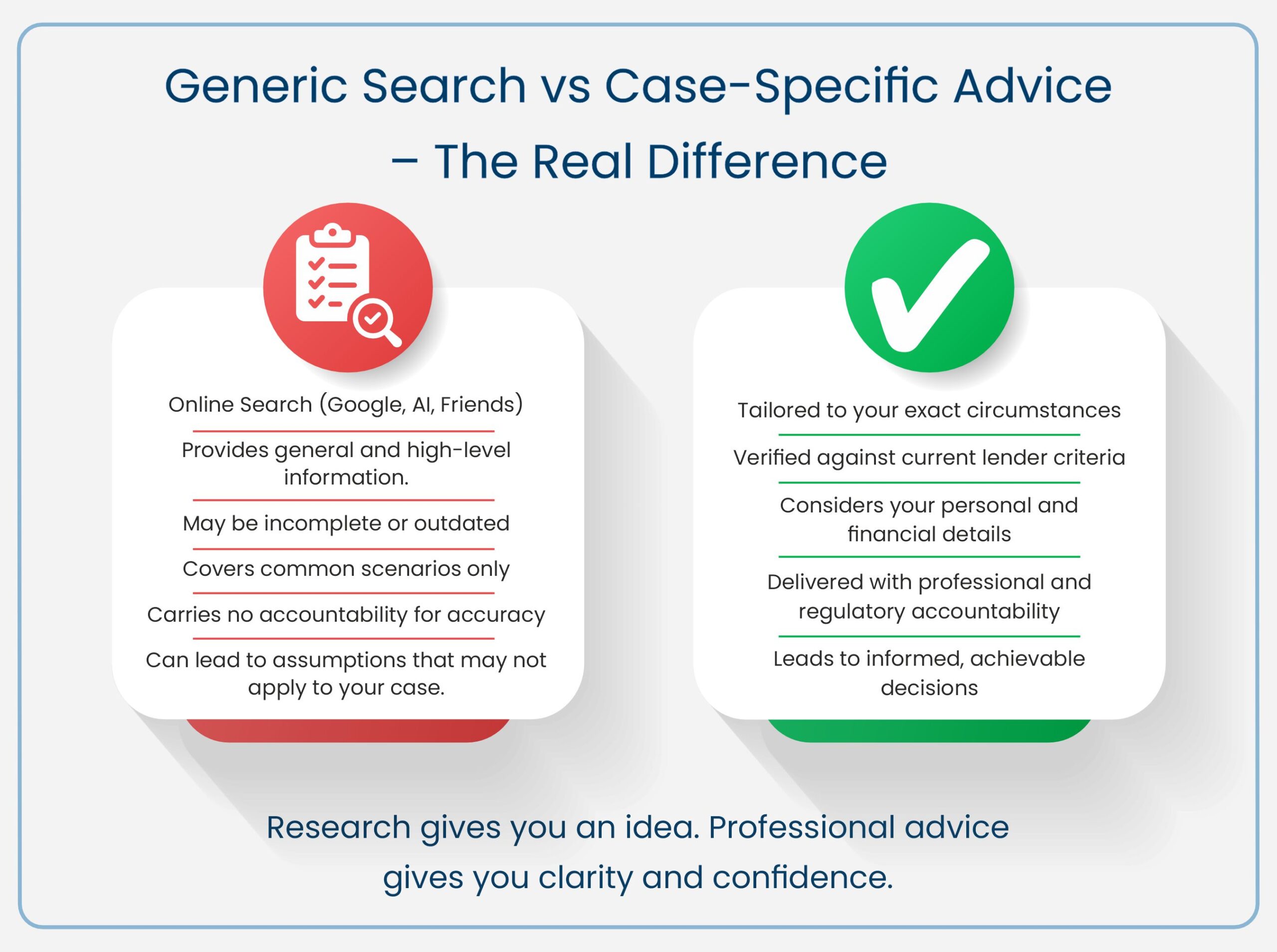

It is quite common for clients to begin their research by checking Google, using AI tools, or speaking to friends who have gone through a similar process. These are all good starting points to understand what is generally possible in the mortgage or property market and to familiarise yourself with key terms and concepts.

