Buying a home is one of the biggest milestones in life. Once your offer is accepted, the legal work that transfers the property into your name begins. This process is called conveyancing.

Conveyancing can feel complex, but understanding what happens at each stage — and why — makes it easier to manage expectations, avoid delays, and plan your move with confidence.

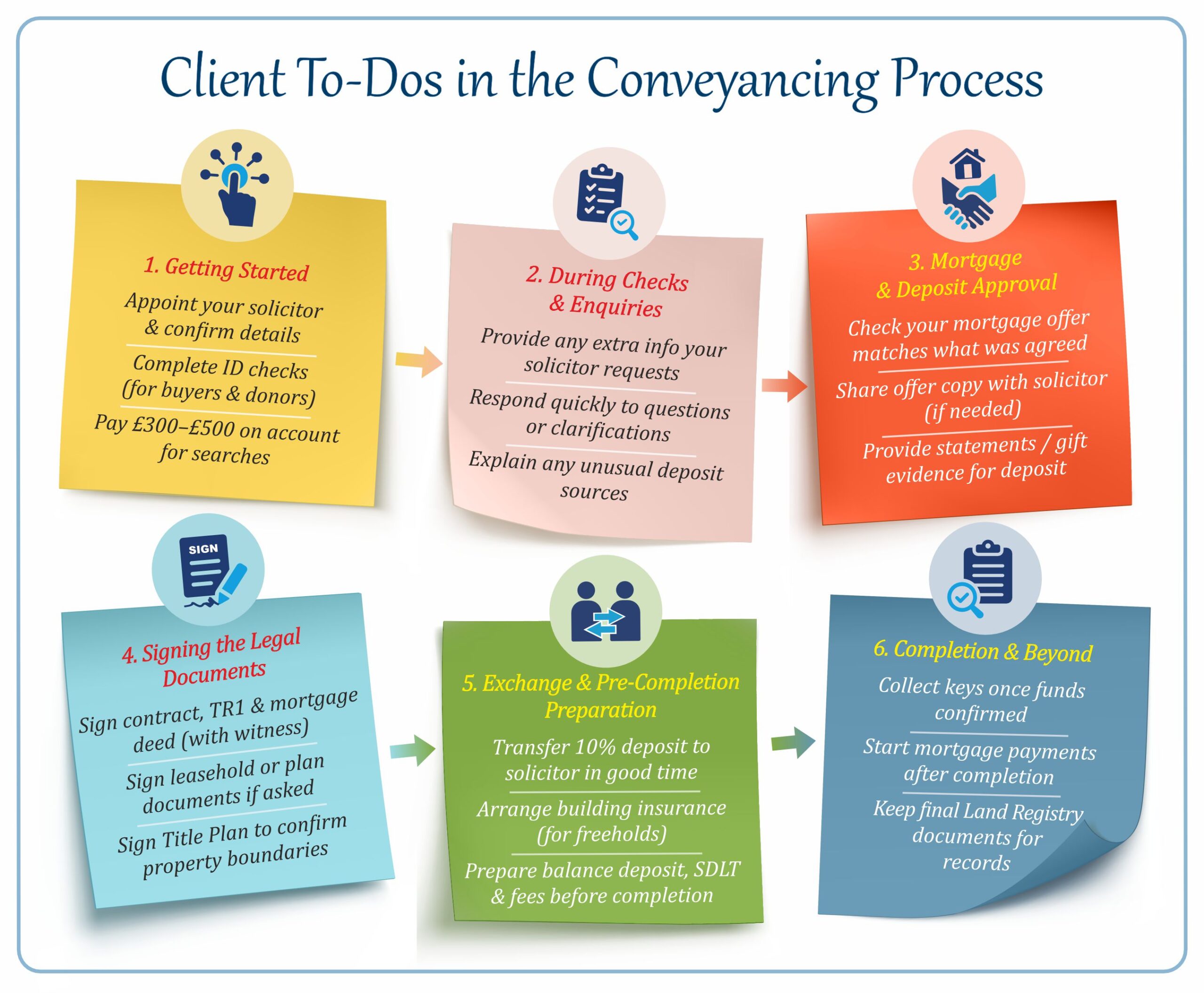

This guide takes you through the process in detail, from instructing a solicitor through to getting your keys, including what you will need to do, common delays, and how to protect yourself when transferring large sums of money.

Your solicitor can only begin once a few essential steps are complete.

From you

- Formal instruction: You confirm in writing that you want them to act for you, providing details such as property address, agreed price, and the names of all buyers. Once this is received, the solicitor opens a new file for your transaction.

