Transfer of Equity (TofE)is the legal process of changing the ownership of a property by adding or removing names from the title. Unlike a sale and purchase transaction, at least one of the existing owners continues to remain on the title. While the actual legal work is carried out by a solicitor, mortgage advisers like us often get involved—because the names on the mortgage must reflect the updated ownership. This article explores the key aspects of a Transfer of Equity and when it might be relevant.

Direct Debit and Monthly Payments When You Remortgage

- 04 Jul 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Direct Debit and Monthly Payments When You Remortgage

When remortgaging from one lender to another, it’s natural to have questions about how your mortgage payments and direct debits will be managed during the transition. This article addresses some of the most commonly asked questions and outlines best practices to ensure a smooth experience.

Transferring a Property to a Ltd Company: Does It Really Make Financial Sense?

- 24 Jun 2025

- Sekkappan Alagu

- Buy to let Mortgages

- Comments Off on Transferring a Property to a Ltd Company: Does It Really Make Financial Sense?

Structuring your buy-to-let portfolio under a Limited Company has become an increasingly popular strategy for landlords. But while this setup can offer clear tax advantages for new purchases, it’s not always suitable when transferring properties already held in personal names—unless the property was once your own residence.

This article walks through how Ltd company mortgages work, who they suit best, when transferring properties makes sense, and the key traps to avoid.

Mortgage Deposit Source & Evidence – What Lenders Expect

- 10 Jun 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Mortgage Deposit Source & Evidence – What Lenders Expect

When buying a property with a mortgage, it’s easy to focus on rates, monthly payments, or loan sizes—but your deposit source and the evidence behind it can make or break your application. This often-overlooked detail has become increasingly important with tighter anti-money laundering checks and lender scrutiny. In this article, we explain what lenders and solicitors need to see, which sources are acceptable, and how you can avoid delays by getting it right from the start.

Acceptable Sources of Deposit

- Savings from Regular Earnings

This is the most straightforward and widely accepted source. Whether saved in the UK or in your personal accounts abroad, lenders will assess the plausibility of your savings by reviewing your income, outgoings, dependants, and duration of savings.

For example:

- A couple earning £80,000 jointly with two dependants and a consistent earning history over six years declaring £150,000 in savings is more credible than a single applicant earning £40,000 over three years with a similar family setup.

- Funds from investments

Money held in ISAs, investment portfolios, individual company shares, or from company share save schemes can all be used as a deposit source, provided you can show ownership and sale proceeds. Lenders may request valuation reports, sale transaction records, or account statements showing the transfer of funds into your account.

- Capital raised from a remortgage of another property

If you already own a property and are raising funds through a remortgage, this is usually acceptable, especially for buy-to-let purchases or onward residential moves. You’ll need to provide the remortgage offer, completion statement, and proof that the funds are available or have been transferred.

- Gifted Deposit from Family

Gifts from close family—typically parents, grandparents, or siblings—are widely accepted. However, each lender has their own criteria. Gifts from extended family (like uncles, aunts, or cousins) are accepted by some lenders but not all, so lender selection becomes key.

Lenders will check:

- That the gift is non-refundable

- That the donor has no legal or beneficial interest in the property

- That the donor has the funds and is not borrowing them

- Proceeds from the Sale of a Property

A common source, particularly for home movers. If the sale and purchase are simultaneous, evidence is straightforward. But if the sale occurred earlier, lenders will require full documentation—such as the solicitor’s completion statement and bank statements showing the deposit funds received from the sale.

- Sale of Other Assets

Funds generated from the sale of cars, jewellery, businesses, or similar are accepted with appropriate evidence. You will need to show:

- Proof of ownership

- Sale agreement or receipt

- Bank trail of money entering your account

- Repayment of a Previous Loan

If you have previously loaned money to someone and they’re now repaying you, this can be accepted as part of your deposit—provided you have clear documentation showing the original transfer and the repayment. Lenders will typically look to verify key details such as the names involved, the amount originally loaned, and the amount being returned to ensure the funds are genuinely yours. Id documents, proof of funds and a loan repayment letter will be required.

