Testmonials

"The entire team was very professional and proactive, making the whole process smooth and easy for us."

Ilford

First-time buyer

"He always presents options that suit my financial situation and helps me make informed decisions."

Leamington Spa

Remortgage client

"Sekkappan and the team were always on hand to answer our questions, and they followed up on everything promptly."

Hertfordshire

Remortgage client

"The service, advice, and support have always been consistent. Every email and call has been answered promptly."

Middlesex

Portfolio landlord

"Thanks to Sekkappan, we saved money on our mortgage and felt supported throughout."

Worcester

Home mover

"Sekkappan and his team took ownership of our requirements and guided us through every stage."

Aylesbury

Home buyer

"Sekkappan made the complex mortgage process feel like a cakewalk."

Croydon

Home buyer

"Their meticulous attention to detail and genuine care for our financial goals were truly appreciated."

Essex

Home buyer

Enquiry Form

Get in Touch with Us for Personalized Finance Assistance

Residential and Buy-to-Let Mortgages

At Nachu Finance, we specialise in both residential and buy-to-let mortgages, with over 18 years of experience helping a diverse range of clients achieve their property goals. Over the years, we’ve seen a wide variety of cases, and our dedication to providing tailored advice has earned us a loyal base of satisfied clients. Our business has grown thanks to their trust and recommendations, and the glowing testimonials from our clients are a testament to the service we provide. Get hassle free and expert guidance from the best mortgage broker in the UK.

- First-Time Buyers

Buying your first home is both exciting and daunting! We’re here to guide you every step of the way, from the dream of owning a home to the day you get your keys (and beyond). We’ll help you navigate the financial aspects, find the right solicitors, and answer all your questions until you’re confidently settled into your first home. - Home Mover Mortgages

Moving to a new home is an exciting step, but managing your current property can raise questions. At Nachu Finance, we can advise you on the various options available to you, whether that’s selling your current property or converting it into a buy-to-let mortgage.

If you’re considering converting your property, we can guide you on the benefits and process of keeping it in your personal name or transferring it to a limited company. These decisions can have significant impacts on your tax situation and overall finances, so having the right advice is essential. We’ll walk you through the options, ensuring that your property strategy aligns with your future plans. - Mortgage for a Second Home

Whether you’re securing a second property for work or helping a dependent relative, such as a parent or sibling, we can help you navigate the complex mortgage landscape. At Nachu Finance, we work with specialist lenders to offer tailored solutions for second homes, ensuring you get the best possible deal. We’ll help you structure the mortgage to suit both your and your relative’s needs, guiding you through all the available options. - Guarantor Mortgages

Saving for a deposit or maintaining a perfect credit score can be tough. Guarantor mortgages allow parents or family members to help you secure a home, leveraging the equity in their home to help you step onto the property ladder sooner. - Gifted Deposits and Family Purchases

Buying or selling a property within the family can streamline your mortgage application and sometimes eliminate the need for a deposit. Similarly, a gifted deposit from a family member is a great way to help younger relatives get onto the property ladder. We are experts in handling these niche transactions, ensuring your paperwork is in order and the process runs smoothly. - Shared Ownership

With rising property prices, shared ownership—part buy, part rent—schemes are increasingly popular, especially in cities or among first-time buyers. We have extensive experience with these arrangements and will guide you through your options to ensure you find a deal that fits your needs. Not only can we assist with your financial assessment, but we also liaise directly with housing associations to help secure an agreement that works for you. - Right to Buy

Navigating a Right to Buy application can be tricky, especially with non-standard property types, complex incomes, or if you’re approaching retirement. But this is where our experience truly shines. We have successfully helped clients with zero deposit obtain their council properties, working directly with councils to provide an end-to-end service. - Contractor Mortgages

As a contractor, your income might fluctuate, but that shouldn’t stop you from securing a mortgage. Whether you are inside IR35, outside IR35, have more than one contract, are paid in a different currency (other than GBP), or are fairly new to contracting, we can still help you find the best lender for your needs. - Construction Industry Scheme (CIS) Mortgages

Under the government’s Construction Industry Scheme (CIS), self-employed contractors can often access more favourable mortgage rates. At Nachu Finance, we have an in-depth understanding of the CIS and can help you maximise your buying power with the right mortgage solution. - Self-Employed Mortgages

