Transfer of Equity (TofE)is the legal process of changing the ownership of a property by adding or removing names from the title. Unlike a sale and purchase transaction, at least one of the existing owners continues to remain on the title. While the actual legal work is carried out by a solicitor, mortgage advisers like us often get involved—because the names on the mortgage must reflect the updated ownership. This article explores the key aspects of a Transfer of Equity and when it might be relevant.

It’s essential that the names on the mortgage align with the proposed ownership structure. Before instructing a solicitor to begin the transfer, it’s important to ensure that the mortgage lender is comfortable with the new arrangement.

A remortgage can be an ideal opportunity to update the ownership. The new mortgage application will be in the correct names, and the solicitor managing the remortgage will also carry out the Transfer of Equity.

However, if you’re not remortgaging—and are tied into your current deal with Early Repayment Charges (ERCs)—you’ll need to approach your existing lender. Most lenders have a process for handling this, which typically involves:

- Completing application forms

- Providing supporting documents

- Paying an administration fee

- Passing affordability and credit assessments

Once approved, the lender issues consent for the name change.

Whether done with a remortgage or separately, a solicitor is always required for a Transfer of Equity.

- If done alongside a remortgage, the lender may cover basic legal costs, and you’ll only pay an additional fee for the transfer of equity.

- If done without a remortgage, you’ll need to appoint and pay a solicitor directly. They will usually require the lender’s consent before starting.

- With a remortgage: £200–£350 + VAT (additional to any remortgage legal costs, which the lender may cover)

- Without a remortgage: £400–£750 + VAT (standalone legal cost)

Just like a property sale or purchase, the change in ownership must be recorded at the Land Registry.

At Nachu Finance, we recommend all clients sign up for the Land Registry Property Alert Service. This free service will notify you when updates are made—such as after a Transfer of Equity. Not signed up yet? Read our blog post about why this is a valuable safeguard.

- With a remortgage: Add 2–4 weeks for the transfer process. Start at least 8–10 weeks before your fixed rate ends.

- Without a remortgage: Typically 2–5 weeks, depending on how quickly the lender provides consent.

- Mortgage-free properties: No lender involvement means the process is often more straightforward and flexible in timing.

No lender consent is required, making this process simpler. Appoint a solicitor to complete the work when convenient. The costs and time frame are similar to doing a transfer without a remortgage, minus the lender involvement.

Stamp duty may apply, as a Transfer of Equity is treated as a part-purchase.

Example:

Satish bought a property in 2020 for £400,000. In 2025, he adds his wife Rekha. The property is now worth £480,000 and has a mortgage balance of £320,000. Rekha is not paying Satish for her share.

Her ‘consideration’ is 50% of the mortgage = £160,000. Stamp duty will be calculated on this amount, based on prevailing rates.

This is a complex and case-specific area. While the default is that the 5% additional property surcharge applies (if the added party owns another property), each situation must be assessed on its own merit. Seek advice before proceeding to avoid unexpected liabilities.

CGT is triggered because the outgoing party is effectively selling a share of the property.

Example:

Ganesh bought a buy-to-let in 2000 for £120,000. In 2025, he adds his daughter Nila. Property value is now £500,000.

Ganesh is deemed to have sold 50% of the gain = (£500,000 – £120,000) ÷ 2 = £190,000. He must report and pay CGT based on the rules in effect at that time.

