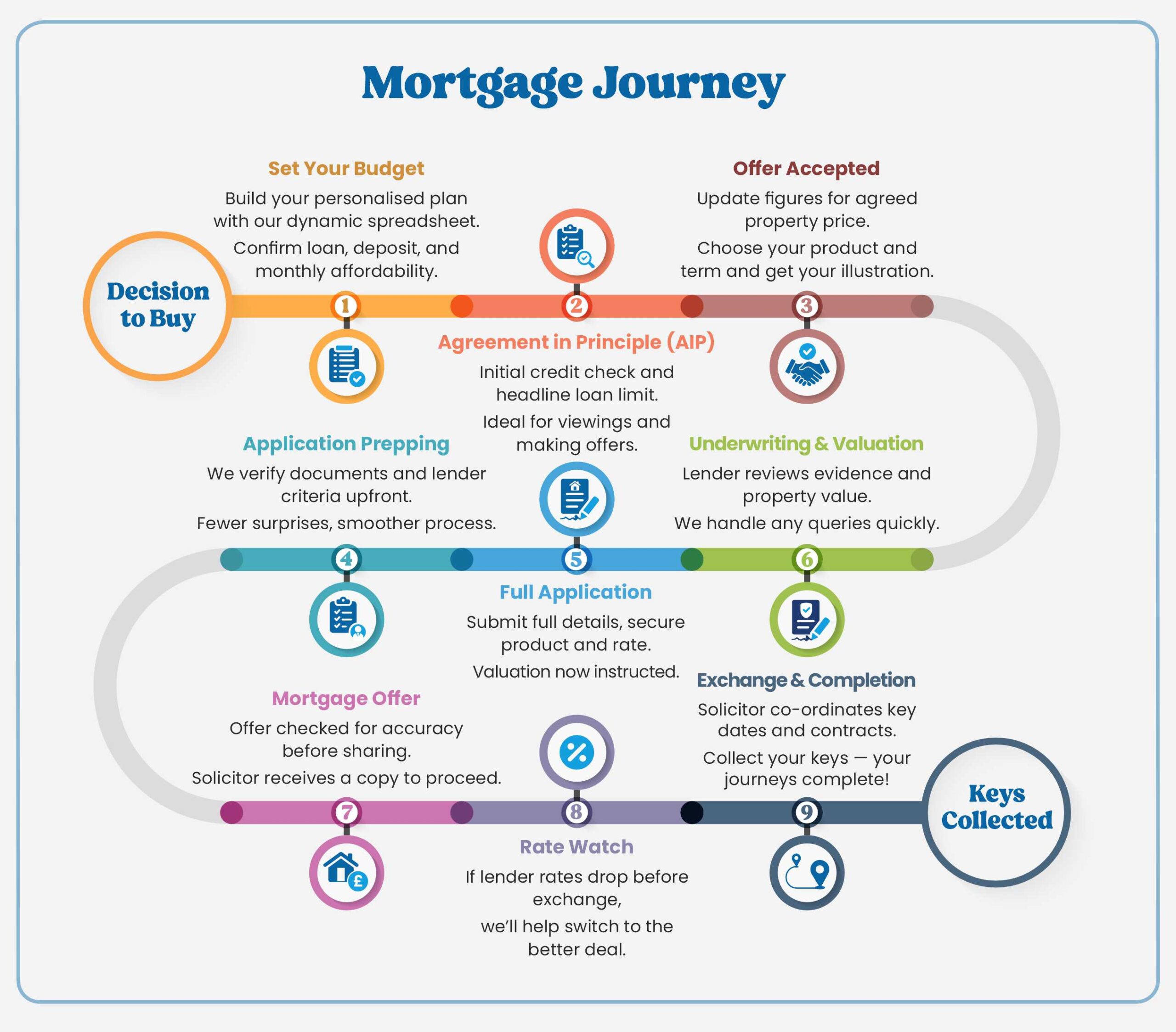

If you are buying your first home and want a clear, end-to-end view of what happens, in what order, and why — this guide is for you.

