Testmonials

"The entire team was very professional and proactive, making the whole process smooth and easy for us."

Ilford

First-time buyer

"He always presents options that suit my financial situation and helps me make informed decisions."

Leamington Spa

Remortgage client

"Sekkappan and the team were always on hand to answer our questions, and they followed up on everything promptly."

Hertfordshire

Remortgage client

"The service, advice, and support have always been consistent. Every email and call has been answered promptly."

Middlesex

Portfolio landlord

"Thanks to Sekkappan, we saved money on our mortgage and felt supported throughout."

Worcester

Home mover

"Sekkappan and his team took ownership of our requirements and guided us through every stage."

Aylesbury

Home buyer

"Sekkappan made the complex mortgage process feel like a cakewalk."

Croydon

Home buyer

"Their meticulous attention to detail and genuine care for our financial goals were truly appreciated."

Essex

Home buyer

Enquiry Form

Get in Touch with Us for Personalized Finance Assistance

Leaving behind a legacy

Nachu Finance has been providing mortgage and insurance services since 2006, and through our journey, we’ve always focused on understanding and addressing the needs of our clients. Over the years, many of our clients expressed a growing demand for estate planning, recognising the importance of preparing for the future beyond just property and insurance.

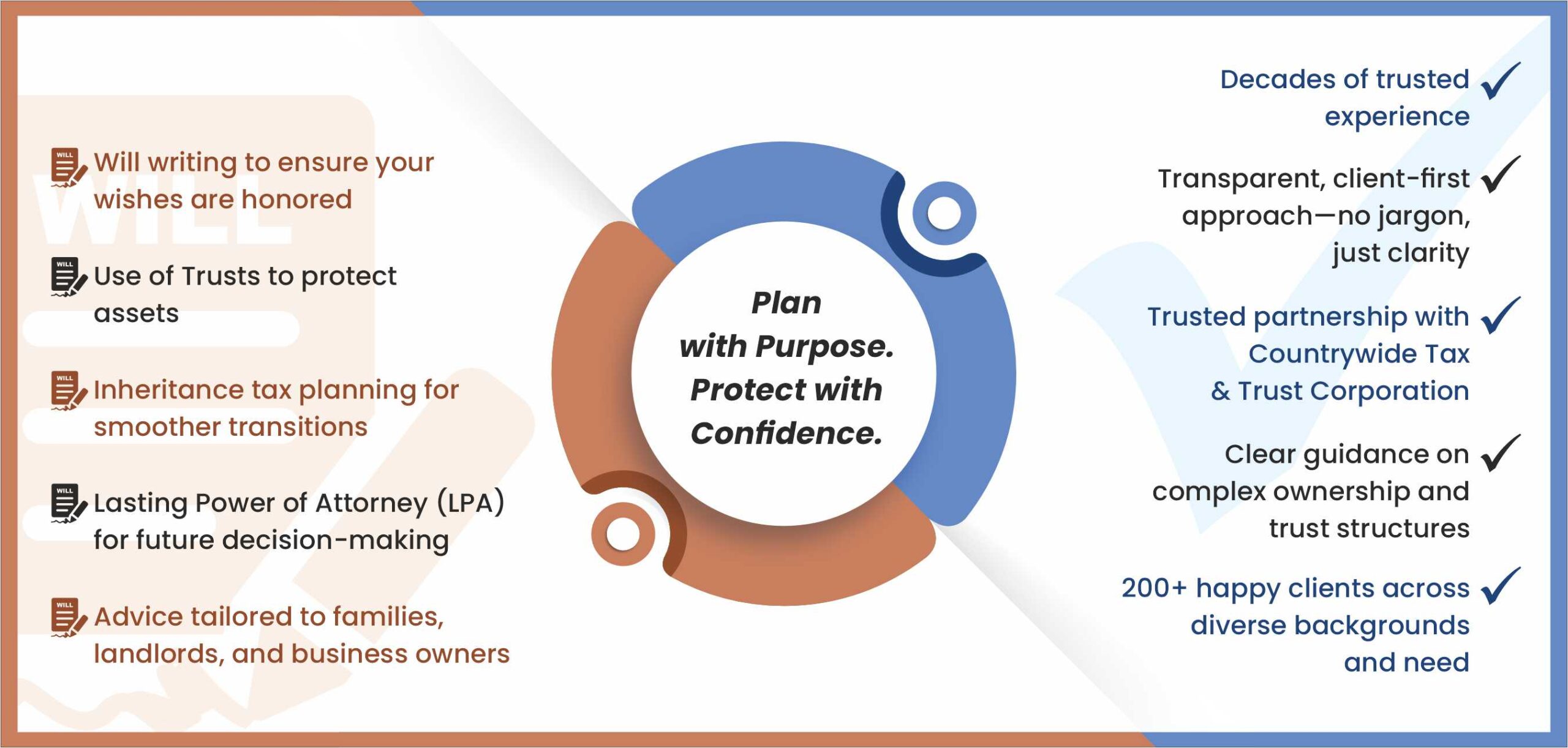

In response to this, we expanded our offerings in 2019 to include comprehensive estate planning services, working in partnership with Countrywide Tax and Trust Corporation, experts and market leaders in this field. This collaboration ensures that our clients receive the highest level of support and advice when it comes to safeguarding their assets and planning for future generations.

What We Offer

Will Writing

Will Writing

Ensuring your assets transition smoothly to the next generation, leaving nothing to chance—everyone with assets or young children needs to have one in place and update regularly. Use of Trusts

Use of Trusts

A powerful tool that separates the legal and beneficial ownership, allowing assets to be managed and distributed efficiently—potentially reducing inheritance tax while retaining control. Inheritance Tax Planning

Inheritance Tax Planning

Planning ahead and using a combination of strategies to minimise the inheritance tax your estate faces, maximising what your family inherits—the sooner you start, the better the chances. Lasting Power of Attorney (LPA)

Lasting Power of Attorney (LPA)

A legal safeguard giving someone you trust the authority to make critical decisions when you’re unable to—a best practice, especially when some or all assets are owned jointly.