- Incentives from a New Build Developer

Some property developers offer financial incentives, such as cash contributions towards your deposit. These are generally acceptable, subject to each lender’s specific criteria. However, it’s important to note that most lenders cap the allowable developer contribution at a maximum of 5% of the purchase price. Anything beyond this may be deducted from the purchase price for lending purposes or may not be accepted at all.

Lenders will also assess how the incentive is structured—whether it’s a straightforward cash contribution, a discount on price, or a package (e.g. paying stamp duty or legal fees)—and treat each case accordingly.

Sources That Are Typically Not Accepted

While some sources may occasionally be accepted under special circumstances, the following are generally not viewed favourably:

- Loans Used as Deposit

Lenders typically do not accept borrowed money as a deposit, as this affects affordability and introduces repayment risk. Some exceptions exist (e.g. inter-family loans on specific terms), but these are rare and require full disclosure.

- Gifts from Friends

Most lenders do not accept gifts from friends, viewing them as potential undisclosed loans rather than true gifts.

- Unexplained Cash Deposits

Large cash deposits raise red flags for anti-money laundering checks. These are scrutinised heavily, and unless there’s a verifiable paper trail, they are best avoided during your deposit-building phase.

- Savings or funds originating from cryptocurrency

Due to the difficulty in verifying the origin and movement of funds in crypto wallets, most lenders do not accept deposits that were held or generated through cryptocurrency—even if the money has since been converted into a standard bank account.

- Lack of Evidence for a Valid Source

Even if the deposit source is normally acceptable, it may be rejected without appropriate documentation to support it. It’s not just the lender who needs to be satisfied—the solicitor handling the purchase is also responsible for verifying the legitimacy of the funds under anti-money laundering regulations. If the evidence is incomplete or unclear, the solicitor may refuse to proceed, even if the lender has initially accepted the deposit in principle.

Myth: “If It’s Been in My Account for a Long Time, I Don’t Need to Prove It”

A common misconception is that if funds have been sitting in your bank account for a long time, you don’t need to show the source. This is not true. Regardless of how long the money has been in your account, lenders and solicitors will still ask for evidence of its origin.

Our Recommended Approach: Be Upfront and Honest

At Nachu Finance, we strongly recommend a transparent approach when it comes to your deposit. If the source is genuine—even if slightly unusual—it’s often easier to present it honestly than attempt to frame it as something more ‘standard’.

Our role is to:

- Understand your deposit source from the start

- Anticipate the lender's stance

- Recommend a lender most likely to accept it

- Support you with all the documentation needed

This may mean a bit more admin early on, but it ensures fewer delays and surprises later.

Why Lenders and Solicitors Require Deposit Evidence

Lenders and solicitors are bound by anti-money laundering (AML) regulations. Often, solicitors request even more detailed documentation than lenders to fulfil their legal obligations. This is standard and should not be a cause for concern.

Use of Technology in Evidence Collection

Some solicitors now use third-party apps and digital tools to collect and verify documents more efficiently. This doesn’t change the need for documentation—it just streamlines the process for both parties.

Estate Agents May Ask Too

Increasingly, estate agents also request evidence of deposit before taking a property off the market. This is to ensure buyers are credible and to meet their own AML compliance obligations.

Best to Avoid Multiple Transfers

We often see cases where clients move money between their own bank accounts multiple times before the funds settle in the final deposit account. While this isn’t necessarily a problem for lenders or solicitors, it does mean more paperwork.

If your deposit has passed through several accounts—for example, from Account A to B, then C, then D, before ending up in Account E—be prepared to provide bank statements for all five accounts. Each transfer must be clearly documented to establish a full trail of funds.

To make things simpler:

- Try to consolidate funds early in one or two accounts.

- Avoid unnecessary back-and-forth transfers between accounts.

- Provide full, unredacted bank statements for any accounts involved in the deposit trail.

This helps reduce delays and makes it easier for everyone involved in the mortgage and legal process to verify your deposit source.

