The long-awaited Renters’ Rights Act became law on 27 October 2025, marking the most significant change to the private rental market in decades.

This reform has been discussed for years, and now that it’s official, every landlord — from those with one rental property to experienced portfolio investors — needs to understand what has changed and how to adapt.

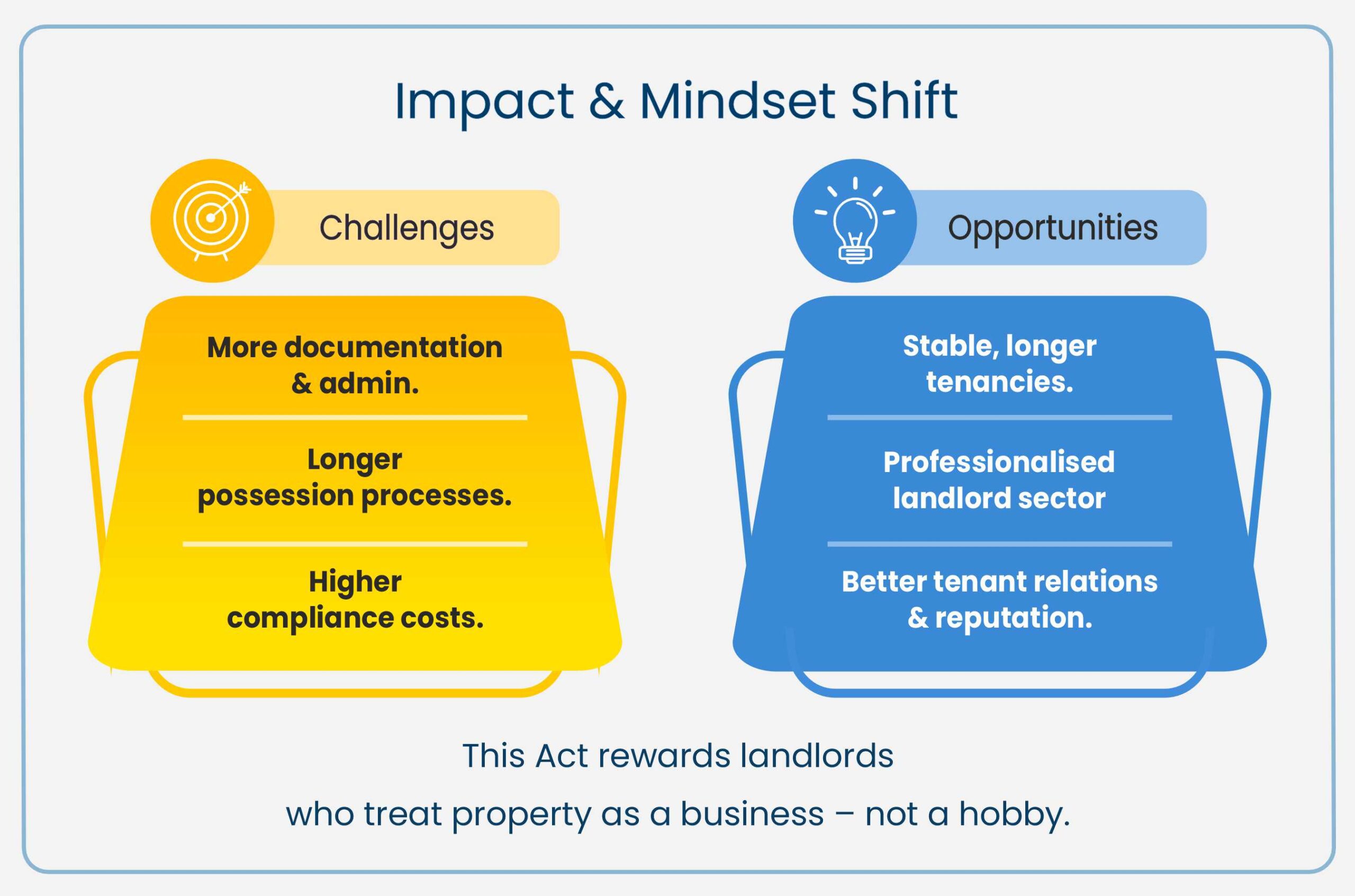

At Nachu Finance, we’ve always emphasised that property investment is not a passive activity. It requires time, care, and compliance — closer to running a small business than simply holding an investment. With the new rules now in force, landlords who treat their property portfolio with professionalism will continue to do well.