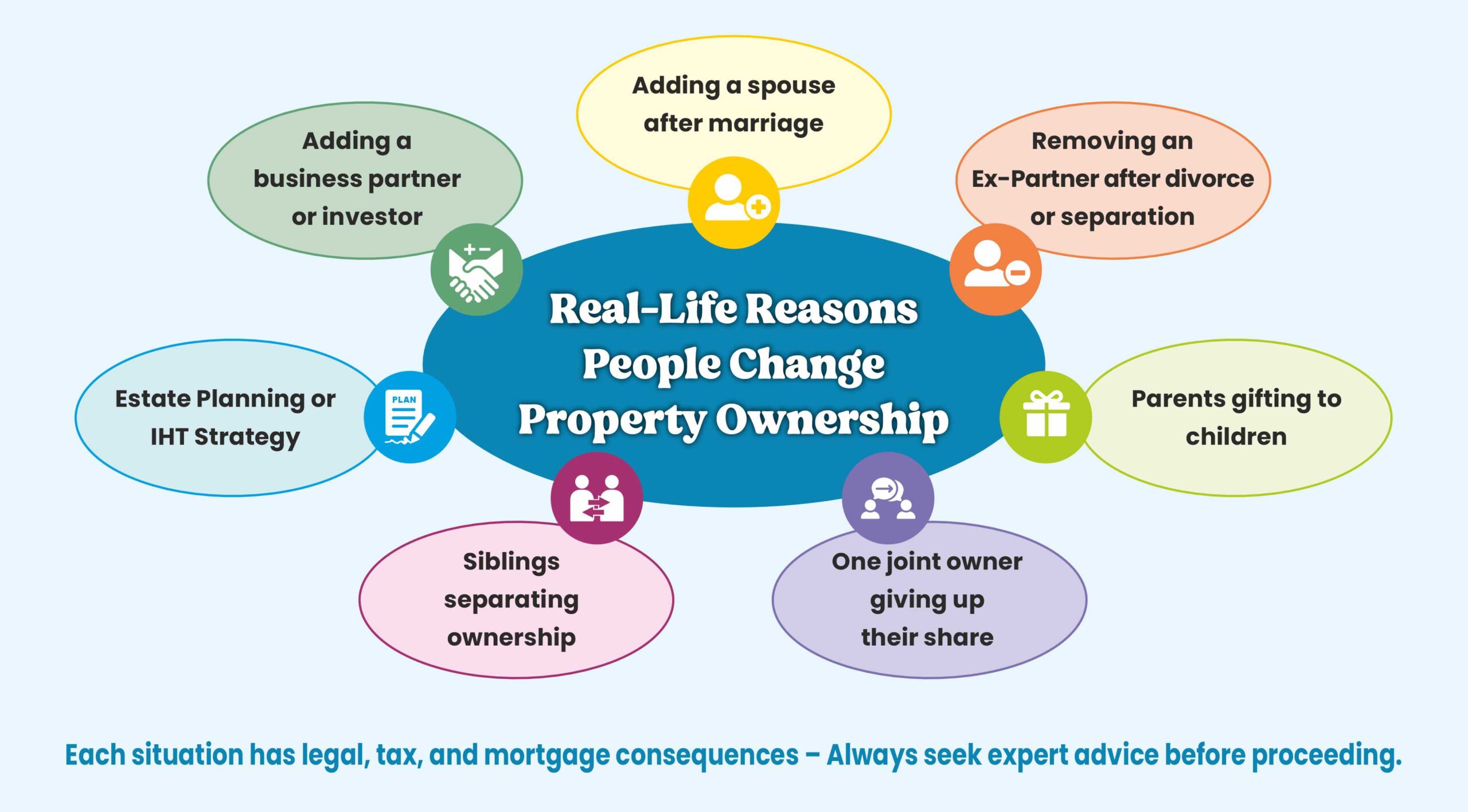

Transfer of Equity commonly applies in the following situations:

- Adding a spouse or partner

- Gifting a share to children

- Removing an ex- partner after divorce/separation

- One joint owner giving up their share

- Siblings wishing to split ownership

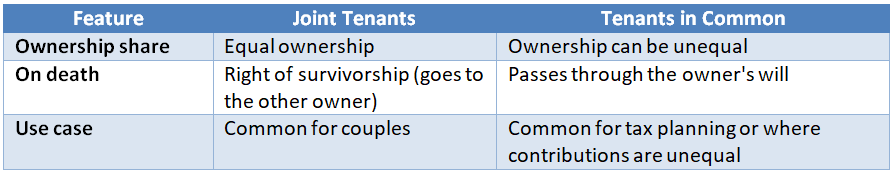

When owning a property jointly, it’s important to choose the right ownership type:

This decision can have real implications, especially in life-changing events like death or separation. For example, if one partner passes away, Joint Tenancy ensures the other automatically inherits the full ownership—regardless of the will. In contrast, Tenants in Common allows each owner to pass their share to someone else via their will, which may be useful in estate planning, particularly for second marriages or when children from previous relationships are involved.

If you’re going through a separation, or considering adding/removing a family member, it’s vital to get advice on the right type of ownership—not just for legal accuracy, but also to protect long-term interests.

In general, we recommend joint ownership for married couples. While there may be exceptions, joint names provide both legal and financial security.

We’ve discussed this topic in more detail here.

While the Transfer of Equity is ultimately completed by a solicitor, the mortgage aspect often brings us into the process—and this is where we add real value.

- We assess the impact on your mortgage and help structure the new mortgage accordingly if you’re remortgaging.

- If you’re staying with the same lender, we can advise you on how best to approach them, what documentation may be required, and what to expect from the assessment.

- For clients unsure if they should proceed, we’re happy to have an exploratory discussion and explain the mortgage implications before involving solicitors.

- We help you plan the timing—especially important if you’re approaching the end of a fixed rate.

- We collaborate with solicitors and can refer you to a reliable conveyancer if needed.

With almost two decades of experience, and a client-first, transparent approach, we support your decisions and help ensure the transfer is processed smoothly—avoiding delays or surprises on the mortgage side.

Our Transparency Promise

We don’t provide generic answers—only advice that fits your unique situation.

We believe that understanding the full picture is key. That’s why we avoid giving generic advice on whether a Transfer of Equity is suitable. We insist on understanding your specific circumstances before making any recommendations—whether it’s the mortgage structure, the ownership pattern, or the tax implications.

We won’t rush you into decisions. We’re here to offer clarity, set expectations, and work in your best interest—even if that means recommending you hold off or take advice elsewhere first.

Ready to Discuss a Transfer of Equity?

Whether you’re adding a partner, removing an ex partner, planning for the future, or making a gift to children, Nachu Finance can help you explore the right way to structure the mortgage aspect of your Transfer of Equity.

With almost two decades of experience, a transparent approach, and client-first advice, we’re here to guide you through the process—step by step.

Contact us today for an initial discussion. Let’s make sure your mortgage reflects your plans and protects your interests.