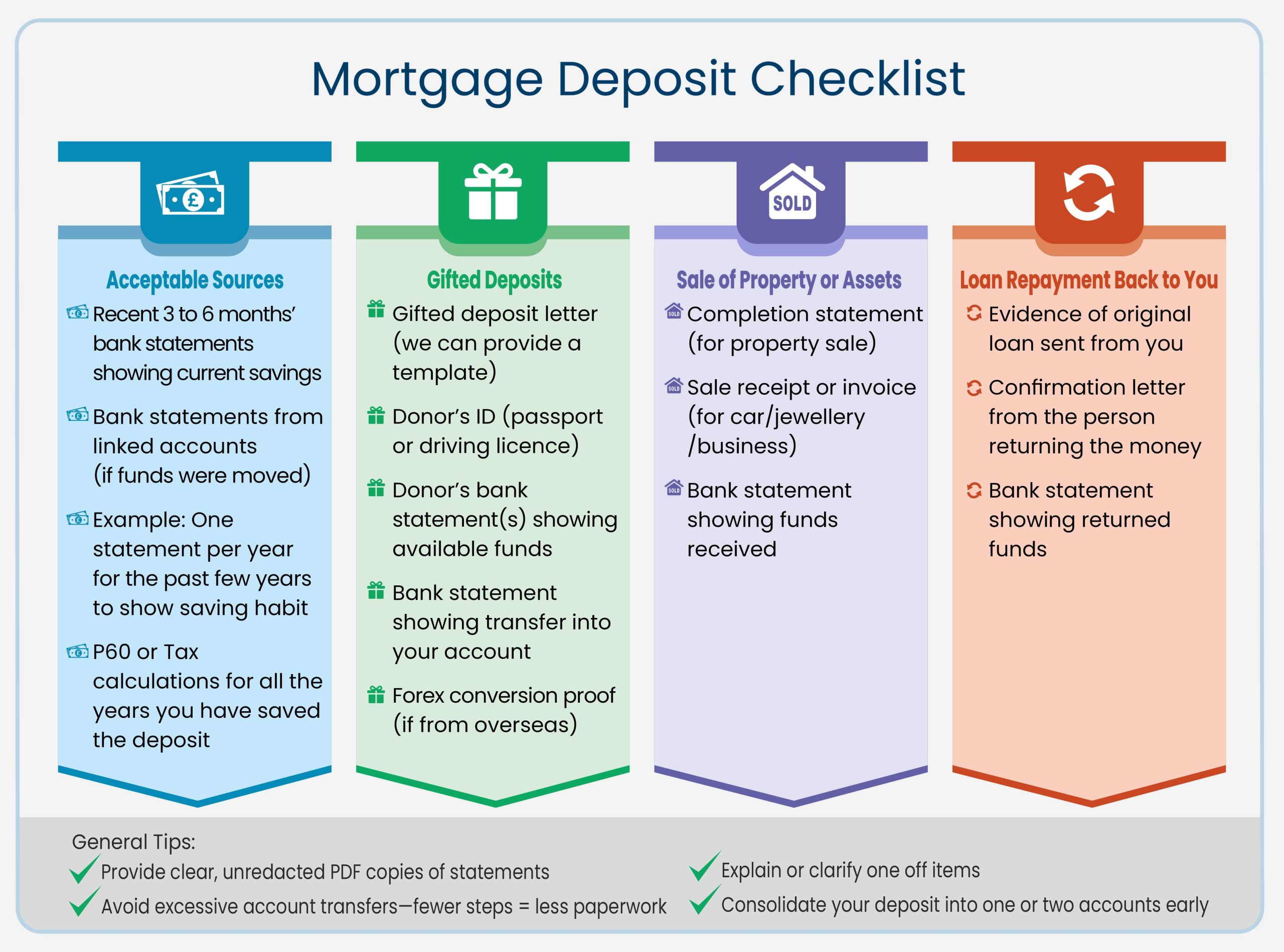

Common Documents Required to Prove Your Deposit

The documents required will depend on the source of the funds, but here’s a general guide based on what lenders and solicitors typically ask for:

- For Savings (from Income)

- Bank statements showing where the money is currently held.

