Would you spend £500 to avoid a £10,000 mistake?

That’s the kind of risk property surveys are designed to manage. While a mortgage valuation checks if a home is suitable for lending, a survey digs deeper into the property itself — helping buyers make confident, informed decisions.

This article explains the difference between a mortgage valuation and an independent survey, outlines the options available, and explores when it makes most sense to get one. We also look at how surveys can affect real purchase decisions, including two case studies from our clients.

Every mortgage lender will instruct a valuation before offering a mortgage. The purpose is limited to:

- Confirming the property is worth the agreed purchase price.

- Checking it is suitable security for lending.

The lender’s concern is simple: if the property had to be repossessed, would it sell easily? This valuation is written for the lender’s benefit, not yours. It does not comment on the condition of the roof, electrics, plumbing, or potential repair costs.

As a buyer, it’s sensible to want more reassurance. A private survey can:

- Highlight structural issues or hidden defects.

- Help you budget for repairs and improvements.

- Provide evidence to renegotiate the purchase price.

- Give peace of mind before making such a large financial commitment.

We often see buyers keen to order a survey as soon as their offer is accepted. At Nachu Finance, our advice is usually to wait — but not too long.

- Too early: Commissioning a survey before the mortgage offer or before solicitors have progressed can mean wasting £500–£1,000 if the purchase collapses.

- Too late: Leaving it until just before exchange means you may not have time to renegotiate or withdraw if serious issues emerge.

Best timing: Once the mortgage offer is in place and legal checks are progressing, but still with enough time to act on the findings.

Think of it as a mid-transaction step — not too early, not too late.

When commissioning a survey, it’s important to set realistic expectations.

- Older properties will show wear and tear. A detailed report is likely to highlight age-related issues, and it’s rare for a survey to declare that everything is perfect. This doesn’t necessarily mean the property is a poor choice — just that maintenance will be part of ownership.

- Not all sellers will negotiate. While some buyers successfully use survey findings to reduce the price, others find sellers unwilling to budge. Sellers may argue that the property’s age and condition have already been factored into the agreed price.

Think of the survey less as a bargaining tool and more as peace of mind — a way to understand exactly what you’re buying, plan for repairs, and proceed with confidence

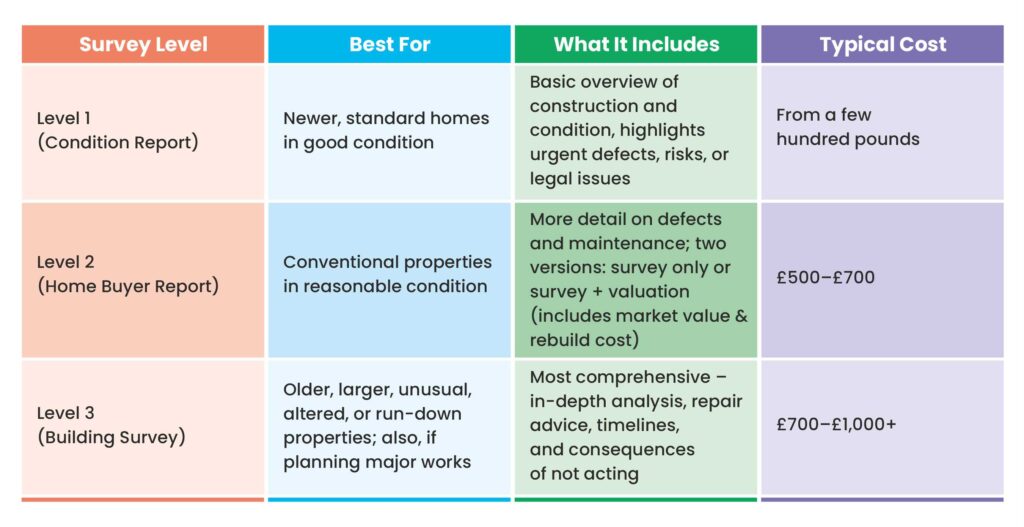

RICS (Royal Institution of Chartered Surveyors) introduced the Home Survey Standard in 2021, which set out three clear survey levels. Each is designed for different types of properties and buyer needs.

Summary

- Level 1 = reassurance for newer, standard homes.

- Level 2 = detailed check, suitable for most buyers.

- Level 3 = full structural insight, essential for older or complex properties.

Whatever the level, always use a RICS-accredited surveyor to ensure the report meets professional standards. You can find approved firms at ricsfirms.com.

For new build homes, the situation is different. These properties usually come with a 10-year new build warranty, which covers structural defects. Since everything is brand new, a full structural survey is often unnecessary.

What can be useful is a snagging survey. This is carried out once the property is complete and checks for smaller defects or finishing issues — often called “snagging items.” These need to be reported within the developer’s defect liability period so that they are fixed at no cost to you. While optional, a snagging survey provides extra reassurance that the build quality has been independently checked.

Felix’s full Building Survey revealed several urgent repairs, with the cost of immediate works estimated at around £12,000. Using this report as evidence, Felix negotiated with the seller via the estate agent and secured a £6,000 reduction in the purchase price. This allowed him to proceed with confidence, knowing he had funds available to cover the essential repairs.

Alfred and Eva had already received their mortgage offer, but when they commissioned a full survey, several red flags were raised. The report highlighted serious issues with the conservatory and concerns over the electrical, gas and heating systems, which lacked up-to-date safety certification. Faced with the likelihood of costly repairs and ongoing risks, they chose to walk away from the purchase and later found another property that passed its survey without major issues.

When arranging your own survey, always ensure the professional is RICS-qualified. There’s no single surveyor we recommend, as our clients buy across the UK. Instead:

- Search for RICS-accredited firms in your area: www.ricsfirms.com

- Compare quotes, reviews, and timescales.

- Choose someone you feel comfortable with.

Yes — even well-presented homes can hide issues such as damp, poor wiring, or structural weaknesses that aren’t visible at first glance.

No, a survey isn’t mandatory. The lender’s valuation is compulsory for the mortgage, but a survey is your choice. It’s strongly recommended to protect your investment.

Not usually. A private survey is for your use only. The lender relies on their own valuation unless you explicitly choose to share the report.

You can use the findings to renegotiate the price, ask the seller to fix issues, or — if the problems are too significant — decide to walk away.

The mortgage valuation protects the lender — but it doesn’t protect you. Commissioning your own survey is about safeguarding your investment and avoiding expensive surprises.

Our advice is simple:

- Understand the difference between a lender’s valuation and a survey.

- Time your survey for the middle of the transaction.

- Choose the right type of survey for your property.

- For new builds, consider a snagging survey instead.

At Nachu Finance, we’ll guide you through every step of the mortgage journey — including when and how to arrange a survey — so you can move forward with confidence.

Make Every Step Count

A property survey can be the difference between a confident purchase and an expensive mistake. Whether it helps you renegotiate, gives peace of mind, or signals it’s time to walk away, it’s a crucial part of the buying journey.

At Nachu Finance, we don’t just arrange mortgages — we guide you through the wider process, including when and how to commission a survey. Our aim is to make sure you have the right information at the right time, so you can move forward without doubts.

Contact us today to discuss your property purchase — and take your next step with clarity and confidence.