In today’s digital world, it’s natural to turn to comparison websites to check mortgage rates.

They’re easy to use and give a quick overview of what’s available in the market.

But when it comes to actually getting a mortgage — and making sure it’s suitable, affordable, and achievable — what you see on a comparison site is only half the story.

That’s where the value of personalised advice comes in.

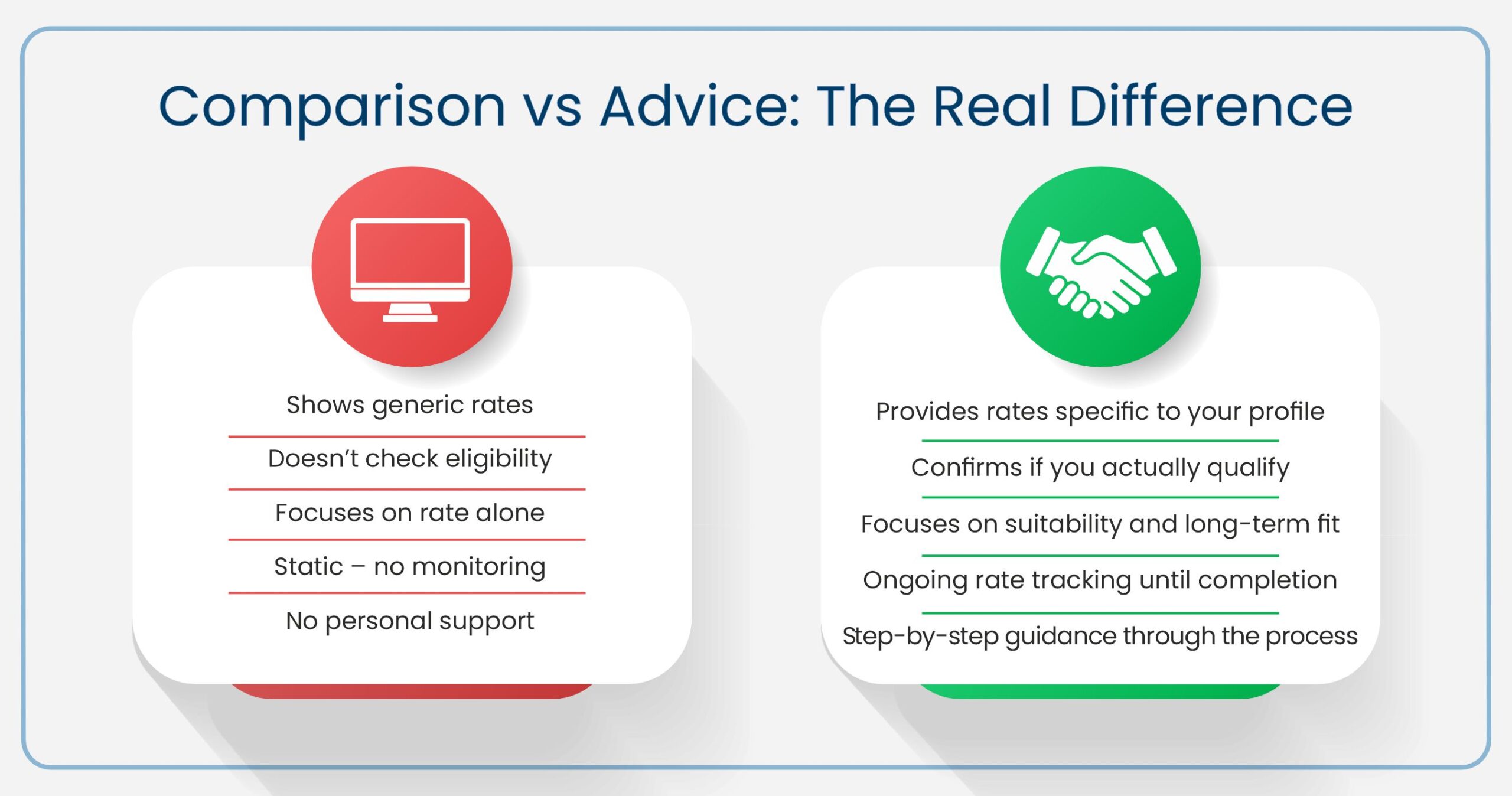

Comparison websites are a great starting point for research. They help you understand the general range of rates in the market.

