Testmonials

Enquiry Form

Get in Touch with Us for Personalized Finance Assistance

Don’t Just Buy a Home - Protect It Too

Taking on a mortgage is one of the biggest financial commitments most families ever make. But what happens if life takes an unexpected turn? Will your loved ones be able to stay in the home if something were to happen to you?

That’s where life insurance becomes a crucial part of your mortgage journey.

Why Life Insurance Matters Now

When we help you arrange your mortgage, we’re not just focused on the loan-we’re thinking about your family’s long-term security. If the unthinkable happens, life insurance can provide a lump sum to repay the mortgage, so your family isn’t left struggling to keep the home.

But it’s not just about clearing the loan-it’s about protecting the people behind it.

Protecting the Family in Light of the Mortgage

At Nachu Finance, we believe the mortgage should never be seen in isolation. Life insurance should be there to support your family through their working-age years, not just pay off the debt.

We understand that budget can be a significant consideration, especially when taking on a new mortgage commitment. But it’s also important to ask: What if something were to happen to one of the breadwinners? In that moment, having proper protection in place can be the difference between financial stability and emotional distress compounded by financial pressure.

As your adviser, we’ll help you choose the right type and level of cover, present you with options at various budget levels, and ensure it’s structured correctly from the outset.

"I Have Life Insurance Through Work" – Is That Enough?

It’s common to hear, “I already have some cover through work.” While employer-provided life insurance is a great benefit, it’s usually not enough on its own-especially when taking on a mortgage.

You typically don’t control or own the policy

The amount may not reflect what your family actually needs

Changing jobs, moving to self-employment, or taking a career break can end the cover immediately

We always factor in the cover you have at work, but we strongly recommend that you also consider having some cover of your own—something portable and designed with your specific needs in mind.

The Truth Behind Common Life Insurance Myths

Timing Is Key-Don’t Leave It Too Late

Another important reason to act early is that life insurance can take time to arrange.

Insurers may require GP reports, medical screenings, or nurse visits, especially if there are any health disclosures. These steps can be time-consuming, and they need to be completed before the insurer can confirm the terms and issue the policy.

That’s why we aim to agree on the direction early in the mortgage journey, so that while your mortgage offer is being produced and your solicitor is progressing with the legal work, we can simultaneously identify the most suitable insurance provider and allow them time to complete their due diligence.

Is Life Insurance Mandatory?

This is another common question.

Life insurance is highly recommended, but not mandatory. That said, it’s worth noting that in some cases-such as with certain medical conditions—it may not always be available or affordable. That’s even more reason to explore your options early.

We believe it’s always prudent to review your options and make an informed decision, even if you choose not to proceed with a policy right away.

If something is holding you back or you’re unsure, we’re happy to have a conversation.

Is there anything in particular that’s making you think again? If so, let’s talk it through.

Why It Helps to Keep Mortgage & Protection Together

As part of your mortgage advice journey, we’ll gather the necessary information to research your life insurance options and present recommendations tailored to your needs and budget.

This joined-up approach allows us to consider your mortgage and protection side by side-ensuring the right level of cover, affordability, and structure from day one.

Unlike a comparison website, we don’t just give you a list of rates. We provide advice on how to set up the policy, take your wider financial picture into account, and-crucially-review your cover periodically as life evolves. Most of our clients find this incredibly helpful when their fixed rate ends or their circumstances change.

Life insurance is a subject that needs careful thought, professional advice, and an understanding of the long-term implications. It’s not something that should be arranged on a DIY basis online through comparison sites-where the focus is often just on price, not suitability or structure.

In line with our Transparency Promise, we also want to say-you might find cheaper home insurance premiums online. And for this type of transactional cover, comparison sites can work well. But life insurance is different. It’s a long-term financial safety net that deserves proper advice, careful setup, and regular attention-exactly what we’re here to offer.

If you’re considering another provider, we’re always happy to review their offer and help you make an informed decision-not just a quick one.