This explains the ideal, logical sequence from first thought to mortgage offer and completion support.

In real life, you might join mid-way, skip a step, or loop back — that’s perfectly normal.

Use the anchor links and checklists to dip into the parts you need most.

- A clear picture of how much you can borrow, how much deposit you need, and what the total monthly cost could be.

- An Agreement in Principle ready to show estate agents so your viewing and offer carry weight.

- A researched product and term only once a property is agreed, not before.

- A thorough application-prepping stage so there are fewer surprises later.

- Prompt responses to lender queries and valuation logistics handled early.

- A final mortgage offer that matches your illustration, checked for errors.

- Ongoing rate watch right up to exchange if the lender reduces rates.

- What is the maximum loan available to you?

- What deposit is needed and where will it come from?

- What one-off costs are likely at the start?

- What will your monthly payments look like under realistic options?

What we capture from you:

- Employment and income details (including bonuses, overtime, or commissions).

- If self-employed or a company director — profits, salary, dividends, latest accounts, or SA returns.

- Credit commitments such as loans, cards, car finance, or student loans.

- Family situation and foreseeable changes affecting affordability.

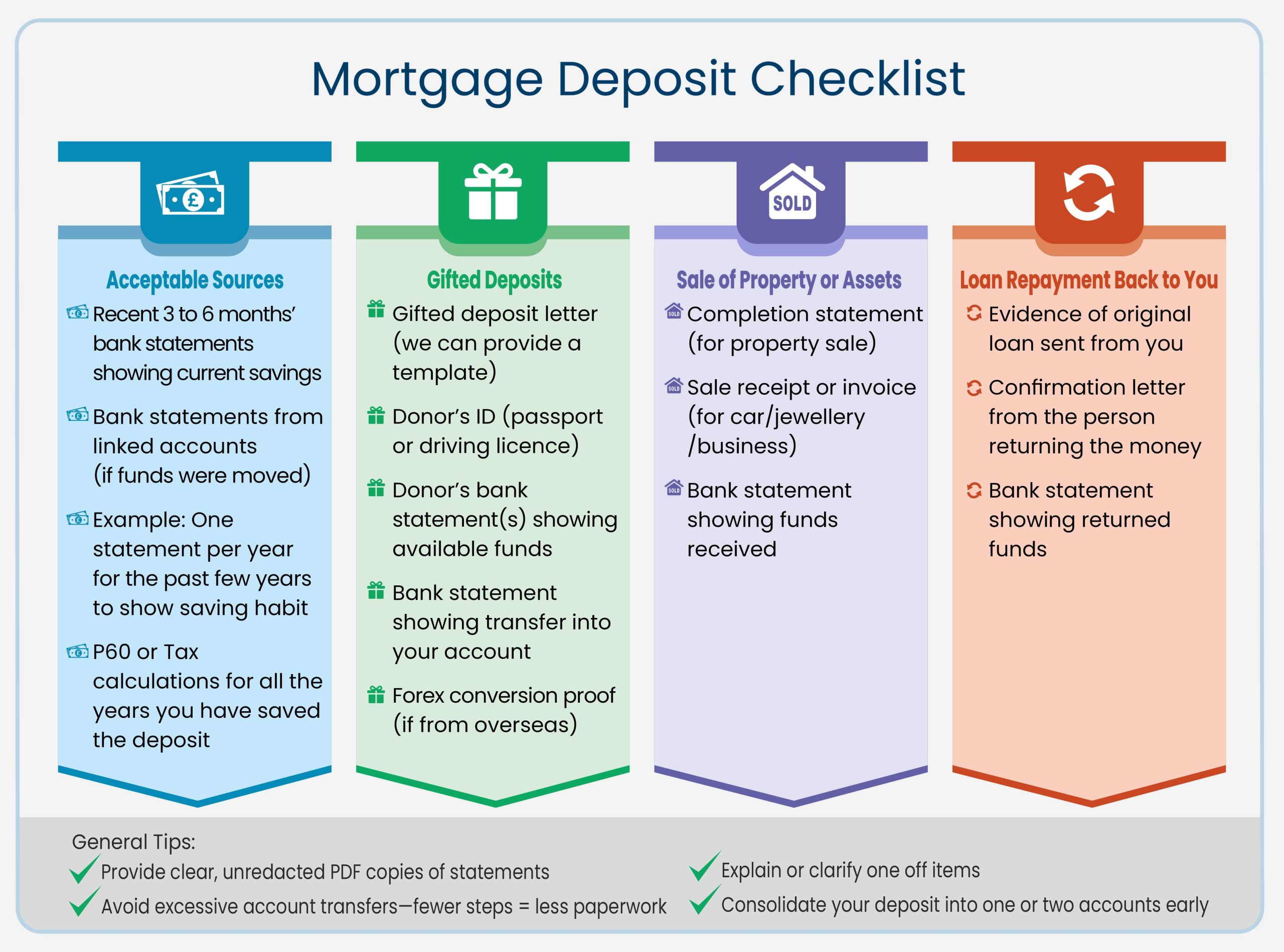

- Deposit source and evidence.

- Property preferences such as freehold or leasehold, service charges, ground rent, or new-build details.

Our unique approach

We prepare a personalised, dynamic spreadsheet that models:

- Different property prices and deposits.

- The impact of term or rate changes.

- How your affordability and payments shift with each scenario.

This prevents wasted viewings and helps you and your family align on a realistic plan before falling in love with a property outside budget.

Outputs you receive:

- A clear headline range for purchase price and loan.

- Estimated upfront costs.

- Indicative monthly payments under a few realistic setups.

- A summary of the best-case pathway, subject to standard checks.