However, what they show are generic products, often filtered only by loan amount, property value, and type of mortgage.

What they don’t take into account are your personal details that actually determine whether you can access that rate, such as:

⦁ How you earn your income – employed, self-employed, or on a contract

⦁ The stability and type of your income – salary, dividends, day rates, or multiple income sources

⦁ Your credit profile and existing commitments

⦁ Source of deposit – personal savings, gift, or from overseas

⦁ Your residency status or visa type

⦁ Type and condition of the property

⦁ Whether you are buying in personal name or through a Ltd company

Each of these factors can significantly alter which lenders are willing to offer you a mortgage — and at what rate.

With personalised advice, the focus shifts from finding a rate to understanding your situation in full.

An adviser takes time to understand your circumstances and objectives before recommending any product

They review the entire market (not just one lender panel or an online list) and select options that are:

⦁ Available to you, based on your profile

⦁ Suitable for your needs and plans

⦁ Compliant with lender and regulatory requirements

⦁ Timed correctly, reflecting how long each rate is valid and when you plan to complete

Every rate shared through personalised advice is one that the adviser is confident you are both eligible for and comfortable with — taking into account your affordability, goals, and any foreseeable changes ahead

commitment.

Mortgage rates in the UK can be volatile and may change even within a single day.

A rate displayed online might already be withdrawn or replaced by the time you apply.

With personalised advice, an adviser will typically:

⦁ Track market movements daily

⦁ Re-check rates right up to the point of exchange or completion for purchases

⦁ Revisit options close to your renewal date in remortgages or product transfers

⦁ Recommend switching to a lower rate, if one becomes available before completion and it suits your circumstances

This level of monitoring helps ensure that the mortgage product you proceed with remains competitive and appropriate right up to the point you lock it in.

One of the most important distinctions between taking personalised advice and using a comparison website lies in accountability.

When you rely on online listings, no one takes responsibility for whether the information shown is accurate, up to date, or suitable for your circumstances. The choice — and any resulting outcome — rests entirely with you.

By contrast, when you receive regulated mortgage advice, the adviser takes full responsibility for the recommendation made. This includes assessing your income, commitments, and future plans to ensure the advice is both appropriate and compliant.

Every recommendation is backed by professional due diligence, regulatory oversight, and the adviser’s Professional Indemnity Insurance, which provides an additional layer of protection and reassurance for clients.

This accountability — combined with ongoing rate monitoring and suitability checks — is what truly differentiates advice from comparison.

The Value of Trust and Expertise

Personalised mortgage advice is not about selling a rate; it is about guiding someone towards the right mortgage solution for their circumstances.There is no incentive for an adviser to withhold a cheaper rate if it is truly suitable — the entire purpose of regulated advice is to find the option that best fits the client’s needs.

The advice process goes far beyond comparing numbers. It involves making sure the application is positioned correctly, the product aligns with future plans, and the overall journey remains clear and manageable.

Securing a mortgage is a journey rather than a single-step process, and understanding how the various stages fit together can make the experience far smoother. You can read more about the typical steps in the process The First-Time Buyer’s Mortgage Journey: A Complete, Practical Guide

While comparison websites provide a quick snapshot of available mortgage rates, they rarely show the full picture. Personal advice goes several steps further — checking eligibility, assessing suitability, and guiding you through the entire process until completion. The difference isn’t just in the rate, but in the reliability and responsibility behind it.

There’s nothing wrong with browsing comparison websites — they can be a useful way to familiarise yourself with the market and get a sense of the available options.

However, it’s important to remember that what appears online is a general snapshot, not a tailored recommendation.

When you work with an experienced, independent mortgage adviser, the focus is not just on the rate itself but on eligibility, suitability, timing, and long-term implications.The process involves careful assessment, documentation, and monitoring — ensuring that the final mortgage solution genuinely fits your individual circumstances and future plans.

Good decisions rely on clarity and context, not on headline rates alone.