Testmonials

"The entire team was very professional and proactive, making the whole process smooth and easy for us."

Ilford

First-time buyer

"He always presents options that suit my financial situation and helps me make informed decisions."

Leamington Spa

Remortgage client

"Sekkappan and the team were always on hand to answer our questions, and they followed up on everything promptly."

Hertfordshire

Remortgage client

"The service, advice, and support have always been consistent. Every email and call has been answered promptly."

Middlesex

Portfolio landlord

"Thanks to Sekkappan, we saved money on our mortgage and felt supported throughout."

Worcester

Home mover

"Sekkappan and his team took ownership of our requirements and guided us through every stage."

Aylesbury

Home buyer

"Sekkappan made the complex mortgage process feel like a cakewalk."

Croydon

Home buyer

"Their meticulous attention to detail and genuine care for our financial goals were truly appreciated."

Essex

Home buyer

Enquiry Form

Get in Touch with Us for Personalized Finance Assistance

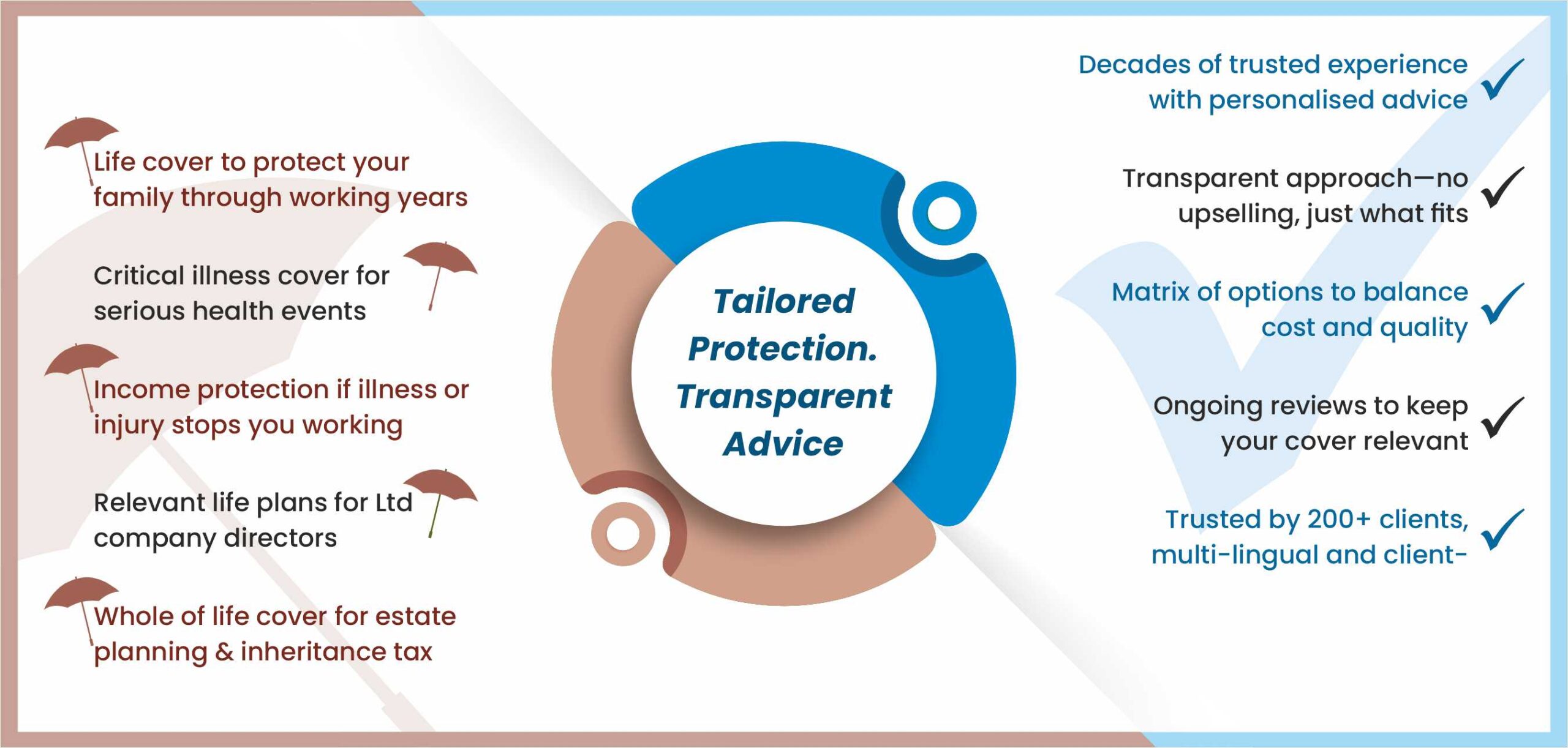

Protecting your family & home

At Nachu Finance, we offer expert advice and arrangement services for both life insurance-covering critical illness, income protection, and accident protection-as well as buildings insurance for both homeowners and landlords. With our extensive experience, holistic approach to finances that extends to estate planning, and strong relationships with insurance providers, we go the extra mile to ensure that you receive the right protection. As whole-of-market advisers, we’re well-positioned to help you find the ideal solution for your insurance needs.