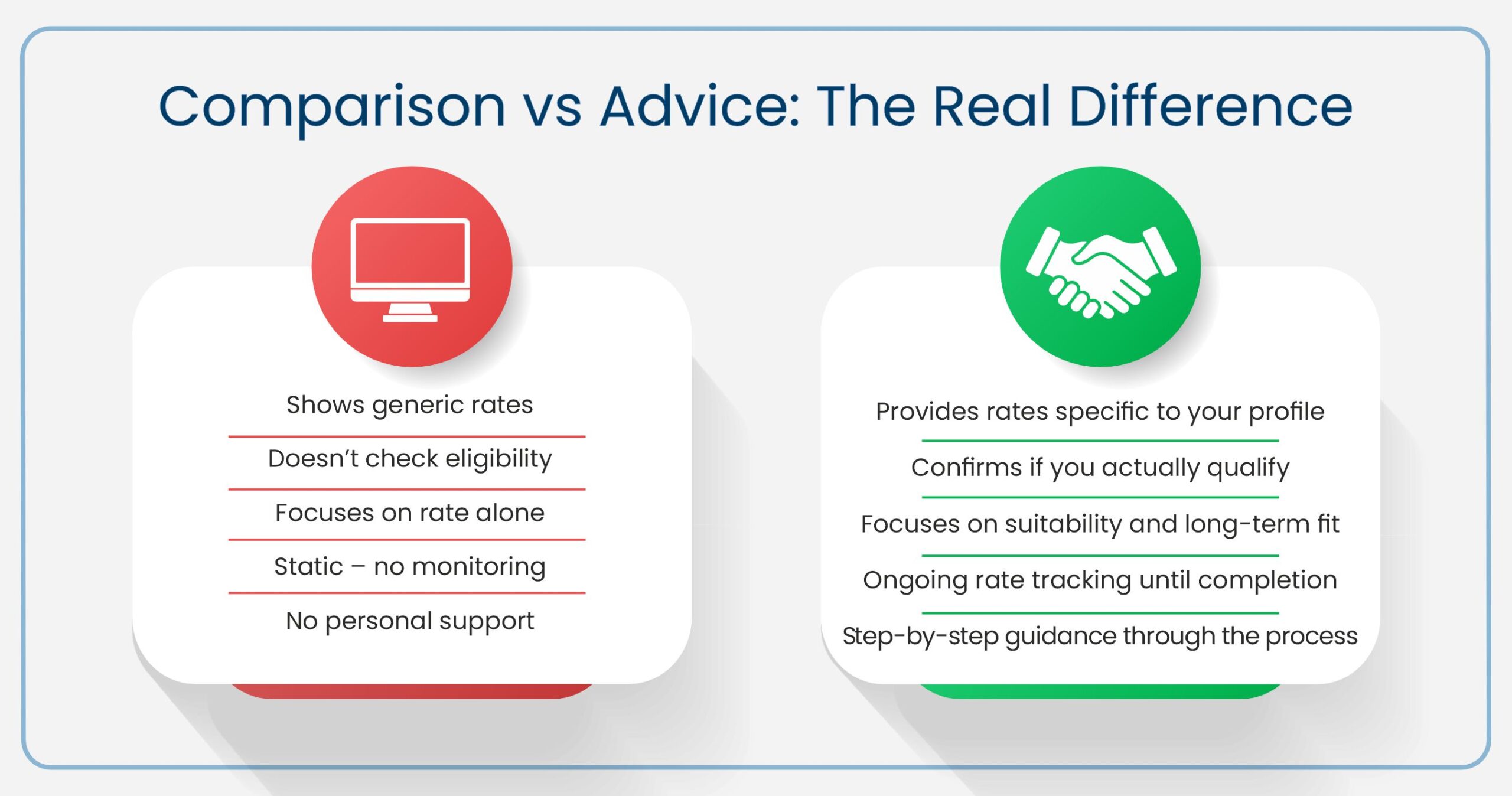

However, while Google searches, AI responses, and friendly discussions can help build general awareness, they cannot replace case-specific professional advice that takes into account your personal and financial circumstances.

If you are specifically interested in how advice-driven product selection differs from comparison websites, see our related article:

Why Personalised Mortgage Advice Goes Beyond Comparision Website

The information found through a Google search or a general discussion with friends is, by nature, generic.

It does not take into account:

- Your income type or employment structure.

- The property’s ownership model or intended use.

- The lender’s current criteria.

- Your residency or credit profile.

Mortgage lending, taxation, and property law all have layers of detail that differ from one case to another. What works well for one individual may not be suitable or even possible for another.

Consider the use of a gifted deposit.

A quick online search might state that lenders are happy to accept gifted deposits as long as the source of funds is evidenced and supported by a donor declaration.

While this is true in many standard residential purchases, the outcome changes significantly when the purchase:

- Is made through a limited company,

- Involves multiple shareholders, or

- Relates to a non-standard property such as a multi-unit block under a single title.

In such cases, the number of lenders available is very limited. Those who accept gifted deposits often do not accept multi-unit properties, and vice versa. The difference between what appears acceptable online and what is actually possible in your case can therefore be substantial.

It involves:

- Interpreting lender and solicitor criteria within the context of your case.

- Balancing compliance, affordability, and timing.

- Ensuring that what appears possible in theory is achievable in reality.

A professional adviser also carries regulatory accountability — meaning the guidance you receive must be suitable, compliant, and in your best interests. That level of responsibility does not exist in a Google search, an AI response, or a conversation with friends.