planning Ahead

Many first-time buyers choose a property that meets their current needs, knowing that life will evolve in the years ahead. It is quite common for young professionals like Arjun, an IT consultant working in Central London, to buy a one-bed flat close to work today and then, as their family grows, keep this first home as an investment property while moving into a larger place.

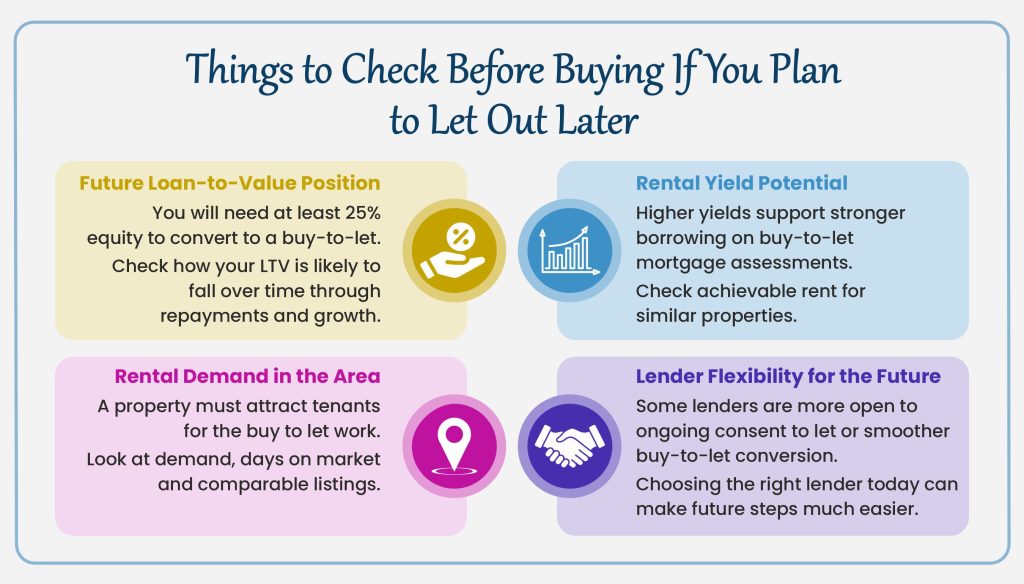

If this is something you are considering, it helps to understand what to think about now, at the point of purchase, so that you are well-placed to rent out the property later without unnecessary complications.

Two Ways to Let Out Your Home in the Future

When the time comes to let out your current home, there are two broad routes.

Both are commonly used and each has its own advantages depending on your long-term plans.

Staying With Your Residential Mortgage and Requesting “Consent to Let”

This option keeps things simple. You continue with your existing residential mortgage and inform the lender that your circumstances have changed. You ask for permission to let out the property, and if the lender agrees, you receive what is known as consent to let.

You do not change the mortgage type.

You do not remortgage.

You do not alter any other aspect of the mortgage apart from the usage.

Some lenders such as NatWest and Santander are known for being flexible and may allow consent to let on an ongoing basis, even when your fixed rate ends. They may also allow you to choose new products while keeping that permission active.

Other lenders, including Halifax and Virgin Money, tend to grant consent for a much shorter period, often one to two years. Once this period ends, they may expect you to formally convert the mortgage to a buy-to-let product or move to another lender.

Why this approach appeals:

It avoids the hassle of remortgaging and allows you to rent out the property without breaching any contract terms.

What to keep in mind:

Since you are technically still on a residential mortgage, you usually cannot:

- Switch the mortgage to interest-only

- Borrow additional funds

- Add or remove names from the mortgage

Consent to let is ideal if you want a simple and temporary arrangement.

Converting the Mortgage to a Buy-to-Let

The second route is to formally convert the residential mortgage into a buy-to-let mortgage. This tends to offer more flexibility and is usually preferred if you want a long-term investment setup.

A key requirement for buy-to-let mortgages is having at least 25% equity.

This means the mortgage must be no more than 75% of the property value.

Even if you bought with a 10% deposit, you may naturally reach this level over time due to capital repayments and property price growth.

If you fall short of the 75% loan-to-value threshold, lenders may ask you to reduce the mortgage balance when converting. This can be done by contributing additional funds.

You can read further about Loan to values here

Thinking Ahead: Will the Rental Income Work?

Buy-to-let lenders assess affordability based mainly on rental income.

It helps to look up the likely rental value of similar properties in the area.

The rental yield gives a useful early indication.

It is calculated as:

Annual rent ÷ property value × 100.

A stronger yield (for instance a 6% yield) makes it easier to borrow the amount you need on a buy-to-let mortgage.

A weaker yield (for instance a 4% yield) may mean the loan amount has to be lower or supported by your personal income.

There are ways to structure this, especially for basic-rate taxpayers or applicants with surplus income, but it is good to be aware of this early on.

You can understand further about rental yield here

Understanding Rental Demand

Some properties make excellent homes but less successful rental investments.

Areas with strong local employment, transport links, and amenities typically see steady rental demand, while certain high-end or larger properties may attract fewer tenants.

If you are buying with the intention to let out later, it is worth spending a little time assessing the area’s rental activity. This can save you surprises in the future.

Considering Lender Appetite from the Start

If you already know there is a good chance you may let out your home one day, the choice of lender for your initial residential mortgage can make a real difference.

Some lenders:

- Offer ongoing consent to let

- Are more flexible when switching to buy-to-let

- Do not charge a premium for having a property on consent to let

Others may be more restrictive or may expect a formal conversion sooner.

Selecting a lender that naturally aligns with future rental plans helps keep your options open.

When Your Move Involves Buying a New Home at the Same Time

If you decide to let out your current home and buy your next home in one go, this becomes something known as a let-to-buy arrangement.

This is slightly different from a straightforward buy-to-let remortgage because it is designed specifically to support your onward residential purchase. You can read more about Let to buy mortgages here

Conclusion

For first-time buyers like Arjun, planning a few steps ahead can make the future transition from homeowner to landlord much smoother.

If you intend to keep your first home as an investment later, it is worth considering:

- How your loan-to-value might look when the time comes

- Whether the rental income is likely to support a buy-to-let mortgage

- The level of rental demand in the area

- How flexible your chosen lender is when it comes to consent to let or future buy-to-let conversion

With the right preparation, your first home can become a stepping stone to longer-term financial planning and investment.

Yes. Every residential mortgage includes a clause requiring you to seek consent before letting out the property. Renting without permission would breach the mortgage contract.

Most lenders will consider it, but each has their own criteria, conditions, and limits. They must also be satisfied that the property was genuinely purchased to live in, not as a disguised buy-to-let.

Once the lender has granted consent and the property is actually rented out, most lenders will assess it similarly to a buy-to-let. The rental income can usually offset the mortgage payments, though each lender’s affordability method differs slightly.

The above blog is more to do with letting out the property entirely and you moving to a different accommodation. If you would like to understand more about continuing to live in the property but rent out a spare room read more about this here.