When applying for a mortgage, especially as a self-employed individual or landlord, one document that often causes confusion is the Tax Year Overview (TYO). Many clients aren’t aware of what this document is, how it differs from the tax calculation, or how to download it correctly from the HMRC website.

Let’s clear up the confusion and walk you through what a Tax Year Overview is, when it’s required, and how to avoid common mistakes when submitting it.

A Tax Year Overview is a one-page document issued by HMRC confirming your income tax position for a specific tax year. It shows:

- The amount of tax due

- The payments made towards that tax

- Any interest, penalties, or surcharges

- Whether the tax has been fully paid as of the download date

This is not the same as a Tax Calculation (previously known as the SA302), which shows how HMRC calculated your income and tax owed based on your Self Assessment. Lenders typically require both documents to cross-verify the income and payment details.

This document is typically required by mortgage lenders to verify income for applicants who:

- Are self-employed and submit Self-Assessment tax returns (this includes sole traders, partners, and Ltd company directors or shareholders)

- Receive rental income under the “income from land and property” heading

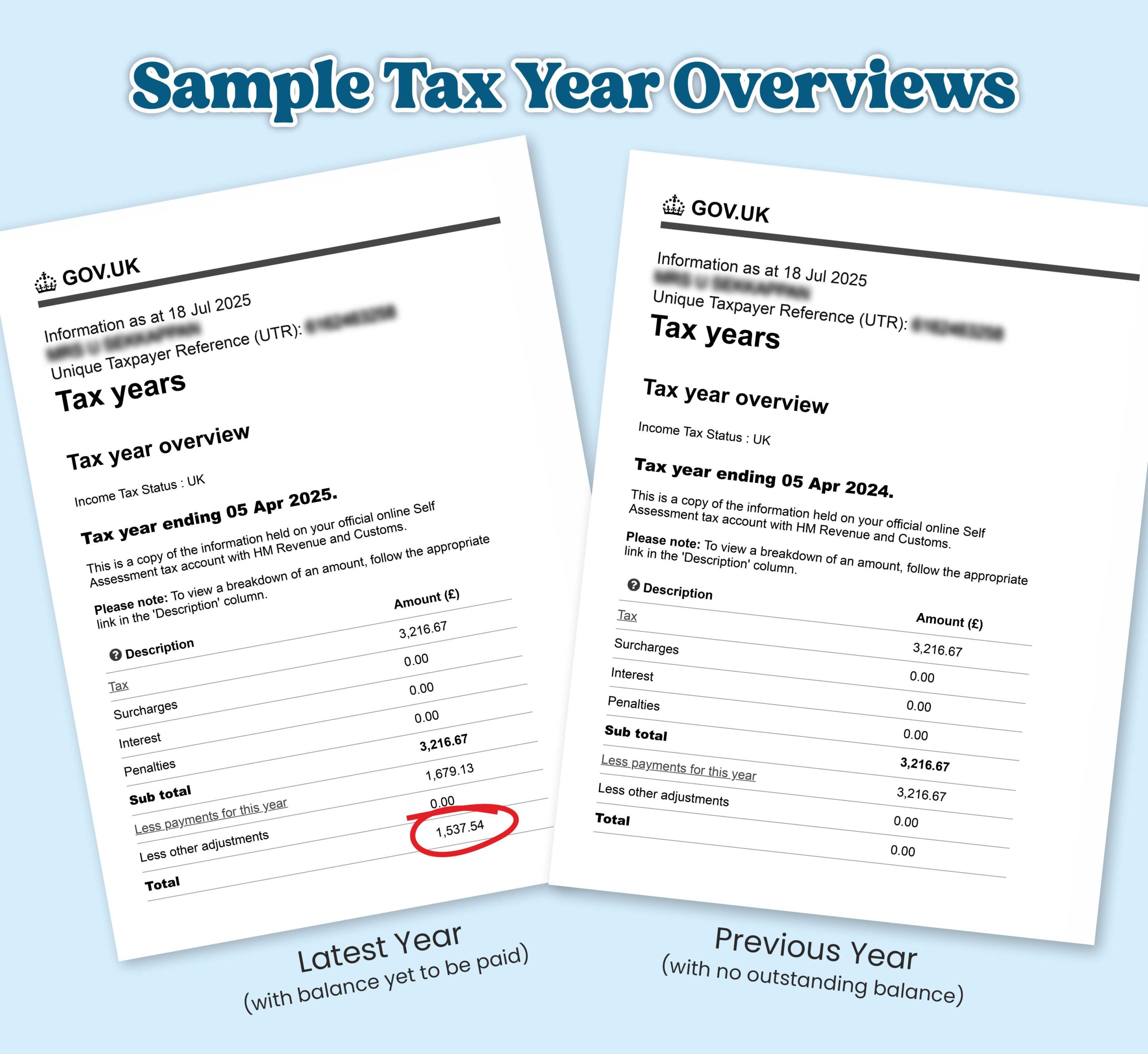

In these cases, the TYO must match exactly with the figures shown in the corresponding tax calculation (SA302).

Lenders use the Tax Year Overview to cross-check the income tax amount declared in the tax calculation. If the two documents don’t match to the penny, they will be rejected, potentially delaying your mortgage application.

You have three options to obtain your TYO:

- From Your Accountant – Your accountant can usually provide this quickly.