- ID checks: Every buyer must complete ID checks. Increasingly, this is done through secure apps rather than just copies of passport and utility bills. If you are receiving a gifted deposit, the donor’s ID is also required.

- Client questionnaire: This detailed form collects information such as your National Insurance number, employment, buyer status (first-time buyer, home mover, additional properties), property details, bank account details for refunds and balances, and the source of your deposit. Many firms now collect this through an online portal.

- Money on account: Typically £300 to £500, used to pay for searches and other disbursements on your behalf. This is not an extra fee; it is drawn against actual costs.

From the agent and seller

- Memorandum of Sale: Provided by the estate agent, this confirms the deal, agreed conditions, and the details of both solicitors. It is the document that connects the buyer’s and seller’s solicitors.

- Draft contract pack: Sent by the seller’s solicitor to your solicitor. It includes the draft contract, title documents, Property Information Form, Fixtures and Fittings Form, and any relevant leasehold information if the property is not freehold.

Your solicitor can properly begin the conveyancing only once all of the above are in place.

This is the solicitor’s core legal work and is designed to protect both you and your mortgage lender.

- Title investigation: Your solicitor reviews the property’s legal title, ensuring it matches what you think you are buying and is acceptable to your lender. They check for restrictions, covenants, rights of way, and other issues. You will usually receive a Report on Title summarising the findings.

- Searches: Local authority, environmental, drainage and water, and other location-specific searches are ordered. These can take one to four weeks to come back and are often the longest single dependency.

- Enquiries: Based on the title, searches, and the seller’s forms, your solicitor raises queries with the seller’s solicitor. Importantly, it is not enough for replies simply to arrive — they must be satisfactory. If not, further clarification is sought.

- Mortgage offer: Once your mortgage offer arrives, your solicitor checks it carefully, explains conditions to you, and ensures it fits the property being purchased.

- Deposit checks: The source of your deposit is verified. Non-standard sources such as gifts or business funds are reported to the lender.

Only once the title is approved, searches are back, enquiries are satisfactorily answered, the mortgage offer is in, and the deposit source is cleared, will your solicitor be ready to recommend exchange.

Leasehold purchases involve additional checks and often take longer.

- Management pack: Your solicitor must obtain a pack from the freeholder and management company, covering service charges, ground rent, building insurance, consents, and any planned works. The seller usually pays for this pack

- Payment status: Confirmation that the seller is up to date with service charges and ground rent is required.

- Timing: Freeholders and management companies are rarely quick to respond, which explains why leasehold transactions often extend to ten to thirteen weeks.

- Insurance: For flats, building insurance is usually held for the entire block by the management company, not by individual owners.

Before exchange, your solicitor will send you a set of documents to sign.

- Contract: Signed by all buyers confirming you agree to the purchase. Usually, this does not need to be witnessed.

- Transfer (TR1): This Land Registry document transfers ownership from seller to buyer. It must be witnessed by an independent adult. The witness:

- Cannot be related to you

- Cannot live at the same address

- Must be over 18

- Can witness for both buyers, but must sign against each name separately.

- Mortgage Deed: Gives your lender a legal charge over the property. Must also be signed and witnessed under the same rules.

- Leasehold forms and plan acknowledgement: If buying leasehold, you may be asked to sign to confirm your understanding of the property boundaries. Some solicitors also require a signature on the plan documents to confirm you know exactly which property within a development is being purchased.

We can witness signatures in our office if needed.

Your solicitor will also request the deposit for exchange at this point. Usually this is 10 percent of the purchase price, but alternative arrangements can sometimes be agreed.

- Contracts are normally signed by you in advance and are then formally dated by the solicitors on the day of exchange.

- The exchange date is often coordinated through the estate agent, who keeps both sides aligned.

- At exchange, you pay the deposit (usually 10%).

Important:

- At exchange, you do not get the keys.

- The seller still occupies the property.

- You are not yet making mortgage payments.

Exchange is about creating the legal commitment to complete on the agreed date.

- Book packers and removals.

- Order furniture, flooring, or appliances.

- Give notice to your current landlord if renting.

Balance deposit example

If your overall deposit is 25 percent, you will normally pay 10 percent at exchange. The remaining 15 percent is then transferred just before completion, along with Stamp Duty and fees.

New builds

Unlike standard properties, new builds often exchange before the property is fully complete. In these cases, completion depends not only on the property being finished but also on receiving sign-offs from building control and warranty providers. This means the completion date may not be fixed at the point of exchange.

- Your solicitor will request your mortgage funds from the lender the day before completion.