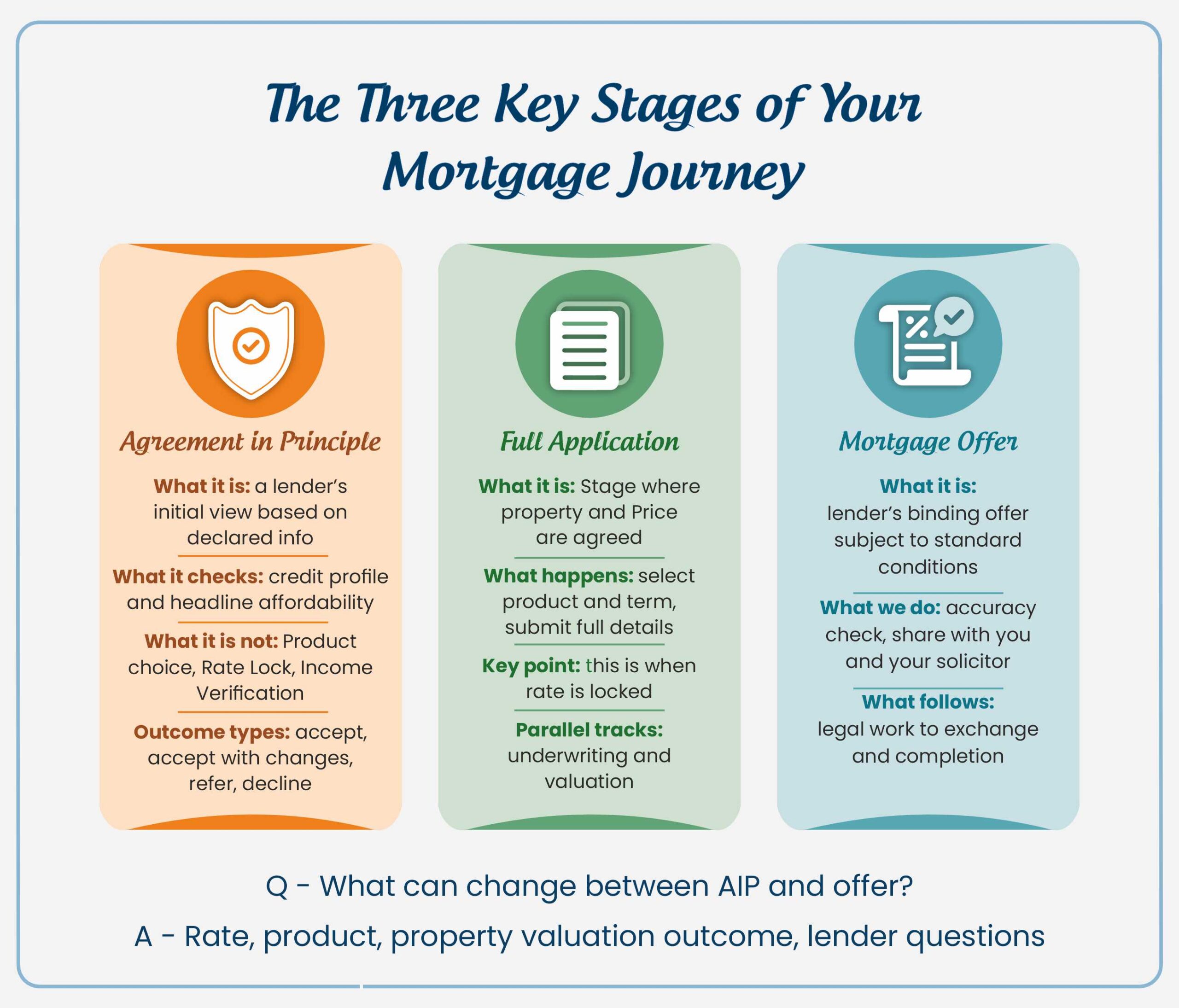

A lender’s non-binding confirmation that, based on declared information, your credit profile and circumstances appear acceptable for borrowing up to a stated limit and deposit.

What it is not:

- Not a product choice or rate lock.

- Not a full underwrite.

- Does not require you to evidence income or deposit to the lender at that stage.

Possible outcomes:

- Accepted for the requested loan and deposit.

- Accepted but for a lower loan or higher deposit.

- Referred for manual review.

- Declined.

Why it matters:

Estate agents often ask for an AIP before viewings or when you make an offer. It demonstrates you’re financially prepared and serious about buying.

Tip:

We usually obtain the AIP at the most conservative deposit level you’re comfortable with. If you later choose to put in a larger deposit, that’s an easy adjustment.

Only after the property and price are agreed. Before that, we show you ranges and examples — not specific products.

Once an offer is accepted, we refresh your spreadsheet and review:

- Product style (fixed, tracker, discount).

- Fixed period (two or five years, and whether flexibility is important).

- Term, affordability, and how it affects long-term cost.

- Fees and whether adding or paying upfront makes sense.

- Leasehold and property-type considerations.

The key document you receive:

A detailed Mortgage Illustration that outlines your rate, fees, term, payments, and deposit.

This forms the foundation of the final mortgage offer, assuming there are no material changes.