Our Insurance Services at a Glance

- Life Insurance

Financial protection for your family from an unforeseen end during your active working years. - Critical Illness Insurance

A crucial safety net for when a serious illness hits—though more expensive than life cover, it’s far more likely to be needed. - Income Protection

Peace of mind for when illness or injury prevents you from working—your family’s finances stay protected. - Relevant Life Plan

A tax-efficient life insurance for Ltd company directors and their family taking a regular salary. Works when you can establish an employee-employer relationship. - Whole of Life Insurance

Where cover is needed even after the active working age. Guaranteed payout means higher premiums but works very well to mitigate inheritance tax. A must-consider option if you are keen to pass on assets to the next generation as efficiently as possible. - Home Insurance

Covering your property and possessions for peace of mind, while also satisfying mortgage lender conditions. - Landlords Insurance

A buy-to-let property could be someone else’s home, but the investment is yours and needs to be well protected.

Insurance is all about balance—finding the right combination of quality cover, including the type of cover, sum assured, and term, while managing monthly premiums. The ideal insurance cover may come with higher costs, and the cheapest cover might not provide adequate protection. That’s why we offer a matrix of options to help you choose the coverage that strikes the best balance for your needs. You can mix and match options to create the most appropriate and affordable solution for your family.

Apart from offering you a matrix of options to pick and choose from, we also make tailored recommendations. Over the years, we’ve found that providing three key options helps clients find the right balance between coverage and cost. These include an ideal cover, which offers the most comprehensive protection for those who can afford it, a budget cover that provides good value without compromising essential protection, and a mid-level cover that strikes a balance between the two. This approach ensures that you have a clear set of choices when selecting the best insurance solution for your family’s needs.

A trust is a very simple yet powerful option when it comes to life insurance. This makes the policy very efficient as well as helps keep the claim proceeds outside of one’s estate from an inheritance tax perspective.

At Nachu Finance, we encourage all clients to place the policy under a trust and help them understand the benefits while setting up the trusts correctly. This may mean a bit of additional work for both parties now in setting up the trust and later if and when the trust needs to be updated, but we are happy to do so in the interest of the policy’s effectiveness for the client.

Our holistic approach, which includes estate planning, means we appreciate and use trusts even better.

It is vital to review life insurance periodically to ensure the policy remains suited to the changing circumstances and requirements of the family.

At Nachu Finance, we proactively review our clients’ policies on a regular basis. We believe this is time well spent, and even if no changes are necessary, we take pride in knowing that the plan set up years ago is still relevant for the client and their family.

While older policies can be very hard to beat from a pricing perspective, in cases where the current policy does not adequately cover the family’s needs, we will recommend top-up covers. This allows you to keep the advantages of the old policy while increasing the protection for your family.

Having advised and arranged insurances for over 18 years, we understand that, unfortunately, there are times when clients need to make a claim on their critical illness policy or the life cover policy of a family member.

At Nachu Finance, we recognise that this is an incredibly challenging time for clients and their families. We offer our full support throughout the claim process, assisting with filling in claim forms, providing the required evidence, and following up until the claim has been successfully paid.

Our holistic advice, which includes estate planning and a deep understanding of how trusts work, comes in handy during these moments. With our long-term, relationship-focused approach, we never hesitate to go the extra mile—especially at this time when the client and their family need all the support they can get.

A family planning to purchase their first home approached us for advice and obtained an Agreement in Principle to begin their house-hunting journey. Following our recommendation to protect the family in light of the mortgage, they started a life insurance policy early on.

Tragically, before they could proceed with their home purchase, their child was diagnosed with leukaemia, which put their plans on hold. Fortunately, we were able to assist them in making a successful critical illness claim for their child’s condition, providing much-needed financial support without affecting their own critical illness cover. The family were unaware that the policy included free child critical illness cover and appreciated the proactive approach that made a big difference at a very difficult time.

Our Transparency Promise

Not all lives can be insured

Despite our experience in arranging insurance for over 18 years and our strong relationships with insurance companies, there may still be challenges in finding coverage for clients with less-than-normal health.

Some of the common challenges include those with diabetes who seek critical illness cover, anyone undergoing ongoing investigations or consultations, and individuals who have already experienced certain critical illnesses. We will be happy to explore options from across the market to see how best this can be placed.

Let Us Protect Your Family

At Nachu Finance, we understand that insurance is not just about ticking boxes—it’s about providing comprehensive protection for your family, not just your mortgage. With over 18 years of experience, a whole-of-market approach, and strong relationships with insurance providers, we offer tailored advice that suits your unique needs. Whether it’s life insurance, critical illness cover, or income protection, our client-first, proactive approach ensures you get the right balance between cover and cost.

We go the extra mile by offering flexible recommendations, effective use of Trusts, and regular policy reviews to make sure your cover stays relevant as life changes. Even in more challenging circumstances—such as pre-existing health conditions—we are committed to exploring all available options across the market.

With our expertise in protecting families and a commitment to transparency, you can be confident that you are in safe hands with Nachu Finance