- Call HMRC – You can request HMRC to post it, but this takes time and isn’t ideal for future use.

- Download Directly from HMRC Online – Recommended for speed and ongoing access.

- Go to: https://www.gov.uk/log-in-register-hmrc-online-services

- Log in or register

- Select ‘Self Assessment’

- Under ‘Previously Filed Returns’, click ‘View your tax year overview’

- Select the relevant tax year and click ‘Go’

- Click ‘Print your tax year overview’ and choose ‘Save as PDF’

- Save the document and share it as needed

- Not refreshing the page by clicking ‘Go’ after selecting the year

- Providing mismatched years between tax calculation and TYO

-

Submitting TYOs that show unpaid taxes or interest

- Differences in figures between TYO and tax calculation

While HMRC allows you to submit your Self Assessment for the previous tax year ending 5th April by the following 31st January, lenders often expect more up-to-date documents.

HMRC Deadline: For the tax year ending 5th April 2025, HMRC allows submissions until 31st January 2026.

Lender Expectations: Most lenders will only accept income documents that are no more than 18 months old. This means:

-

If you are applying for a mortgage in December 2025, the tax documents for the year ending 5th April 2024 may already be too old.

- Instead, lenders will expect to see documents for the tax year ending 5th April 2025.

If you are planning to apply for a mortgage between October and January, it is advisable to:

-

Submit your tax return sooner than the HMRC deadline

- Ensure that both the Tax Calculation and Tax Year Overview reflect the most recent tax year

This consideration is especially important for self-employed applicants and landlords. Lender expectations during this period may exceed HMRC’s timeline, and being proactive helps prevent unnecessary delays or rejections.