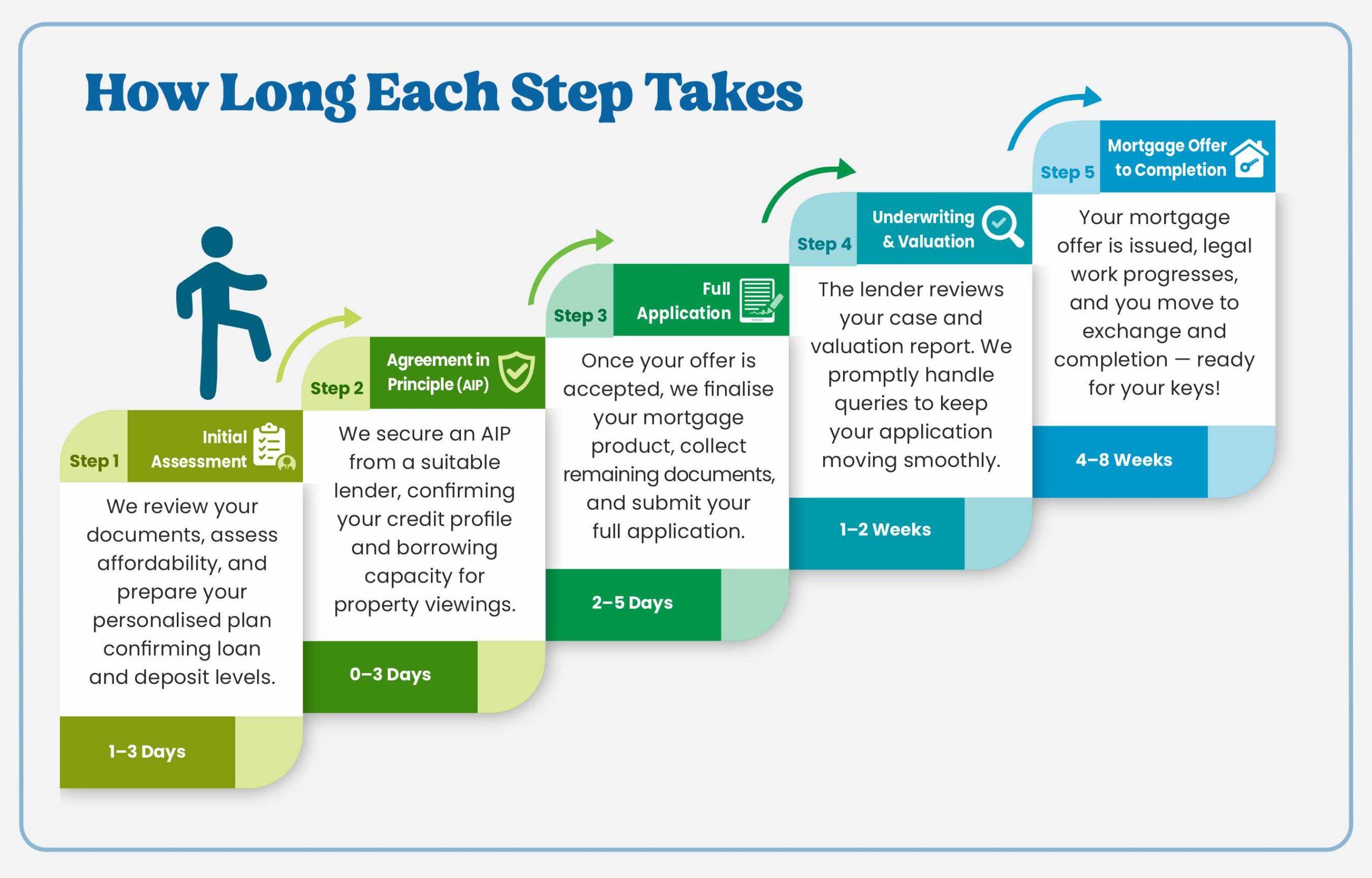

- ID and address verification.

- Income documents: latest payslips, P60s for the last two years, and employment letter if required; or SA302s (Tax Calculations), Tax Year Overviews, company accounts, and accountant references for business owners.

- Bank statements and explanations for unusual transactions.

- Evidence of all credit commitments and deposit source.

- Property details (lease, ground rent, new build warranty, etc.)

Why this matters:

It reduces back-and-forth, makes underwriting smoother, and surfaces deal-breakers early when there’s still time to adapt.

- The case manager checks that all documents match the application.

- Queries are common; some cases complete in a single round, while others require several iterations depending on complexity.

- The lender focuses on identity, affordability, credit conduct, and how your deposit is sourced and evidenced.