Being self-employed can make obtaining credit challenging, especially when it comes to a residential mortgage. Whether you are a sole trader, part of a partnership, or run a Ltd company, we can help. With our experience and connections to specialist lenders, we can help you get a mortgage with as little as one year of self-employment history. No matter how complex your income streams are, we’ll ensure your application accurately reflects your affordability, even liaising directly with your accountants to create a clear picture for lenders. - Complex Properties

Purchasing a non-standard property—whether it’s a flat with a short lease, a thatched cottage, or a home above a commercial premises—can be difficult. Many lenders are hesitant to finance these types of properties. However, through diligent research and working with specialist lenders, we’ve successfully helped clients secure mortgages on these more unusual homes, ensuring your application is presented in the best possible way. - Remortgaging

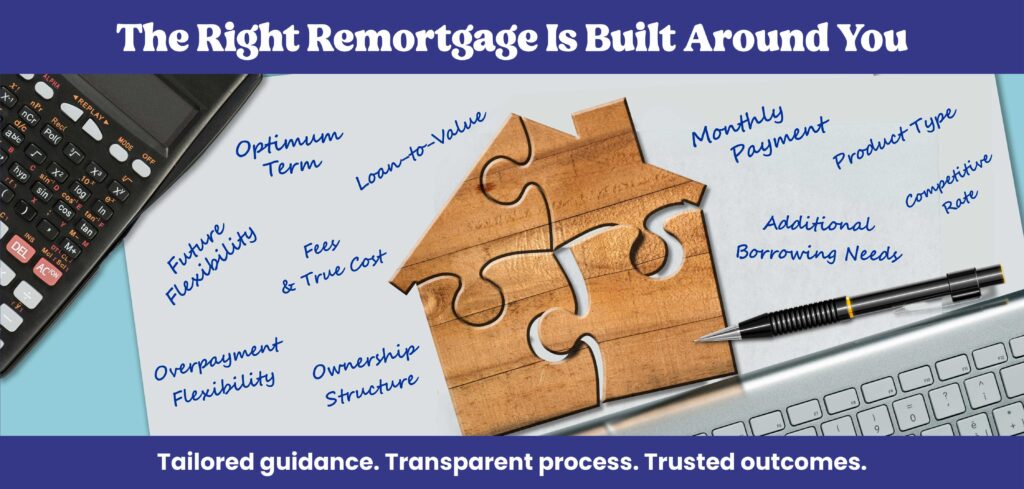

Remortgaging is an excellent way to capitalise on new market rates or release equity for home improvements, purchasing a new car, or helping your children get on the property ladder. We will help you find the most competitive deal given your circumstances and requirements, whether that’s with your current lender or a new one. - Secured Loans

Secured loans offer an alternative to remortgaging by allowing you to use your property’s equity without changing your primary mortgage. Our expertise in secondary secured loans means we can find flexible solutions that work in your favour. - Foreign National Mortgage

If you’re not a UK national or don’t yet have permanent residency (indefinite leave to remain), securing a mortgage might seem challenging. However, at Nachu Finance, we have the expertise to help. Whether you’re from the EU or any other part of the world, we’ll work with you to secure a home for you and your family in the UK. - Bad Credit Mortgages

A less-than-perfect credit history doesn’t have to prevent you from owning a home. Whether you’ve had a County Court Judgment (CCJ) or are recovering from an Individual Voluntary Arrangement (IVA), we work with specialist lenders who understand these circumstances and offer tailored solutions. If needed, we will work with you to improve your credit score and help you on the path to repairing your credit report and bringing it to a more lender-friendly stage. Don’t let past financial challenges stop you—reach out to us, and we’ll find a lender willing to work with your unique situation.