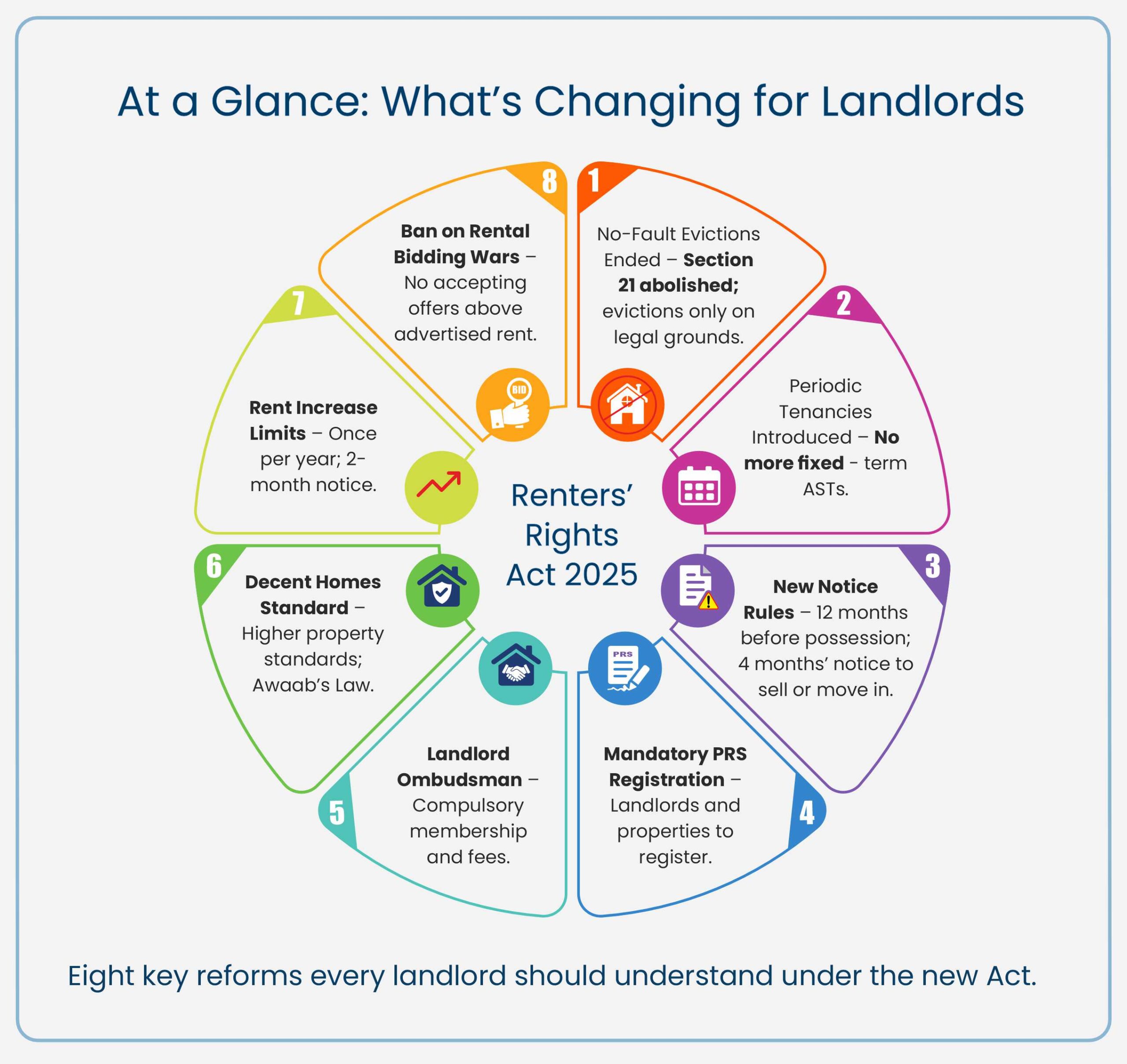

The Renters’ Rights Act 2025 has introduced sweeping reforms to improve tenant protections and raise housing standards. Here’s what this means for landlords:

- End of Section 21 Evictions: The familiar “no-fault eviction” has been abolished. Landlords must now use Section 8 and demonstrate valid reasons such as rent arrears, anti-social behaviour, or the need to sell or move back in.