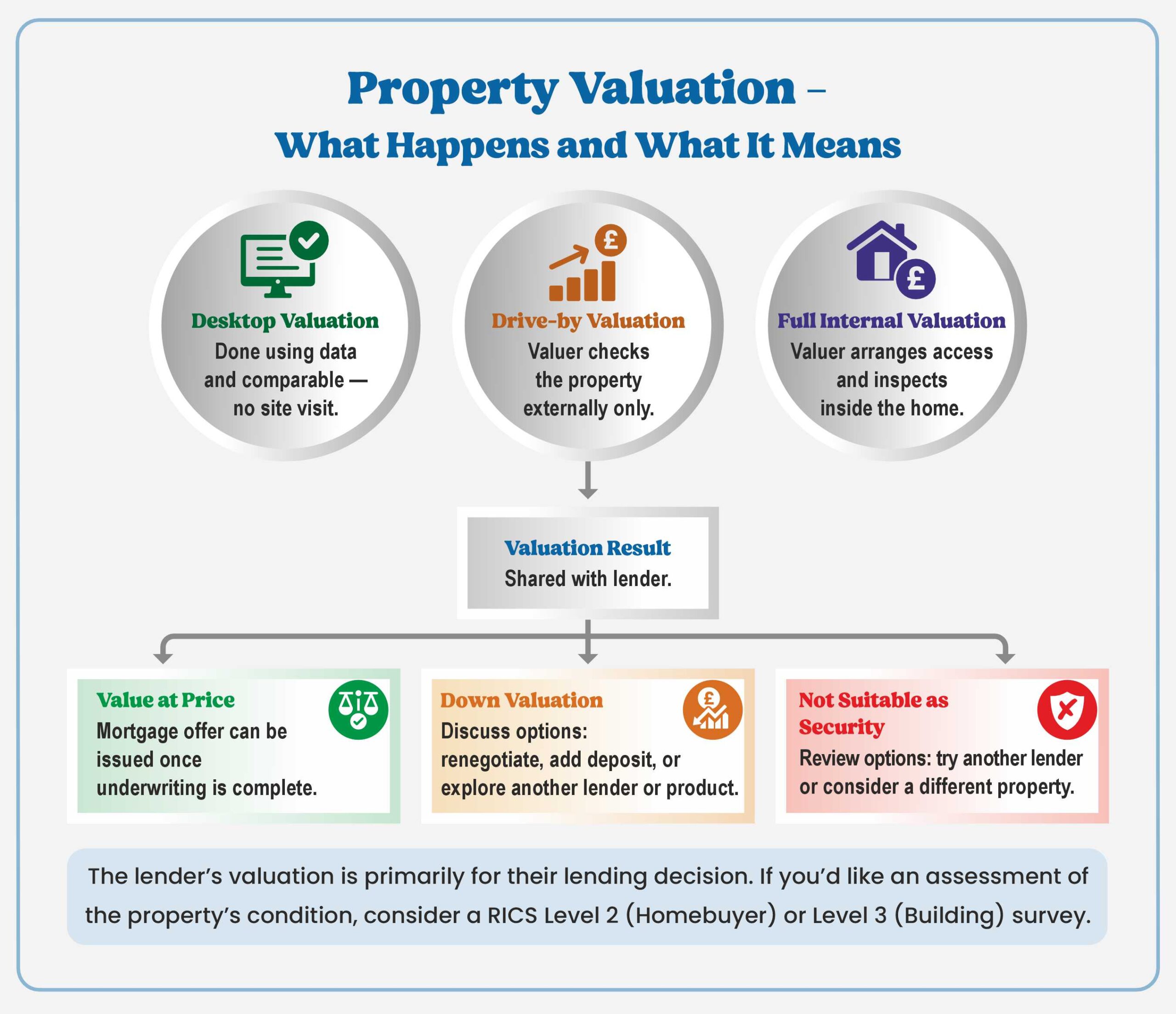

Valuation — types, triggers and outcomes:

At this point, the lender instructs a valuation to confirm that the property is suitable security for the mortgage and that its value matches the agreed price.

You may not always see a valuer in person — sometimes it’s done digitally or from outside the property.

The infographic above shows the three main valuation methods and the possible outcomes.

Here’s how to read it in context:

- If the valuation comes back at the agreed price, the process moves smoothly to mortgage offer.

- If it’s lower than the purchase price (a “down valuation”), we’ll discuss options — renegotiating the price, increasing your deposit, or exploring alternative lenders.

- If the property is deemed unsuitable as security, this usually points to structural or legal issues. In such cases, we’ll reassess whether another lender or property is more appropriate.

If you’d like to understand the different types of property surveys and when each is recommended — for example, a RICS Level 2 (Homebuyer) or Level 3 (Building) report — read our detailed guide:When to Get a Property Survey

- Review it thoroughly to ensure it matches the illustration and key details.