- You provide any balance deposit, Stamp Duty Land Tax, and solicitor’s fees.

- Once the seller’s solicitor confirms receipt of all monies, they authorise the estate agent to release the keys.

When does the seller vacate?

In most cases, the seller vacates the property on completion day, sometimes the day before. Keys are usually available from the estate agent once funds clear.

When do mortgage payments start?

Only after completion. No mortgage interest is charged and no repayments are due before this point.

- Paying any Stamp Duty Land Tax due to HMRC.

- Registering your ownership at HM Land Registry.

- Registering your lender’s charge over the property.

- Sending you final confirmation and updated title documents.

These steps happen in the background after you have moved in.

- Freehold homes: three to eight weeks from instruction to exchange.

- Leasehold homes: ten to thirteen weeks due to management company delays.

A sensible expectation is six to eight weeks for a freehold and ten to thirteen weeks for a leasehold.

Exchange and completion can sometimes happen on the same day if everyone agrees and logistics allow. More commonly, there is a gap of a week or more.

Large sums are transferred during conveyancing, which unfortunately attracts fraud attempts. Always follow best practice:

- Verify bank details securely: Solicitors do not change bank details mid-transaction. Treat any message claiming otherwise as suspicious and phone the firm using a verified number.

- Use telegraphic transfer: Online banking often has daily limits. Telegraphic transfers carry a fee but are faster and safer for large amounts.

- Funds must come from your account: Solicitors will only accept funds from the buyer’s own account.

- Gifts from family should be paid into your account first.

- If using business funds, transfer them to your personal account before sending to your solicitor.

Keep transfers to as few payments as possible and always confirm receipt.

- Instruct solicitor, provide full details, and complete ID checks.

- Return the client questionnaire promptly.

- Pay money on account to enable searches.

- Gather deposit evidence (including gift paperwork).

- Look out for document packs to sign and arrange a proper witness.

- Be ready to pay the 10 percent deposit at exchange.

- Plan for the balance deposit, SDLT, and fees at completion.

- Coordinate exchange and completion dates through your estate agent.

- Verify solicitor bank details and plan how you’ll transfer funds.

- Book removals once the completion date is fixed.

No. You sign the contract earlier. On the day of exchange, solicitors date and formally exchange contracts.

After completion. No interest or repayments are due before then.

Yes, if all parties agree, though it’s less common where there is a chain.

Because your solicitor must obtain and check information from freeholders and management companies, who often take time to respond.

An independent adult over 18, not related to you and not living at your address. Friends, colleagues, or neighbours are ideal.

Our Transparency Promise

The Process Is Less Than Desirable

Buying a property in England involves one of the lengthiest legal processes in the world — and unfortunately, it’s widely recognised that the current system is not fit for purpose. Even the Government has acknowledged that the numerous steps, layers of checks, and dependency on multiple parties can lead to severe delays. These delays affect not only home movers but also the wider economy.

Given this complex and long-drawn process, it’s also fair to acknowledge that solicitors are often managing a large number of cases at the same time. As a result, they may not always be as responsive as you might hope. This is not necessarily a reflection of a lack of effort or interest, but rather the reality of their workload and the volume of communication involved in property transactions. Expect some delays in reaching them or hearing back, and try to plan around this to avoid unnecessary frustration.

For now, this is the system we must all work within. Until improvements are made, the best approach as a buyer is to prepare yourself for a process that can take time and make sure you do everything within your control promptly and accurately.

While it can feel like a long journey, the end result is absolutely worth it — that unforgettable day when you finally complete and collect the keys to your new home. We believe that being mentally prepared, well-informed, and fully supported makes all the difference in turning this complex process into a smoother and more satisfying experience.

How Nachu Finance Can Help During the Conveyancing Process

At Nachu Finance, we don’t stop once your mortgage offer is in place — we stay actively involved while the legal work happens.

When you instruct solicitors we work with regularly, the process often feels smoother because we already have established communication and trust. Our role includes:

- Coordinating and following up with the solicitors to keep your case moving.

- Sharing key documents and information you’ve already provided to us, so you don’t have to repeat yourself.

- Chasing updates and clarifying progress, then keeping you informed in plain language.

- Helping with forms and signatures, including acting as a witness where appropriate for certain documents.

- Offering reassurance and explanations — helping you understand what’s happening and why each step matters.

We’ll be honest — liaising with solicitors and managing timelines is one of the more time-consuming parts of what we do, but it’s also one of the most satisfying. Buying a home is a major milestone, and we take pride in being alongside you throughout this important, and sometimes daunting, journey.