Capital Gains Tax (CGT) is payable to HMRC on the gain made when disposing of an asset, including property. However, it’s not just sales that are classed as a disposal-gifting a property can also trigger CGT.

In this article, we explore the implications of gifting a property either fully or partially, how it differs from inherited property, and what happens when property is placed into a trust. We also look at Stamp Duty considerations and share a real-life case study involving a family who transferred property between siblings.

CGT on Property That Is Not Your Main Home

Capital Gains Tax (CGT) in the UK applies to properties that are not used as your primary residence, such as:

- Buy-to-let properties

- Second homes

- Holiday homes

As of 6 April 2025, CGT rates on residential property are:

- 18% for basic rate taxpayers

- 24% for higher or additional rate taxpayers

If a property has been used as your main home for part of its ownership and rented out for the rest, you may qualify for partial relief. The CGT will be proportionate, with a deduction for the time the property was your primary residence.

Gifting Property to Family – Key Principles

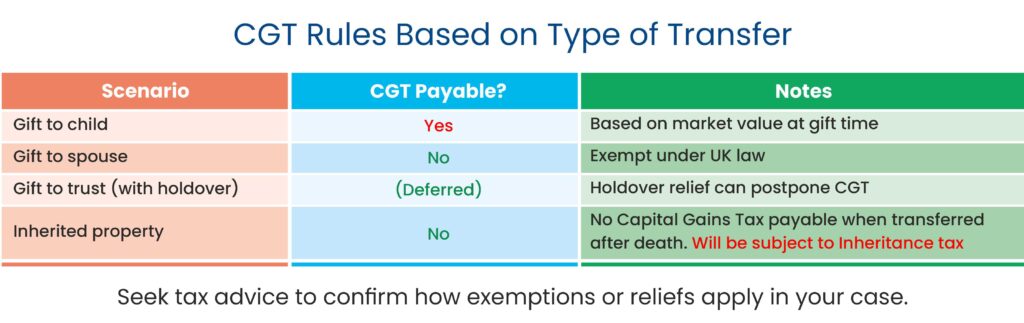

Even though no money changes hands, gifting a property is treated by HMRC as if it were sold at market value. That means CGT is still assessed on the gain.

Example: Gifting a Property to a Child

Let us suppose Grace purchased a buy-to-let property in 2010 for £320,000. In 2025, she decides to gift it to her daughter without taking any payment. If the property is now worth £550,000, then the gain of £230,000 (before costs and allowances) is still subject to CGT.

If Grace chooses to gift only 50% of the property, then CGT will be due on half the gain—£115,000 in this case.

CGT is based on market value at the time of the gift, not the original purchase price or amount received.

Example: Gifting to a Spouse

Let us suppose Harrison bought a buy-to-let property in 2015 for £250,000. In 2025, after marrying Thea, he transfers 50% of the property to her. The property is now worth £400,000.

Ordinarily, this £150,000 gain would make half the gain (£75,000) taxable. However, transfers between spouses or civil partners are exempt from CGT, so no tax is payable here.

When property is gifted to a close relative, there’s no actual sale to determine an open-market value. To avoid disputes or challenges from HMRC, we recommend obtaining a formal valuation from a RICS-approved surveyor—that is, a member of the Royal Institution of Chartered Surveyors, the globally recognised professional body for land, property, and construction standards. A RICS valuation provides credible evidence of the property’s market value at the time of the gift and offers stronger protection if ever reviewed by HMRC.

This offers:

- Credible evidence if HMRC questions the valuation

- Peace of mind for both parties

- Stronger protection than using an estate agent or mortgage lender’s estimate

When transferring an investment property to a lifetime trust, it’s possible to defer CGT using holdover relief. This does not exempt the tax but postpones it.

Example: Using Holdover Relief

Let us suppose Dinesh and Gayathri bought a buy-to-let in 2000 for £200,000. In 2015, when it was valued at £500,000, they placed it into a Family Holdover Gift Trust, deferring the gain.