- Buy-to-Let Purchase

Purchasing a buy-to-let property can be a lucrative investment, but it requires careful planning. We will help you secure the right mortgage that fits your financial goals, whether you’re looking for a high-yield rental property or a long-term investment. Our expertise ensures you can access competitive rates and mortgage terms from a range of lenders, including specialist buy-to-let providers. - Buy-to-Let Remortgage

Remortgaging your buy-to-let property is a great way to release equity for further investments or reduce your mortgage payments by securing a more competitive rate. Whether you’re looking to reinvest in another property, make improvements, or simply take advantage of better market rates, we can find the best remortgage solution for your needs. - Let-to-Buy Mortgages

If you’re planning to move to a new home but want to keep your current property as a rental investment, a let-to-buy mortgage could be the ideal solution. We’ll guide you through the process of converting your existing mortgage to a let-to-buy product, enabling you to purchase a new home while generating rental income from your previous property. - Mortgages for Portfolio Landlords

Managing a portfolio of properties comes with its own unique challenges, especially when it comes to financing. If you have four or more mortgaged buy-to-let properties, there are additional regulatory requirements to fulfill. We work with specialist lenders who understand these complexities and can advise you on the best options, balancing your personal circumstances with each lender’s requirements. Whether you’re expanding your portfolio or seeking to refinance existing properties, we’ll help structure your mortgage deals to optimise both your cash flow and long-term investment goals. - Limited Company Mortgages

For those looking to invest through a limited company, buy-to-let mortgages can offer tax advantages, especially with changes in mortgage interest tax relief. We provide expert advice on whether this route is right for you, helping you understand the benefits and complexities of borrowing through a limited company structure. We are happy to discuss the share ownership structures that lenders will accept and the various ways capital can be introduced to the business to make the most of your investment.

Given our experience spanning over 18 years, we’ve handled a vast variety of complex mortgage solutions, making it difficult to highlight just one or two cases. However, one that stands out for its emotional impact and the deep appreciation from the clients occurred in 2018.

A couple came to us with the desire to purchase their council property under the Right to Buy scheme, using only the discount and no deposit. After trying multiple lenders directly without success, they were disheartened and prepared to let go of their dream of homeownership. They were recommended to us by one of our clients, arriving with low confidence and little hope.

Much to their surprise, we were able to secure them a mortgage with competitive rates from a high street lender—something they had not expected at all. The joy and relief they experienced were overwhelming, and their gratitude has stayed with us ever since.

The clients are deeply religious and undertake a pilgrimage every year. What truly humbles us is that they return each year with messages of thanks, telling us they include us in their prayers. This ongoing connection has become a reminder of why we do what we do.

While the loan size and revenue generated from this case were modest, the satisfaction and fulfilment we gained from helping this couple was immense. Their story continually inspires us to do our best for clients who are struggling to get on the property ladder, proving that the impact we make goes far beyond numbers.

We know every client’s challenge is different, and this variety is what makes every day interesting. Feel free to reach out with your challenge, and we will be happy to do our best.

We help and guide our clients every step of the way, providing advice on how to best structure the deal based on your personal circumstances and requirements. At Nachu Finance, we are happy to go the extra mile for our clients. Not only will we guide you through the mortgage process, but we can also put you in touch with other related specialists, such as tax advisers, property managers, or solicitors, to ensure every aspect of your investment is covered.

We advise you on the best practices, whether it’s managing your rental property, handling difficult tenant situations, or making informed decisions on property improvements. We understand that being a landlord can sometimes be challenging, and there are several compliance requirements to adhere to, such as safety regulations and tenancy laws. That’s why we often serve as a sounding board for landlords, offering guidance and support when issues arise. Our goal is to provide you with peace of mind, knowing that you have a knowledgeable and experienced team by your side, every step of the way.

Whether you’re looking for the most tax-efficient option or need guidance on managing multiple properties, we’ll ensure your buy-to-let strategy aligns with your long-term goals.

Our Transparency Promise

Not Afraid to Turn Away Business

We take great pride in providing value-added services to our clients, focusing on those who benefit most from our personalised, comprehensive advice. In cases where a client is looking for purely transactional support to execute a decision they’ve already made, we believe it’s in everyone’s best interest for us to step aside and point them to comparison websites or directly to lenders.

This ensures that we dedicate our time and effort to clients seeking in-depth advice and strategic guidance, where we can truly add value and make a meaningful impact on their financial journey. It’s not about arrogance, but about prioritising the kinds of clients to whom we are better suited, ensuring they receive the highest level of service and support.

Join Our Happy Clients Today

Contact us and take your first step to joining the several happy Nachu Finance clients.

As well-experienced, transparent, whole-of-market advisers with excellent client reviews and a willingness to go the extra mile, we are confident that we’ll be the right choice to act as your trusted advisers.

With our tech-savvy, client-focused, and flexible approach, reaching us is easy and simple. Let us guide you through your property journey with confidence and care.