With estate planning, it is not a case of one size fits all, and the solution for each client varies significantly based on family circumstances as well as their requirements. There is no rate card as such to publish, but once we have a better understanding of your case, we can make some recommendations and share the cost for the same then.

There are no charges for the initial meeting. Within our recommendations, we also provide you with options to do this in phases, which gives you the flexibility to manage your estate planning over a period of time.

A high-net-worth client with adult children wanted to transfer a property to each of his children but was concerned that these assets might be vulnerable to claims by future partners. He also wanted to retain control over the assets while avoiding immediate capital gains tax on the transfers.

Nachu Finance, in association with Countrywide Tax and Trust Corporation, offered a tailored solution by placing the properties in a trust, with the client and children as trustees, ensuring the client maintained control throughout their lifetime. The trust structure protected the assets from potential claims by future partners of the children, and by using a holdover trust, we deferred the capital gains tax liability. The clients were also able to move the tax liability on the rental income to the child.

In addition to setting up the trust, Nachu Finance established a Lasting Power of Attorney (LPA) and drafted a Will with further trust provisions. The client chose to complete the process in two phases, with plans to continue after the seven-year period from the property transfer.

Our Transparency Promise

Nothing called a perfect solution

While there are several tools and strategies that can be used, it is important to note that it may not be possible to achieve the perfect solution. The objective should be to improve the position from where it is now rather than expect the position to become an ideal one.

It may not be possible to find a solution that optimises inheritance tax, capital gains tax, and income tax without compromising on control and protection. We may need to settle for a solution that improves upon the current position and is better than the other available options.

Why Choose Nachu Finance for Estate Planning?

With over 18 years of experience in financial services and our partnership with Countrywide Tax and Trust Corporation, we provide a holistic approach to estate planning. Our collaboration with Countrywide Tax and Trust Corporation means you receive advice backed by leading experts in estate planning. We are committed to transparency, always going the extra mile to ensure our clients’ success. Our positive reviews reflect our dedication to delivering outstanding service.

We make the process straightforward, ensuring that your estate is managed efficiently and in line with your wishes.

Let Nachu Finance help you secure your legacy and provide peace of mind for your family