In 2025, the trust sells the property for £700,000. CGT is payable on the full gain of £500,000 (from £200,000 to £700,000), because the deferred gain is carried forward.

If they had instead paid the CGT in 2015 on the £300,000 gain, the 2025 sale would only attract tax on the £200,000 increase since then.

Holdover relief defers the CGT—it doesn’t erase it.

👉 You can read more here: Transferring Property to a Lifetime Trust – Full Guide

Capital Gains Tax on Inherited Property

It’s important to understand that Capital Gains Tax (CGT) does not apply when a property is passed on through inheritance. When the owner passes away, any unrealised gains effectively die with them. Instead, Inheritance Tax (IHT) may apply to the estate based on the total value of the deceased’s assets, including the property.

Example: Inheriting vs Gifting During Lifetime

Let us suppose Dinesh and Gayathri owned a buy-to-let property purchased for £200,000 in 2000. In 2025, the property is worth £700,000. If they had not gifted the property during their lifetime (either directly or via a trust) and instead passed it to their son Ashwin via their Will:

- No CGT would be payable on the £500,000 gain (£700K – £200K)

- The property would be revalued to £700,000 as part of probate

- IHT may be payable on the £700,000, depending on the size of the estate

- When Ashwin eventually sells the property, his base cost for CGT purposes will be £700,000

In summary: CGT liability is wiped out on death, and the beneficiary gets a “stepped-up” value for CGT purposes. The tax exposure shifts from CGT to IHT.

Nathan’s family owned three properties jointly between a brother and sister. They lived in one and rented the other two.

In 2024, the sister decided to move into one of the rental properties. The arrangement involved:

- Remortgaging the main residence in the brother’s sole name, with the sister gifting her share

- Remortgaging one buy-to-let in the sister’s name, with the brother gifting his share

- No changes to the third property

Outcome:

- The main residence was exempt from CGT due to principal residence relief (you do not have to pay capital gains tax on any profit if it has been your only or main home throughout the entire period of ownership.)

- The buy-to-let property being gifted to the sister triggered CGT on the brother’s gain

- Stamp Duty applied on both properties, calculated at 50% of the outstanding mortgage balance

While this topic deserves its own article, here’s a brief summary:

- No SDLT is usually payable if the property is mortgage-free when gifted

- If the property is mortgaged, the SDLT is based on the proportion of the outstanding mortgage transferred

Example: Gift with Mortgage

Let us suppose Alex owns a property worth £400,000 and gifts 50% to his daughter Melissa in 2025. If the mortgage at that time is £200,000, the consideration for SDLT purposes is £100,000 (50% of the mortgage). SDLT would then apply on this amount.

Gifting property is often part of long-term financial or inheritance planning, but the CGT implications can be significant-even when no money is exchanged.

Whether you’re:

- Gifting to a child or spouse

- Transferring to a trust

- Inheriting or dealing with property between siblings

…understanding CGT and SDLT is essential.

At Nachu Finance, we help clients navigate these decisions with transparency and clarity. While we do not offer tax advice ourselves, we work closely with tax professionals and estate planning experts to guide you to the right solution.

Plan Smart, Gift Wisely

At Nachu Finance, we understand that gifting or inheriting property is rarely just a tax decision—it’s a family decision, a financial decision, and often, a legacy decision.

That’s why we offer holistic, well-rounded advice that considers:

- How best to structure a property gift or inheritance from a tax and mortgage perspective

- Whether to gift during your lifetime or leave assets through your Will

- The impact on your broader financial plans, including protection, lending, and estate strategy

With the experience of guiding clients through these complex choices for almost two decades, a transparent, client-first approach, and access to trusted tax and legal professionals, we go beyond the transaction to help you do what’s best for your family—now and in the future.

Thinking about gifting property? Let’s explore the right way to do it.