- Supporting statements from any linked or feeder accounts.

- Savings build-up evidence: While “five years” is often cited, the actual duration depends on how long you’ve been saving. Lenders will want to see a pattern that aligns with your income and expenses. For example, one month’s bank statement per year (e.g. every June) helps illustrate this.

- For Sale of Property or Other Assets

- Completion statement from solicitor (for property sale) or sale invoice/receipt (for other assets like a car or jewellery).

- Bank statement showing proceeds credited to your account.

- For Gifted Deposits (from Family)

- Donor’s ID (valid photo ID, ideally passport or driving licence).

- Proof of donor’s funds (bank statements showing how they built or held the gift amount).

- Gifted Deposit Letter – confirming it’s a gift, not a loan, with no interest in the property (we can help you draft this).

- Bank statement showing the gift transfer into your account.

- Forex conversion documentation if gifted from abroad.

- For Repayment of a Previous Loan Given by You

- Proof of the original loan transfer from you to the borrower.

- A letter from the borrower confirming it is a repayment, not a new gift or loan.

- Bank statement showing the returned funds entering your account.

- General Best Practices

- Provide clear copies of all bank statements (PDFs, not screenshots, with no redactions).

- Highlight relevant transactions where needed to help the case handler or underwriter.

- Be proactive—gather all relevant documents early and keep them in one place.

How Nachu Finance Can Help

We can’t make an unacceptable source of deposit magically become acceptable—but we can help you find a lender who will work with your circumstances.

Over the years, we’ve built long-standing relationships with a wide range of mortgage lenders. This allows us to understand which lenders are more likely to accept specific deposit sources that others may decline.

Our client-first approach means we always deal with this important aspect of the mortgage process upfront. By understanding your deposit position early and matching you with the right lender, we help avoid unnecessary delays or disappointments later.

Back in 2013, Rishi, a first-time buyer earning a basic salary of £74,000 plus an annual bonus of over £10,000, was keen to purchase his first home priced at £250,000. While affordability for the mortgage wasn’t an issue, the main challenge was the deposit—he didn’t have enough saved.

To bridge the shortfall, Rishi was willing to take out a personal loan. However, using a loan as a source of deposit is typically not accepted by most mortgage lenders, as it impacts both affordability and risk perception.

At Nachu Finance, we reviewed the case carefully. Given that the overall affordability remained strong even after accounting for the personal loan repayments, we approached one of our trusted high street lenders—known to consider such scenarios on a case-by-case basis. After discussing the application directly with our relationship manager at the bank and presenting the full picture transparently, the mortgage offer was issued without delay.

We also advised the solicitors upfront about the arrangement and confirmed that the lender had approved the use of a personal loan for the deposit. The purchase completed smoothly, without any last-minute hurdles.

Since then, we’ve successfully supported many clients in similar situations—where the source of deposit may not be straightforward, but the case is genuine, and the affordability checks out. With the right guidance and lender selection, even cases that don’t fit the standard mould can be placed confidently.

Our Transparency Promise

At Nachu Finance, our transparency promise means we leave no stone unturned at the outset. This includes a thorough due diligence process—where reviewing your deposit source and ensuring the evidence stands up to scrutiny is a central part.

Yes, we are on your side. But we are also realistic about what lenders and solicitors will require. That’s why we prefer to examine the deposit documentation in detail at the beginning, so we’re ready with the right explanations or supporting documents if queries arise.

So please don’t take it the wrong way if we request detailed paperwork early on—it’s all in your best interest and helps avoid issues further down the line.

Ready to Secure the Right Mortgage for Your Situation?

If there’s a way to place your case, we will find it.

At Nachu Finance, we pride ourselves on understanding each client’s unique situation. If your deposit source is acceptable to even a small number of lenders, we’ll identify them and present your case in the best possible light.

Whether your deposit is coming from multiple sources, overseas accounts, or less common routes, we’ll help you gather the right documentation and guide you every step of the way.

Contact us today for honest, experienced, and lender-aware mortgage advice that doesn’t shy away from the details.

