Life insurance, critical illness cover, and income protection are essential pillars of family protection. Yet, once policies are in place, many people rarely revisit them.

At Nachu Finance, we believe a periodic review of your existing life insurance can make all the difference — ensuring your cover remains relevant, accessible, and effective when your family needs it most.

Make Sure the Policy Is Accessible

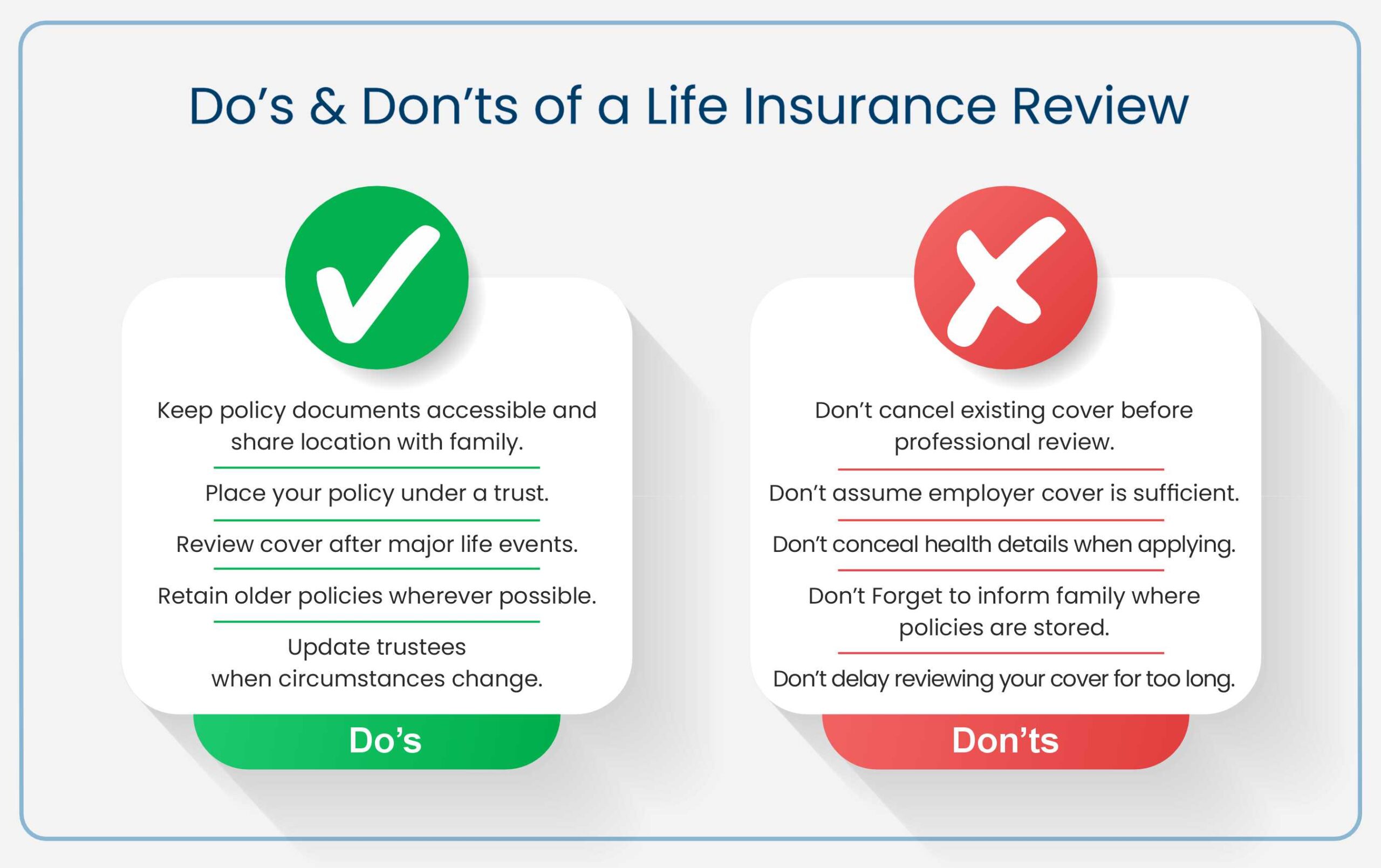

Before anything else, ensure that your family knows what policies you hold, who the providers are, and where to find the documents.

It is surprisingly common for families to be unaware of the details of existing policies. If you find it difficult to locate your documents while everything is going well, imagine how challenging this could be during a crisis.

Keep your policies accessible — ideally in both digital and physical form — and make sure immediate family members or adult children know where to find them.

Placing a life insurance policy under a trust ensures that proceeds are paid quickly and tax-efficiently to your chosen beneficiaries.

If your policy isn’t already under a trust, we strongly recommend setting this up.