The Advantage of Starting Early

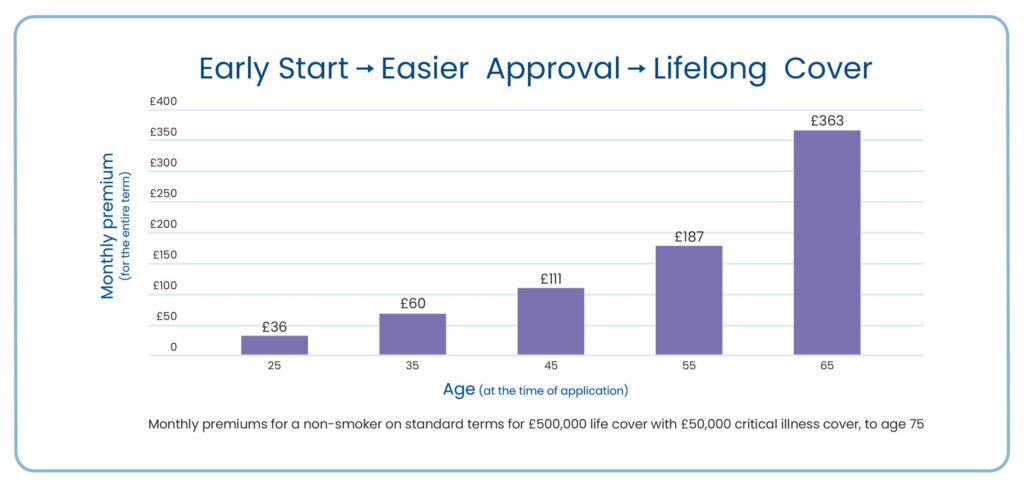

When it comes to life insurance, starting early can make a big difference—both in cost and coverage.

The younger you are when you take out a policy, the lower your premiums are likely to be. By choosing a policy with guaranteed premiums, you can lock in that lower rate for the full duration of the term-whether that’s 30, 35, or even 40 years.

Starting younger also gives you a better chance of being accepted on standard terms, especially if you’re in good health. As time passes, even minor health issues can influence pricing or insurer decisions, so getting cover while you’re young and healthy is often the most cost-effective approach.

It’s just one more reason why it makes sense to consider life insurance right alongside your mortgage-not later down the line.

Support for Non-Standard Health Profiles

Not everyone’s health, lifestyle, or family history fits neatly into what insurance companies call “standard terms.” Whether it’s a past medical condition, chronic medical condition, BMI concerns, or family history of illness, these factors can significantly affect the availability or cost of life insurance.

At Nachu Finance, we carry out extensive upfront research to identify the insurers who are likely to take a more favourable view of your situation. We’ll discuss what information is worth sharing early on, and help you position your case in the best possible light when applying.

This is another clear example of why personalised advice matters—and why starting the conversation early in your mortgage journey is key. Identifying the right insurer takes time, and if needed, we want to allow room for any medical reports or screenings so that everything is in place before completion.

Bringing Estate Planning Insight Into Life Cover Advice

At Nachu Finance, our role doesn’t stop at arranging mortgages and insurance—we also provide estate planning services and have supported families during probate, when dealing with the loss of a loved one.

This experience gives us a unique perspective. We’ve seen first-hand what happens when protection plans are well structured—and when they’re not. It allows us to use that real-world understanding to build more effective financial plans for our clients, ensuring the right money gets to the right people at the right time, should the worst happen.

This integrated view makes our advice not just practical—but powerful.

When Aaron first arranged his life insurance, he was a smoker—so the premiums reflected that higher risk. A few years later, as his fixed-rate mortgage period was coming to an end, we reached out to review both his mortgage and protection arrangements as part of our usual process.

During the conversation, Aaron mentioned he had successfully quit smoking and had remained a non-smoker for over two years.

As part of our holistic review, we helped him reapply for life insurance as a non-smoker. The result? A significantly lower monthly premium—and in fact, he was able to increase his cover while still paying less than before.

It was a great outcome with no compromise on protection. This case is a clear example of why ongoing reviews matter and how positive lifestyle changes, when paired with the right advice, can lead to meaningful financial improvements.

Shankar was initially accepted for life insurance on standard terms during the mortgage process. However, shortly after the policy began, he chose to cancel it—feeling it wasn’t essential at the time.

A few years later, he returned wanting to reinstate cover. Unfortunately, by then, Shankar had developed certain medical conditions and ongoing symptoms. Despite trying with multiple providers, no insurer was able to offer cover due to the new health concerns.

This experience was a difficult one—not just financially, but emotionally too. It also served as a strong reminder that life insurance is easiest to obtain and most affordable when you’re in good health. Once health changes, options can become severely limited.

Taking cover when it’s available and affordable can be a one-time opportunity—and it’s not something to delay lightly.

One of our clients, Richard, originally had life insurance set up through his limited company as a Relevant Life Plan (RLP). Later, after closing the business and moving into employment, he approached us to review and restructure his cover.

He still wanted the same level of protection, but now received employer-provided life insurance equivalent to four times his salary, and wanted this factored into any new arrangement.

We carried out a full review, cancelled his existing RLP, and arranged new personal life cover that topped up his workplace benefit to reach the overall protection he was comfortable with.

This is a good example of how life insurance planning isn’t static—it needs to evolve with your career, income, and life stage. And it shows the importance of working with an adviser who takes a joined-up view of all your cover sources.

Let’s Make Sure You’re Covered

Your home is more than just bricks and mortar-it’s the heart of your family’s future. At Nachu Finance, we take pride in offering advice that protects both.

During your mortgage journey with us, we’ll explore life insurance options that fit your needs-not just today, but for the years ahead.