- Flag and correct any discrepancies with the lender.

- Share the confirmed copy with you and your solicitor.

- Update the estate agent that the offer is in place (without sharing private documents).

From this point, the legal work drives the timeline — searches, enquiries, and exchange.

We remain engaged until completion and monitor for potential rate reductions that may benefit you.

- Provide complete documents promptly in the requested format.

- Keep us updated on any job, income, or deposit changes.

- Respond quickly to emails or document requests.

- Facilitate access for surveyors and solicitor ID checks without delay.

We remain available to coordinate lender conditions, monitor rates, and keep all parties aligned.

Yes — we’ll need your solicitor’s details before we submit your full mortgage application.

Having a solicitor in place helps avoid delays once the mortgage offer is issued and ensures your legal work can start promptly.

We’re happy to share a quote from one of the solicitors we work closely with for you to consider — entirely without pressure or obligation.

Yes, most lenders are comfortable with gifted deposits as long as there’s a formal letter confirming it’s a genuine gift, not a loan.

We’ll guide you and your family through what’s required so that the paperwork is exactly as lenders expect.

That’s absolutely fine — just let us know as soon as you can.

A change of job can affect how a lender assesses your application, but not always negatively.

We’ll review the new details, check lender criteria, and help you decide the best way forward without losing momentum.

Often yes, if there’s enough time before exchange and if the lender allows product switches.

We’ll assess whether it makes sense financially and, where worthwhile, help you move to the lower rate so you don’t miss out on potential savings.

It depends on the lender. Some carry out a soft search that doesn’t affect your credit score, while others perform a hard check that appears on your file.

We’ll always choose the most suitable route for your circumstances and discuss the implications before proceeding.

Your rate is locked only when we submit your full mortgage application with the chosen lender and product.

That’s why we don’t rush to select a deal too early — we’ll time it carefully so you can secure the best rate available once your property and price are confirmed.

It’s best to avoid taking on any new credit or making unnecessary credit applications until your property has completed.

Lenders may run additional checks before releasing funds, and new borrowing can affect your affordability assessment or credit score.

If something is essential and doesn’t increase your monthly commitments, that’s usually fine — but always check with us first to be sure.

Here’s how we add value throughout your mortgage journey:

- Whole-of-market advice: We assess options from across lenders to find what truly fits your circumstances.

- Dynamic personalised spreadsheet: Unique to Nachu Finance — helping you visualise how deposit, term, or price changes affect costs.

- Application-prepping approach: We identify and fix potential issues before submission, saving you time later.

- Transparent communication: You’ll always know where your case stands, what’s possible, and what’s not.

- Ongoing support: From rate watch to coordination with solicitors, we stay with you right up to key collection.

Explore more on our Mortgage Services page for detailed insights on first-time buyer, home mover, and specialist mortgage options.

Our Transparency Promise

When Things Don’t Go to Plan

While we’ll do everything possible to make your mortgage journey as straightforward as we can, the truth is that not every application runs exactly to plan.

At times, issues may arise that are outside anyone’s control — whether due to lender processes, valuation outcomes, or solicitor delays.

What we can promise, however, is that we’ll always be in your corner.

We’ll keep you informed, fight your case wherever possible, and work closely with all parties involved to achieve the best possible outcome for you.

Our role is not just to submit your mortgage — it’s to stand by you until your goals are achieved, with transparency, persistence, and care guiding every step.

Ready to Make Your First Home a Reality?

Buying your first home can feel complex — but with Nachu Finance by your side, it doesn’t have to be.

We’ll guide you from that very first calculation through to collecting your keys, ensuring each step is clear, compliant, and stress-free.

Our approach is more than just finding you a mortgage. We help you understand your numbers, prepare your documents, and structure your application so it fits perfectly with your circumstances. You’ll have full visibility at every stage, and confidence that your mortgage is right not only for today but for your long-term plans too.

Contact us today to begin your first-home journey with trusted, whole-of-market advice and genuine personal support.