Testmonials

Enquiry Form

Get in Touch with Us for Personalized Finance Assistance

Smart IHT Planning: Transfer Property to a Trust While Keeping Control

While a Will—with or without the use of Trusts—helps ensure your assets go to the intended beneficiaries smoothly after your death, it does not reduce your Inheritance Tax (IHT) liability.

Mitigating IHT can only be done through careful lifetime planning. A common mistake many people make is transferring assets directly to beneficiaries in absolute terms. In most cases, a more suitable approach for effective IHT planning would be to transfer the assets into a Trust instead.

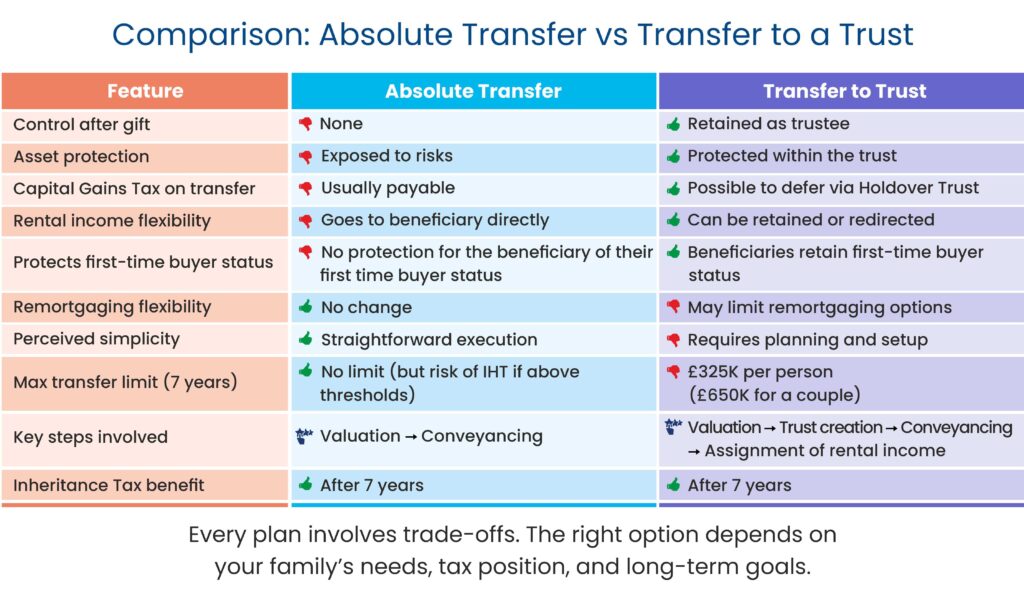

Absolute Transfer vs Transfer to a Trust

When you transfer assets directly to a beneficiary without using a trust, this is known as an absolute transfer. While there’s no restriction on how much you can transfer in this way, this method comes with significant drawbacks:

- Loss of control: You relinquish all control over the asset.

- No protection: The asset is now vulnerable to risks such as divorce, creditors, or poor financial decisions by the beneficiary.

- Tax implications:

- If the asset has appreciated, Capital Gains Tax (CGT) is payable at the time of transfer.

- The income generated by the asset is also passed to the beneficiary, who becomes liable for the tax on that income.

From an IHT perspective, if you survive for seven years after making the gift, the value of the asset falls outside of your estate. However, the lack of control and protection, and the CGT implications, make absolute transfers less appealing for most families.

Why Transferring to a Trust is More Suitable

Transferring assets into a Trust offers significant advantages:

- Control: You may continue to act as a trustee and retain control over how the asset is managed during your lifetime.

- Asset Protection: The asset is protected against claims such as divorce or creditor actions.

- Deferring CGT: With the right type of Trust—such as a Holdover Gift Trust—you may be able to defer the Capital Gains Tax that would otherwise arise.

- Income Planning: You may retain or redirect the income from the asset depending on your needs and Trust structure.

To better understand how a Trust protects your asset while still giving you control, read our related blog:

👉 How Does a Trust Actually Help Protect the Assets

These advantages make transferring assets to a Trust a significantly better option in most cases. However, it’s important to understand that one can only transfer up to £325,000 into a Trust every seven years without triggering an immediate IHT charge. For couples, this allowance doubles to £650,000, assuming joint assets are involved. If this threshold is exceeded, an immediate IHT charge applies at 50% of the standard rate. Given that the current IHT rate is 40%, this means a 20% IHT is payable on the portion that exceeds the threshold at the time of transfer.