-

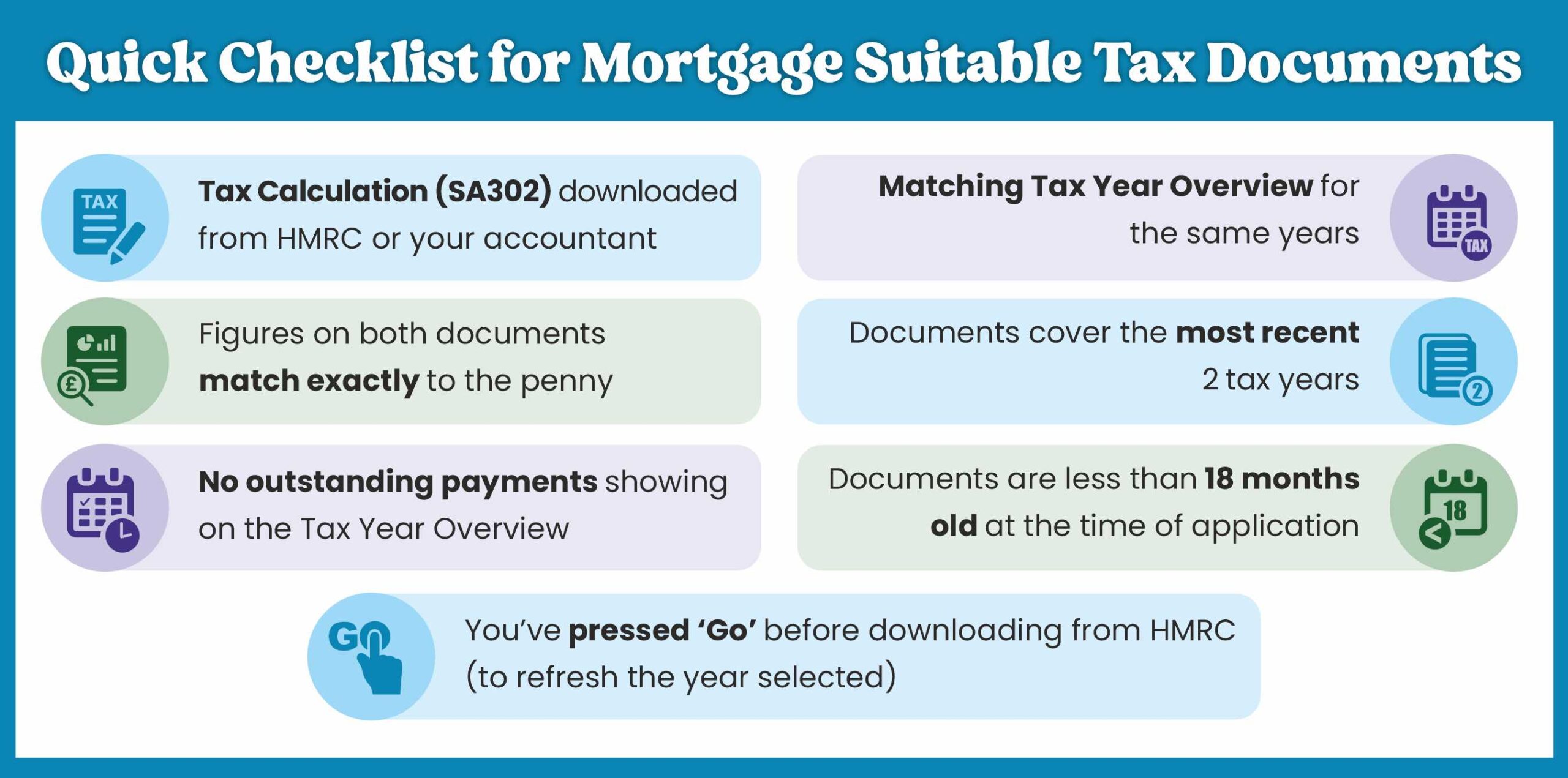

Tax Calculation (SA302) downloaded from HMRC or your accountant

- Matching Tax Year Overview for the same year

- Figures on both documents match exactly to the penny

- Documents cover the most recent 2 tax years

- No outstanding payments showing on the Tax Year Overview

- Documents are less than 18 months old at the time of application

- You’ve pressed ‘Go’ before downloading from HMRC (to refresh the year selected)

No, the Tax Year Overview confirms payments made to HMRC, whereas the SA302 shows your income and tax liability as calculated.

No. Lenders typically require both the Tax Calculation and the Tax Year Overview for cross-verification.

You’ll need to make the payment and re-download the updated Tax Year Overview before it will be accepted by most lenders.

Need Help Getting It Right?

At Nachu Finance, we understand that navigating the mortgage process—especially as a self-employed individual or landlord—can feel complex and overwhelming. That’s why we go beyond simply ticking boxes. We work closely with you to ensure your documents are accurate, up to date, and fully aligned with what lenders expect.

From helping you retrieve the right Tax Year Overview and Tax Calculation, to advising on how to present your income clearly, we’re here to make the process smoother and more transparent. Whether you’re preparing for your first mortgage or a remortgage, our advice is always tailored to your unique situation.

Get in touch today and let us help you submit with confidence