If it is already under a trust, ensure the trustees’ details are up to date — especially if children have now become adults or if any trustee is no longer suitable to act.

Read more in our related article: Why Your Life Insurance Policy Should Be Placed Under a Trust

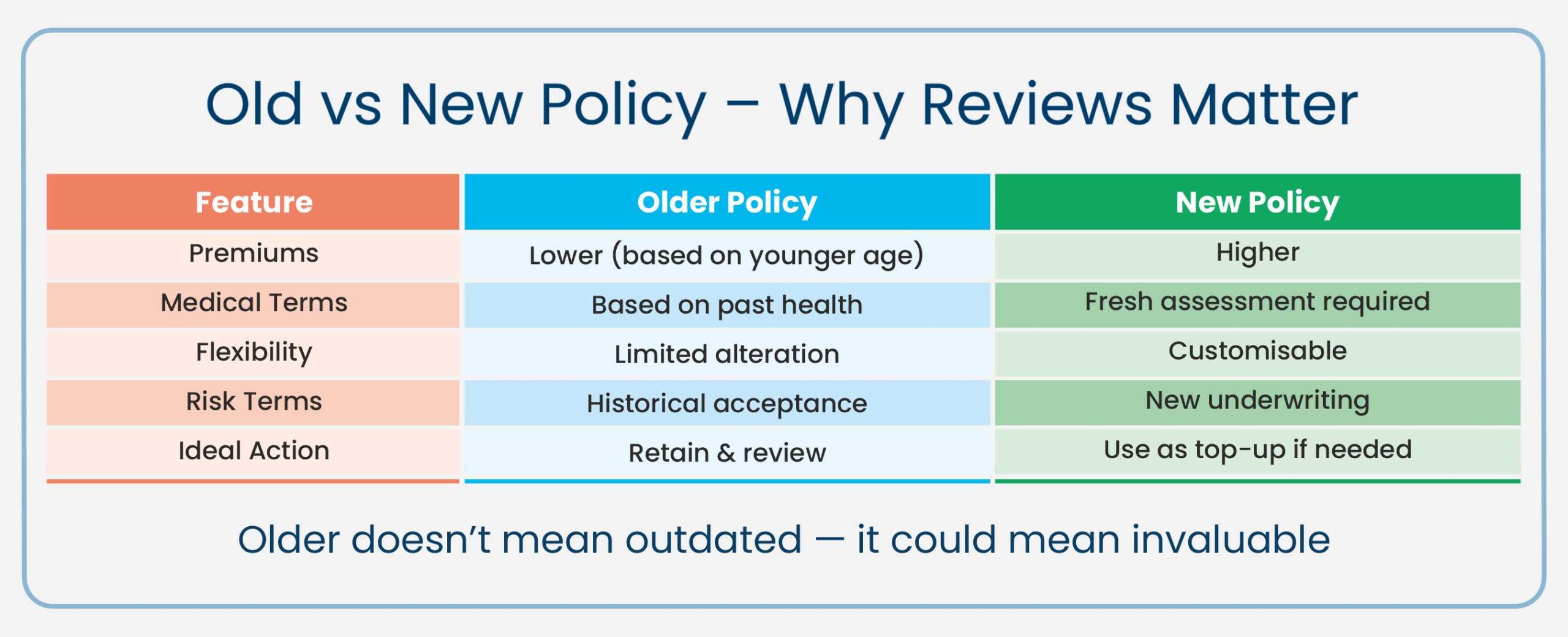

Older life insurance plans can often be genuine hidden gems.

Premiums are based on your age and health at the time you apply, which means policies taken out years ago often benefit from significantly lower, locked-in premiums and medical terms that may no longer be available today.

Before cancelling, altering, or replacing an existing policy, it is essential to seek professional advice. At Nachu Finance, we review older policies with care to ensure they remain relevant to your current needs, and we rarely recommend cancelling them unless there is a clear and meaningful benefit.

Because premiums rise sharply with age, older plans can offer outstanding long-term value compared to arranging cover later in life. Our premium comparison chart by age clearly shows how starting early keeps costs lower for the entire duration of the policy — you can view it Don’t Just Buy a Home-Protect It Too for a clearer picture.

It is natural to wonder whether an existing policy can simply be extended to cover a longer term or increased to a higher amount.

In most cases, insurers will not allow an increase in cover or extension of the term without full medical reassessment, as this changes the original risk profile.

Our approach is to:

- Keep your existing policy as it is.

- Add a “top-up” policy for additional cover or a longer term if needed.

This way, you retain the advantages of your older policy while ensuring your family remains fully protected.

Life evolves — so should your insurance.

Events such as marriage, buying a new home, having children, or changes in employment (for instance, moving from employed to self-employed) all affect your protection needs.

A periodic review helps you check whether:

- The level of cover matches your mortgage balance and family needs.

- Your term still aligns with your working years.