A prudent estate plan should strike a balance between:

- Mitigating IHT

- Maintaining control over the assets

- Protecting those assets for future generations

At Nachu Finance, we generally do not recommend outright transfers of assets to beneficiaries. Instead, we explore suitable trust-based strategies that protect your family’s interests while helping reduce your estate’s IHT exposure.

Buy-to-Let Properties and Lifetime IHT Planning

For landlords who own one or more buy-to-let properties, Inheritance Tax is likely to be a serious concern. With the IHT-free threshold limited to between £325,000 and £500,000, many property owners find that a substantial part of their estate could be exposed to IHT.

At Nachu Finance, we have been advising clients on mortgages and estate planning since 2006. Many of our long-standing clients are landlords, and lifetime IHT planning for them is a common requirement.

In partnership with Countrywide Tax & Trust Corporation (CTTC), we offer a range of estate planning solutions, including trust structures tailored to your personal and financial circumstances.

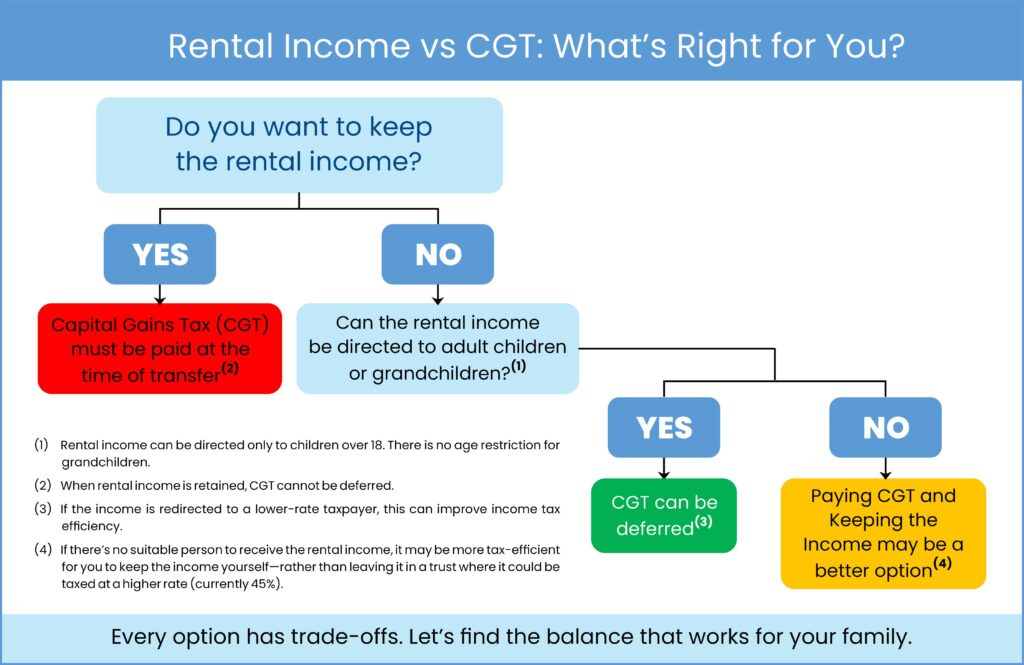

Key Consideration: Do You Need the Rental Income?

The first and most important question when transferring a buy-to-let property into a Trust is:

Do you need the rental income from the property during your lifetime?

There are two possible routes:

- If you DO NOT need the rental income:

You can transfer the buy-to-let property into a Trust and direct the rental income to a chosen beneficiary (an adult child or grandchild, but not a minor). The beneficiary will be liable for the income tax on the rental income received.

This option is straightforward if:

- You’re happy to give up the rental income

- You have a suitable beneficiary

- The beneficiary is in a lower tax bracket

- If you DO need the rental income:

You can structure the Trust to continue receiving the rental income yourself. However, this introduces other complications, especially around Capital Gains Tax, as we explain below.

Sometimes this can be a challenge, particularly if:

- Children are already high-rate taxpayers

- There are no suitable grandchildren to receive the rental income

In such cases, income tax mitigation may not be fully possible—even with a trust.

Protecting First-Time Buyer Status

A lesser-known but valuable advantage of using a trust structure is the ability to preserve the first-time buyer status of the beneficiary.

Even if your child or another beneficiary starts receiving rental income from a property held within a lifetime trust, they are treated as a beneficial owner, not a legal owner. The legal owner of the property is the trust itself.