- All Tenancies Become Periodic: Fixed-term Assured Shorthold Tenancies (ASTs) are gone. Every tenancy automatically rolls month to month, giving tenants flexibility to leave with two months’ notice, and landlords can only end tenancies on specific grounds.

- New Possession Rules: Landlords can still regain possession to sell or move in, but only after 12 months and with four months’ notice.

- Mandatory Registration: Both landlords and their properties must be registered on the new Private Rented Sector (PRS) Database before being marketed or let.

- Landlord Ombudsman Scheme: All landlords must join a new redress scheme, paying annual fees. The ombudsman can require remedial action or compensation where complaints are upheld.

- Decent Homes Standard: This applies to all private rentals for the first time. Properties must be safe, warm, and free from hazards such as damp or mould.

- Rent Increase Rules: Rent can only be increased once per year, with at least two months’ notice. Tenants can challenge increases at a tribunal.

- Ban on Rental Bidding Wars: Landlords cannot advertise a rent and then accept higher bids.

For professional landlords who already maintain their properties well, these changes will mainly mean formalising existing good practices rather than reinventing the wheel.

Landlords can no longer rely on fixed end dates to regain possession, which makes tenant selection, documentation, and ongoing communication more critical than ever.

While eviction rules have tightened, landlords still retain rights where genuine reasons exist — such as rent arrears, breach of tenancy, or the need to sell.

This means thorough record-keeping and prompt action will now carry even greater importance.

With mandatory registration, higher property standards, and new complaint-handling procedures, landlords must now operate with stronger systems and checks.

- Register both yourself and each property on the PRS Database once the portal is available.

- Join the Landlord Ombudsman Scheme and budget for the annual fee.

- Keep compliance documents up to date — Gas Safety, EICR, EPC, deposit protection, and right-to-rent checks.

- Address any issues such as damp, mould, or faulty wiring proactively.

- Update tenancy agreements to reflect periodic terms and rent increase rules.

- Ensure your advertising is transparent, with a clearly stated rent figure.

- Maintain proper records for inspections or future possession claims.

Most experienced landlords will already be doing much of this. The difference now is that compliance will be monitored more closely, and the penalties for neglecting it are higher.

The Renters’ Rights Act may sound complex, but the path forward is clear.

Every landlord — whether you let out one property or manage several — can start by reviewing three key areas:

- Registration and Documentation: Get ready for PRS and Ombudsman registration, and make sure every compliance certificate is current.

- Property Condition and Maintenance: Plan works early to meet the new Decent Homes Standard.

- Process and Planning: Build a system for reminders, record-keeping, and communication with tenants.

The infographic below summarises these into a simple step-by-step plan to help you stay ahead.

The best way to approach the new legislation is with preparation, not panic.

Here’s a practical way forward:

- Audit your portfolio: Check every property for safety and compliance.

- Plan maintenance budgets: Bring older properties up to the Decent Homes Standard.

- Review insurance cover: Especially rent guarantee, legal expenses, and pet-related damage.

- Set reminders: Use systems or spreadsheets to track renewal dates for safety certificates.

- Coordinate with your letting agent or managing agent to ensure they’re up to date with the new regulations and compliance requirements.

- Join a landlord body: Organisations such as the NRLA provide valuable updates and guidance.

For landlords who already manage their properties professionally, the new Act simply means documenting more of what you already do.

It’s understandable that these changes might feel like additional burden, but they also mark a positive step toward a more transparent and professional rental sector.

While some landlords may decide this isn’t for them, those who continue with structure, diligence, and care will find greater stability in the long run.

The goal now should be to strengthen your systems, review your processes, and stay informed — not to step back from property altogether.

The Renters’ Rights Act may bring higher expectations and more oversight, but it also brings clarity and consistency.

For responsible landlords, this is an opportunity to stand out for doing things right — maintaining well-kept homes, fair treatment, and strong compliance.

With a little extra care and organisation, you can continue to thrive in this new landscape and provide homes you’re proud to let.