- Any employer benefits or other cover overlap with your personal policies.

Here are three real-life examples that show how a life insurance review can make a meaningful difference at different stages of life. Each case has a different outcome, but in every situation the review still proved to be the right and sensible step.

Ishan & Sitara

Ishan bought his first property in 2017 for £320,000 with a £250,000 mortgage. At the time, he took out £250,000 of life cover and £100,000 of critical illness cover in his sole name.

When he returned in 2023, he was now married to Sitara and the couple were buying a new family home for £610,000. During our review, we found that Ishan’s historic policies offered excellent terms and very competitive premiums, which would be hard to replicate today.

We therefore kept both existing policies in place, placed his life cover under a trust, and recommended top-up life cover to match his new financial responsibilities. Since Sitara had no protection at all, we also arranged suitable life and critical illness cover for her.

This is a textbook example of why older plans should not be cancelled automatically. With a review, the couple were able to:

- retain valuable historic cover

- place the policy under trust

- top up protection to match their new life stage

- ensure both partners were fully covered

Felix & Amy

Felix and Amy came to us in 2021 for a remortgage. They had originally purchased their home in 2015 and arranged their life insurance directly with the insurer at the time.

When we asked for their policy documents, they initially struggled to locate them — a common issue that becomes critical during a claim. After some effort, they shared a copy with us and also made sure their family knew where the documents were safely stored.

Following a full review, we concluded that their existing life and critical illness policies were still appropriate for their current circumstances. No top-up cover was needed, but we placed their existing plans under trust and securely stored copies of their documents in their client folder.

Although no new insurance was taken, the review still delivered meaningful benefits:

- policy documents were located and securely stored

- the family now knows exactly where to find them

- the plans were placed under trust for efficient payout

- reassurance that their existing cover remains fit for purpose

This case shows how valuable a review can be even when no policy changes are required.

Vivan & Rebecca

Vivan and Rebecca approached us around 11 months after their original life insurance was set up at the time of their property purchase. Both were employed when the policies were first taken out.

Within a year, Vivan had moved from employment into a day-rate contracting role through his own limited company. This meant he no longer received the death-in-service benefit he previously enjoyed from his employer.

During the review, we kept Rebecca’s policies unchanged, as her circumstances remained the same. For Vivan, we recommended restructuring his protection by:

- cancelling his new-but-still-young personal life cover

- replacing it with a Relevant Life Plan to benefit from significant tax efficiencies

- increasing the level of life cover to reflect his new responsibilities and lack of workplace benefits

We also reviewed critical illness cover. Although a higher amount would have been sensible, Vivan decided not to increase it for now due to cost considerations.

This case highlights how a review can help align protection with changing employment circumstances — especially when moving to self-employment or contracting.

At Nachu Finance, we appreciate that older policies can hold immense value.

When we review your existing cover, we:

- Check if it remains suitable for your current family and financial circumstances.

- Help optimise it — including setting up or updating the trust.

- Securely store copies of your policies in your client file, so your family can easily access them in the event of a claim.

- Review both policies arranged by us and those you arranged elsewhere.

Even if no changes are needed, the reassurance that your policy is still fit for purpose is a valuable outcome in itself.

No. The insurer bases its terms on your health and lifestyle at the time of application.

Once the policy is live, there is no obligation to update them about later changes.

Yes. You can replace or add trustees at any time.

We always recommend reviewing the trustees during your periodic insurance review to ensure they are still appropriate and willing to act.

Yes. You can hold multiple policies with different providers.

At application, you must declare any existing cover so the insurer can assess your total cover amount correctly.

Absolutely.

For clients whose policies were arranged through us, claim support is fee-free.

We believe compassionate, expert help at such a crucial time is an essential part of our service.

Yes. Many people keep their older policies because they offer lower premiums and favourable terms, and simply add a top-up policy when their protection needs increase. This is completely normal, and it allows you to retain the benefits of your historic cover while ensuring your overall protection keeps pace with life changes.

Our Transparency Promise

Full Disclosure, Complete Peace of Mind

At Nachu Finance, we insist that all applications are made with full and honest disclosure of health, lifestyle, and smoking status.

We review every detail with you before submission, so the insurer receives accurate information.

We would rather an insurer take extra time to verify your details now than risk a claim being declined later for non-disclosure.

This careful approach protects your family’s peace of mind and ensures that your policy pays out when it matters most.

Let Us Review Your Policy

As holistic advisers, we see life insurance as a core part of family financial planning.

Our transparent, no-pressure approach means we’ll only recommend action when it’s genuinely in your favour.

Reach out to Nachu Finance for a free, transparent review of your existing life insurance.

We’ll give you an honest assessment and, if needed, help you:

- Place the policy under a trust

- Adjust or top-up your cover

- Optimise your family’s protection for today and the years ahead