This distinction is important because first-time buyer eligibility—and associated benefits such as reduced stamp duty—is based on legal ownership. By structuring the arrangement through a trust, the beneficiary may still qualify as a first-time buyer when they go on to purchase a property in their own name.

For families looking to support the next generation while still giving them a clean slate for their own future property purchase, this can be a powerful planning benefit.

Capital Gains Tax (CGT) When Transferring to a Trust

Even if the transfer of an asset to a Trust is done for no consideration (i.e. no money is exchanged), Capital Gains Tax is still payable.

CGT is calculated based on the notional gain—the difference between the original purchase price of the asset and its market value at the time of transfer to the Trust.

However, if you use a Holdover Gift Trust, it is possible to defer the CGT. This means you don’t have to pay it at the time of transfer. Instead, the tax becomes payable only when the Trust eventually sells the property. But the tax will be based on:

- The original purchase cost, not the market value at the time of the transfer.

As the name suggests, the “holdover” or “deferment” of CGT only postpones the liability—it does not eliminate it.

This option is especially useful when you don’t want to pay the CGT upfront but are okay with the liability passing to the Trust (and ultimately the beneficiaries) at the time of sale.

You Can’t Keep the Income and Defer the CGT

You Can’t Keep the Income and Defer the CGT

Here’s the key trade-off when transferring a buy-to-let property into a Trust:

You must choose between one of the two benefits—

- Keeping the rental income

- Deferring the Capital Gains Tax

—but you cannot have both.

Option 1: Keep the Rental Income

If you wish to continue receiving the rental income from the property after it is transferred to the Trust, you must pay CGT at the time of transfer.

Option 2: Defer the CGT

If you want to defer the CGT using a Holdover Gift Trust, then you must forgo the right to receive the rental income. Instead, the income must go to a beneficiary, who will be responsible for the associated income tax.

This choice between paying CGT now vs giving up rental income is a crucial part of the decision-making when considering lifetime IHT planning through a Trust.

Transferring Buy to let Properties with or without a Mortgage

It is possible to transfer a buy-to-let property into a lifetime trust regardless of whether the property is mortgage-free or mortgaged.

- For mortgage-free properties, you can transfer either the entire property or a specified percentage into the trust.

- For properties with an outstanding mortgage, you can transfer the equity—either fully or partially—into the trust.

Example:

Let’s consider Ishan, who owns a buy-to-let property valued at £500,000, with an outstanding mortgage of £200,000. The property generates £2,000 in monthly rental income.

Ishan can create a lifetime trust and transfer £300,000 worth of equity (representing 60% of the property’s value) into the trust. Following the transfer:

- 60% of the rental income (£1,200 per month) would belong to the trust.

- The trustees can decide who will benefit from that share of income.

This approach allows the asset to start exiting Ishan’s estate for IHT purposes, while providing flexibility over who receives the income.

A mortgage lender’s consent is generally not required to transfer equity into a trust. However, remortgaging the property with a different lender after such a transfer is typically not possible, as most lenders are unwilling to lend on properties held within a trust. As a result, the mortgage would need to remain with the current lender without any changes. It’s important to ensure that the existing lender will allow you to select a new product (product transfer also known as rate switch) when the current fixed rate period ends.