Understanding Capital Gains Tax When Gifting or Inheriting Property

- 03 Jun 2025

- Sekkappan Alagu

- Estate Planning

- Comments Off on Understanding Capital Gains Tax When Gifting or Inheriting Property

Capital Gains Tax (CGT) is payable to HMRC on the gain made when disposing of an asset, including property. However, it’s not just sales that are classed as a disposal-gifting a property can also trigger CGT.

In this article, we explore the implications of gifting a property either fully or partially, how it differs from inherited property, and what happens when property is placed into a trust. We also look at Stamp Duty considerations and share a real-life case study involving a family who transferred property between siblings.

EPC Ratings and Mortgages: What Buyers and Landlords Need to Know

- 20 May 2025

- Sekkappan Alagu

- Buy to let Mortgages

- Comments Off on EPC Ratings and Mortgages: What Buyers and Landlords Need to Know

When buying or letting out a property the EPC rating can have a larger impact than expected as it is not just legal compliance. It can influence your mortgage options, ongoing energy costs, and even your long-term returns. Whether you are a first-time buyer, a home mover, or a landlord, understanding how EPC ratings fit into the bigger picture is essential.

When applying for a mortgage, particularly for buy-to-let or investment properties, the Energy Performance Certificate (EPC) is NOT just a formality. It carries financial, regulatory, and environmental importance.

At Nachu Finance, we are not energy advisers, but we do take a holistic approach to mortgage planning, and EPC considerations are an important part of the advice we provide.

Overpaying into a Mortgage – Residential or Buy-to-Let?

- 10 May 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Overpaying into a Mortgage – Residential or Buy-to-Let?

When clients ask about overpaying their buy-to-let mortgage, I often challenge them to consider whether overpaying the residential mortgage might be a better financial move.

If you have both types of mortgages, it’s important to look beyond the surface. While reducing any debt is a positive step, I firmly believe that – in most cases – overpaying the residential mortgage should be prioritised. Here’s why.

Stay One Step Ahead: Register for Free Land Registry Property Alerts

- 17 Mar 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Stay One Step Ahead: Register for Free Land Registry Property Alerts

When it comes to property-related fraud, the stakes are high-after all, the bigger the asset, the greater the motivation for fraudsters. However, a simple yet effective step to protect yourself is registering for Land Registry Property Alerts, a free service that helps you monitor activity related to your property title.

First Mortgage Payment Explained: Why It’s Higher and How to Prepare

- 10 Mar 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on First Mortgage Payment Explained: Why It’s Higher and How to Prepare

One of the most common questions new homeowners ask is about their first mortgage payment-specifically, why it appears higher than the regular monthly payment. At first glance, this can seem confusing or even concerning. Here’s a clear explanation to help you understand why this happens and what to expect.

Joint Tenancy vs. Tenants in Common

- 05 Mar 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Joint Tenancy vs. Tenants in Common

When purchasing a property jointly in personal names, there are two ways to structure ownership: Joint Tenancy or Tenants in Common. The choice between these options plays a significant role in inheritance, estate planning, and financial arrangements. Understanding the key differences ensures you make an informed decision that aligns with your long-term goals.

Why Married Couples Should Purchase Their Home in Joint Names

- 26 Feb 2025

- Sekkappan Alagu

- Residential Mortgage

- Comments Off on Why Married Couples Should Purchase Their Home in Joint Names

Many clients wonder whether they should purchase a property in joint names, especially if they can afford it in a single name or if one partner does not have an earned income. Some mistakenly believe there are advantages to purchasing a property in a single name. Let’s explore why joint ownership is often the better choice and debunk some common myths along the way.

How does a Trust Actually Help Protect the Assets

- 20 Jan 2025

- Sekkappan Alagu

- Estate Planning

- Comments Off on How does a Trust Actually Help Protect the Assets

A trust is an incredibly useful tool in estate planning, offering numerous benefits-one of the most significant being its ability to protect assets from potential risks. While the idea of a relatively straightforward setup providing such robust protection may seem too good to be true, it’s a proven and effective strategy. In this article, we’ll explore how a trust provides this protection, supported by real-life case studies to help illustrate its impact.