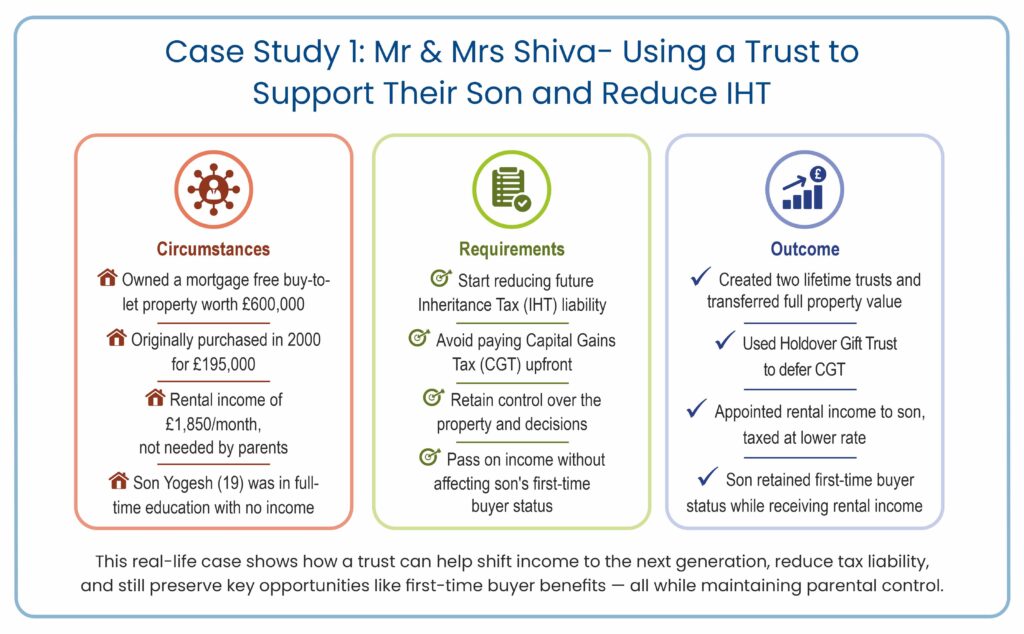

Real-Life Case Study: Lifetime Trust for a Buy-to-Let Property

We’re sharing below a detailed example to highlight the considerations and benefits of transferring a property into a lifetime trust. Names and certain details have been slightly modified to protect client confidentiality.

Background

Mr and Mrs Shiva owned a buy-to-let property purchased in 2000 for £195,000. By 2022, the property was valued at £600,000 and produced £1,850 per month in rental income. The property was jointly owned in their personal names, and both were already higher-rate taxpayers with sufficient income from other sources. They had no need for the rental income, and their primary objective was Inheritance Tax (IHT) planning.

In 2021, as part of updating their Wills, we assisted them in changing the ownership structure from joint tenants to tenants in common, allowing each to hold a 50% share. This laid the foundation for individual trust planning.

👉 To understand more about this type of ownership change, see our article: Joint Tenancy vs Tenants in Common

With no other lifetime transfers made in the preceding seven years, the recommended strategy was for each of them to create a lifetime trust and transfer their respective 50% share into those trusts.

Given the increase in property value since purchase, there was a significant capital gain of £405,000, which would ordinarily trigger a considerable Capital Gains Tax (CGT) liability. However, because the clients were willing to give up the rental income, and their 19-year-old son Yogesh—a full-time student with no other income—was available to receive it, we were able to utilise a Holdover Gift Trust structure. This allowed the CGT to be deferred rather than paid immediately.

What Happened After the Transfer

- The property was successfully transferred into two lifetime trusts—one for each spouse.

- Yogesh was appointed as the beneficiary of the trust’s rental income, receiving £1,850 per month.

- As Yogesh had no other income, he paid lower income tax on the rental income compared to his parents, who were both higher-rate taxpayers—resulting in ongoing annual tax savings.

- The property is now protected within the trust structure from potential risks such as divorce or creditors.

- Mr and Mrs Shiva continue to act as trustees, maintaining control over the asset during their lifetimes.

- Countrywide Tax and Trust Corporation were appointed as professional trustees, supporting proper trust administration and ongoing compliance.

- Yogesh was named a reserve trustee, allowing for a future transition of responsibilities if and when needed.

- The clients incurred a total cost of around £4,500 for the entire process, including trust setup, legal work, and valuation. However, given the level of asset protection and tax planning achieved, they viewed this as money well spent.

Preserving First-Time Buyer Status

In line with the principle explained earlier in this article, Yogesh’s first-time buyer status was preserved.

Although he has been receiving rental income from the property held in the lifetime trust, he is only a beneficial owner, not the legal owner. As a result, he is currently progressing with the purchase of his first residential home, and is applying for a mortgage and eligible for first-time buyer stamp duty relief.

This real-life scenario demonstrates how trust planning can provide financial support to the next generation without affecting their ability to access first-time buyer benefits.

Outcome and Long-Term Benefits

This well-structured trust arrangement resulted in several important outcomes:

- The rental income was shifted from higher-rate taxpayers to a family member paying lower tax, creating annual income tax efficiency.

- The Capital Gains Tax liability was deferred through the use of a Holdover Trust, avoiding an immediate tax bill.

- The property is now protected under the trust structure.

- Control of the asset remains with the clients as trustees.

- Yogesh retains his first-time buyer eligibility, despite benefiting from the trust’s rental income.

- The Inheritance Tax saving, if Mr and Mrs Shiva survive seven years from the date of transfer, would be 40% of £600,000 = £240,000—a substantial gain for the family.

This case study clearly illustrates how thoughtful lifetime planning, when done correctly, can deliver tax efficiency, family benefit, and long-term peace of mind—all while keeping control of the property in trusted hands and safeguarding the next generation’s financial journey.

We’re sharing below a second case study to demonstrate how lifetime trust planning can be tailored to suit different client needs. Names and some details have been slightly modified to protect client confidentiality.

Background

Mr and Mrs Sumit purchased their new residential home in 2023. They retained their former home, which they had lived in from 2008 to 2023, and by 2024, they wanted to transfer this property into a lifetime trust for long-term estate planning.

The former home, now let as a rental property, was:

- Originally purchased in 2008 for £300,000

- Valued at £640,000 in 2024

- Subject to a buy-to-let mortgage of £240,000

- Generating a monthly rental income of £2,250

Although the property had risen significantly in value, the Capital Gains Tax (CGT) exposure was minimal, due to the extended period the property had been their main residence.

The Planning Objectives

Mr and Mrs Sumit:

- Did not have adult children or grandchildren to pass income to

- Wanted to retain the full rental income for their own use

- Still wished to start removing the property from their estate for Inheritance Tax (IHT) purposes

Given their circumstances, it was important to structure the plan to retain income, minimise tax, and maintain control, while gradually reducing the IHT burden.

The Recommended Solution

We advised Mr and Mrs Sumit to each create a Family Gift Trust and transfer their equity into it.

- The property had a total equity value of £400,000 (after deducting the mortgage)

- They transferred this equity into the trust—£200,000 each, which equated to 25% of the property per person, or 62.5% in total

Because they wanted to retain the rental income, they chose not to use a Holdover Gift Trust (which would have allowed deferring CGT in exchange for giving up income). Instead, they opted to:

- Pay whatever minimal CGT was due now

- Retain all rental income from the property going forward

This setup achieved an important uplift in the property’s tax base for the trust:

- The trust now held the property with a base cost of £640,000, instead of the original £300,000

- This significantly reduced future CGT exposure if the trust ever decides to sell the property

Control and Tax Outcome

- Mr and Mrs Sumit remain as trustees, keeping full control of the asset and its management

- They continue to receive the full rental income as beneficiaries of their own trust

- After seven years, the £400,000 of equity transferred into the trust will no longer be part of their estate for IHT purposes

- By choosing to pay a small amount of CGT now, they avoided a large CGT charge in future and structured the property for long-term protection

Outcome and Long-Term Benefits

This case study demonstrates how lifetime planning using trusts can still be effective even when the clients wish to retain all income:

- Minimal CGT was paid upfront, with a significant uplift in base cost for the trust

- The property is now partially outside of the estate, offering a potential IHT saving of £160,000 (40% of £400,000) after seven years

- The trust structure provides ongoing control and flexibility

- The income stream continues uninterrupted, with no disruption to their financial lifestyle

This example reflects how trust-based solutions can be adapted to fit real-life situations—balancing control, tax efficiency, and long-term estate planning.

Our Transparency Promise

Balancing Benefits with Real-World Trade-Offs

At Nachu Finance, we believe in being upfront about both the advantages and the limitations of any estate planning solution. When it comes to lifetime transfers of property to a trust, it’s important to understand that no single plan can optimise everything—whether it’s income, Capital Gains Tax, or Inheritance Tax.

The reality is that every solution comes with trade-offs. For example:

- If you wish to keep the rental income, you may have to pay Capital Gains Tax upfront.

- If you’d like to defer Capital Gains Tax, you may have to give up the right to receive rental income.

- If you want to reduce Inheritance Tax exposure, you may need to relinquish some control over how the asset is used or who benefits.

Our role is to help you identify the right balance—to maximise the long-term benefits while minimising the elements you may need to give up. We’ll walk you through the options, explain the trade-offs clearly, and guide you towards a plan that aligns with your goals, values, and family circumstances.

This is the essence of our transparency promise: no unrealistic promises—just practical, well-informed, and personalised advice.

Let’s Structure Your Buy-to-Let Property the Right Way

Whether your buy-to-let property is mortgage-free or still under a current mortgage, the right lifetime trust strategy can help you reduce Inheritance Tax, protect the asset, and pass on rental income tax-efficiently.

At Nachu Finance, we specialise in helping landlords structure their property holdings with long-term goals in mind.

✅ Tailored advice for buy-to-let owners with or without a mortgage

✅ Trusted guidance on income, CGT, and IHT trade-offs

✅ Decades of property and estate planning experience

✅ Transparent, jargon-free, and personally tailored to your family

📞 Get in touch today to explore the best way to plan ahead — while keeping control of your property and maximising the benefits for your loved ones.